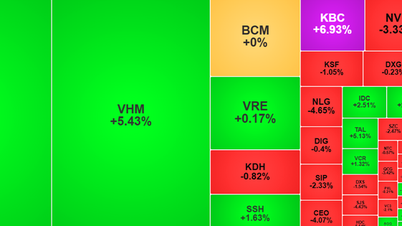

At the end of the trading session on July 8, VN-Index continued to explode when it increased sharply to 1,415.46 points, up 13.4 points compared to the previous session. The stock market is at its highest level in more than 3 years.

Cash flow from individual and institutional investors is strong, with the HOSE trading value alone exceeding 1 billion USD. With the current positive outlook, some experts and securities companies predict that the VN-Index could reach 1,500 points between now and the end of the year.

Many investment opportunities in the second half of the year

At the stock talkshow "Investment opportunities in the second half of 2025?" organized by Nguoi Lao Dong Newspaper on July 8, experts all commented that there is great prospect for the stock market. Accordingly, there is a lot of positive information about the macro economy , the prospect of upgrading the market from frontier to emerging, the tariff policy is cooling down and the picture of business results in the second quarter of 2025 as well as the first half of the year of listed companies is bright...

Mr. Dinh Duc Minh, Senior Investment Director, VinaCapital Fund Management Company, analyzed that in the second half of 2025, the forecast of business profits of enterprises in the second quarter and the first half of this year is positive. If the whole year, the profit growth of listed enterprises will be around 10% -15%. Investors should pay attention to industries that can benefit from credit growth, low interest rate policies, public investment, stimulating domestic consumption, upgrading the market, etc.

Experts say there is great promise for the stock market.

Regarding specific industries, Mr. Vo Van Huy, Head of Senior Client Department, DNSE Securities Company, analyzed that there are 3-4 large industries that account for the main capitalization proportion of listed enterprises: banking industry with forecasted profit will continue to increase from 15% -20%; real estate industry is promising; with retail and steel industries, it will depend on some outstanding stocks.

At a 3-year peak, market valuation remains low

Similarly, at the VPBankS Talk 05 workshop: Smart investment with AI - From Data to decision, organized by VPBankS Securities Company on the same afternoon, Mr. Nguyen Xuan Thanh, senior lecturer at the Fulbright School of Public Policy and Management, Fulbright University Vietnam, analyzed that the stock market recently reacted quite positively to the macro figures, coming from the results of tariff negotiations.

Exports surged as businesses ramped up production in preparation for tariffs; public investment was robust.

According to experts, public investment is one of the sectors that will benefit well in the next 3-4 years, in which investors may be interested in some stocks of leading enterprises.

Mr. Tran Hoang Son, VPBankS Market Strategy Director, commented that in terms of valuation, P/E is at 13.9 - 14 times. Compared to historical data, this valuation is still at a very low level, showing a lot of market potential. From the end of 2025 to the beginning of 2026, the market still has opportunities from the public offering of shares of a number of enterprises in fields such as financial services, consumer goods, and information technology.

"If upgraded, it is forecasted that passive and active capital flows into Vietnam could reach 3-7 billion USD. The net buying trend of investors since the beginning of July has reached more than 6,000 billion VND - buying very quickly, similar to the trend of investors net buying before, during and after upgrading in many other markets. The disbursement of 3-7 billion USD in a short time will create a huge boost for the market" - Mr. Son said.

Source: https://nld.com.vn/tien-o-at-chay-vao-chung-khoan-mua-co-phieu-nao-don-song-1500-diem-196250708195253126.htm

![[Photo] Party and State leaders meet with representatives of all walks of life](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/24/66adc175d6ec402d90093f0a6764225b)

![[Photo] Phu Quoc: Propagating IUU prevention and control to the people](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/24/f32e51cca8bf4ebc9899accf59353d90)

Comment (0)