Trading activities at Duc Xuan market, Bac Kan city are taking place normally. (Photo taken on the morning of June 9, 2025).

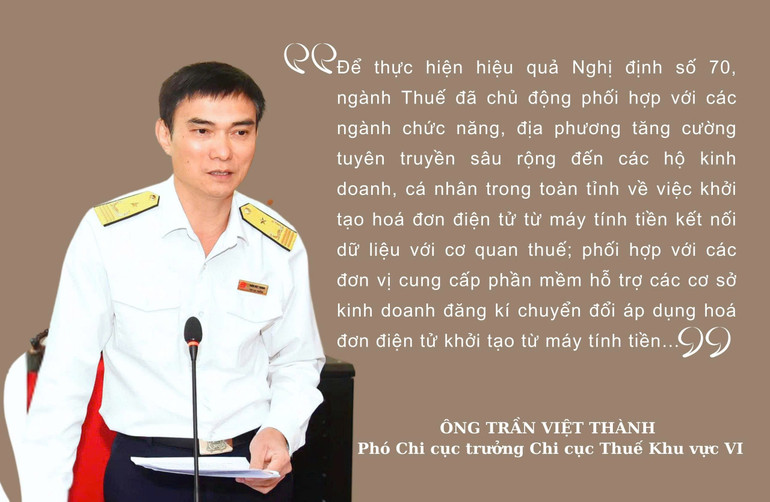

According to Decree No. 70/2025/ND-CP dated March 20, 2025 of the Government , business households and individuals doing business in the retail, food and beverage, hotel, transportation, entertainment sectors... if achieving revenue of 1 billion VND/year or more must use electronic invoices generated from cash registers and connect data directly to tax authorities. At the same time, the lump-sum tax method for large business households will be terminated.

Specifically, starting from June 1, 2025, business households with revenue of 1 billion VND or more must switch to actual declaration instead of paying taxes at the previous fixed rate...

Through research and discussion with some business people in Bac Kan city, most households are worried about increased costs and pressure when using technical operations; most business owners are old, so accepting information technology applications is still quite difficult. Some traders at Duc Xuan market, Bac Kan city are confused because the use of electronic invoices in the early stages according to regulations will not be able to catch up immediately.

In cases where taxpayers intentionally conceal revenue or make dishonest and incomplete tax declarations, the sector will use professional measures to collect additional tax, determine taxes, punish false declarations, tax evasion, or may be prosecuted. Therefore, the Tax sector hopes to continue to receive the support of the business community and business households in properly implementing tax laws, contributing to building a healthy and transparent business environment.

Visiting some restaurants and businesses in the city shows that most people and businesses still lack information about some tax policy changes. According to the reporter's investigation, for about a week now, some shops and businesses in the local markets have temporarily closed due to inefficiency or to review paperwork and business items to serve the inspection and market control work of the authorities... There is absolutely no situation of refusing to accept transfer payments, only accepting cash to "avoid taxes" to avoid revealing real revenue as rumored.

Ms. Do Thi Huong, the owner of a beverage stall at Duc Xuan market (Bac Kan city) said: "I have been selling here for about 10 years, fully implementing the contract to rent a place to sell and paying taxes to the State according to regulations, but in the past few days, I have heard information from small traders in the market discussing the need to use electronic invoices, declare taxes... I am not sure how?".

Ms. Linh Thi Tra, a pork seller not far away, affirmed: “Every year I declare and pay taxes fully to the State as required. Currently, I still receive money transfers or cash from consumers every time I come to buy goods. Recently, we have heard that we will use electronic invoices generated from cash registers and connect data directly to tax authorities, we also completely agree. However, we need to be guided by specialized agencies to operate more effectively.”

Ms. Linh Thi Tra's pork shop at Duc Xuan market still accepts payments via bank transfer or cash from customers. (Photo taken on the morning of June 9, 2025)

In reality, the application of lump-sum tax as in the recent past shows that some business households have actual revenue much larger than the tax authority's estimate, but still only pay at the same level as business households with lower revenue. This has created injustice in tax compliance according to regulations.

It is known that in recent times, the Tax sector has deployed many new tax documents and policies to taxpayers in the area. However, in order for taxpayers to fully understand the benefits and tax obligations to the State, there needs to be drastic involvement of functional sectors.

The tax authority really hopes that business households and individuals will be alert businessmen, learn about legal regulations, and not listen to and follow illegal acts, such as concealing revenue, being unclear in economic transactions, etc. Make correct and complete declarations of revenue when selling goods and services./.

Quy Don - Nguyen Nghia

Source: https://baobackan.vn/thuc-hu-chuyen-tieu-thuong-bac-kan-dong-cua-hang-de-ne-thue-post71270.html

![[Maritime News] Wan Hai Lines invests $150 million to buy 48,000 containers](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/20/c945a62aff624b4bb5c25e67e9bcc1cb)

![[Infographic] Party Committee of the Ministry of Culture, Sports and Tourism: Marks of the 2020 - 2025 term](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/22/058c9f95a9a54fcab13153cddc34435e)

Comment (0)