Abolish the State monopoly on gold bar production

On August 26, the Government issued Decree No. 232/2025/ND-CP amending and supplementing a number of articles of Decree No. 24/2012/ND-CP dated April 3, 2012 on the management of gold trading activities.

Notably, the State monopoly mechanism on gold bar production, raw gold export and raw gold import for gold bar production is abolished. Gold trading of 20 million VND/day or more must be paid through bank accounts; enterprises are considered by the State Bank for granting a gold bar production license when meeting many conditions, including having a charter capital of 1,000 billion VND or more...

In fact, the gold bar monopoly mechanism stipulated in Decree No. 24/2012/ND-CP, which had the mission of preventing the "goldenization" of the economy , is no longer suitable and has revealed many limitations, first of all, limiting supply.

Saigon Jewelry Company Limited (SJC), the only gold bar brand designated by the State Bank to produce in Vietnam since 2012, no other enterprise is allowed to produce national brand gold bars. The enterprise is also not allowed to import raw gold to produce gold bars, only allowed to re-stamp dented and distorted gold, making it difficult to meet market demand.

The fact that only one unit is allowed to produce and import gold bars (through the supervision of the State Bank) has created a shortage of supply, leading to the price of SJC gold bars always being significantly higher than the world gold price.

At times, this difference is up to 20 million VND/tael, not only causing losses to people but also creating risks for the market.

In particular, in recent days, also due to limited gold supply, domestic gold prices have increased sharply. If in April 2025, the world gold price was around 3,400 USD/ounce, the price of SJC gold bars was 124 million VND, then currently the international gold price is at 3,380 USD/ounce while the price of SJC gold bars is up to 128 million VND/tael - the highest level in history.

The large gap between domestic and international gold prices is the main driving force behind gold smuggling, causing foreign currency losses and affecting national foreign exchange reserves. Therefore, the Government's issuance of Decree No. 232/2025/ND-CP has been highly appreciated by experts.

Expert Nguyen Quang Huy, CEO of the Faculty of Finance and Banking (Nguyen Trai University) acknowledged that Decree No. 232/2025/ND-CP is a turning point in the management of Vietnam's gold market, when it eliminates the monopoly on gold bar production and replaces it with a conditional licensing mechanism.

This is not simply a change in legal techniques, but also reshapes the market structure, encourages competition, ensures transparency and moves closer to international standards.

The market will be diverse.

Sharing the same view, gold expert Tran Duy Phuong said that the issuance of the above decree is a positive move for the gold market.

"The mechanism of the State monopolizing the production of gold bars, exporting raw gold and importing raw gold to produce gold bars is abolished, which will help many other gold bar brands have the opportunity to enter the market, thereby diversifying the market, giving investors and people more choices. Improved supply, with many gold bar brands on the market, will create competition in the future, and people will buy gold at more reasonable prices," Mr. Phuong said.

According to Mr. Nguyen Quang Huy, for enterprises with charter capital under 1,000 billion VND, the door to gold bar production has officially closed. They have lost the opportunity in the segment with the highest liquidity and profit, but there are still other directions: Developing gold jewelry and fine arts, where creativity can be promoted and sustainable consumption needs can be met; becoming an official distribution channel for large enterprises; or expanding ancillary financial services such as gold mortgages, storage, and pledges. Although no longer in the main "playing field", this group still plays an important role in the gold market value chain.

For SJC, the impact is two-sided. SJC currently owns a superior brand and social trust. However, when losing its monopoly position, SJC is forced to compete substantially.

The profit margin from the buy-sell spread will narrow, and the pressure from new competitors will increase. If they continue to innovate, upgrade testing technology, develop financial products related to gold, and strengthen the distribution system, SJC can still maintain its leading position. On the contrary, if they rely on the halo of the past, they will gradually lose market share.

“The group of enterprises with charter capital of VND1,000 billion or more, in addition to SJC, has the opportunity to enter the gold bar sector - a playground that has been protected for many years. This is a potential “newbie” with the ability to create a new competitive counterweight. Their advantages lie in capital potential, management and the ability to build a long-term strategy. But the big challenge is the social trust in SJC gold bars that has accumulated over many years and to change people's habits requires perseverance, transparency and a commitment to two-way buying and selling to create sustainable liquidity,” said this expert.

Many experts believe that with the issuance of this decree, in the coming time, the gold market will stabilize, domestic gold prices will be close to world gold prices, however, we cannot expect the difference to decrease quickly, there will need to be a delay.

“At the market level, in the short term, the gap between domestic and world gold prices is difficult to erase immediately. Supply has not yet diversified, while speculative psychology and brand name still make SJC gold bars highly valued. Therefore, gold prices may still fluctuate and not fully reflect real supply and demand. But in the long term, when many qualified businesses participate in production, compete on price and service, the market becomes more transparent, the price gap with the world will narrow. More importantly, social trust in the stability and transparency of the gold market will be strengthened, contributing to macroeconomic stability and enhancing the position of the national financial system,” said expert Nguyen Quang Huy.

Some other experts also said that currently, the market has no supply and needs specific instructions to implement the decree, so the gold price cannot decrease immediately. When there is supply, the market "absorbs" enough demand, then the difference between domestic and world gold prices will shrink to a reasonable level of about 5-6 million VND/tael.

The gold market may cool down in the near future because Decree No. 232/2025/ND-CP helps to ease the psychology, those who want to buy gold at all costs will hesitate, while those who have gold and want to sell can aggressively take profit to optimize profits.

Source: https://hanoimoi.vn/thi-truong-vang-se-canh-tranh-trong-thoi-gian-toi-714188.html

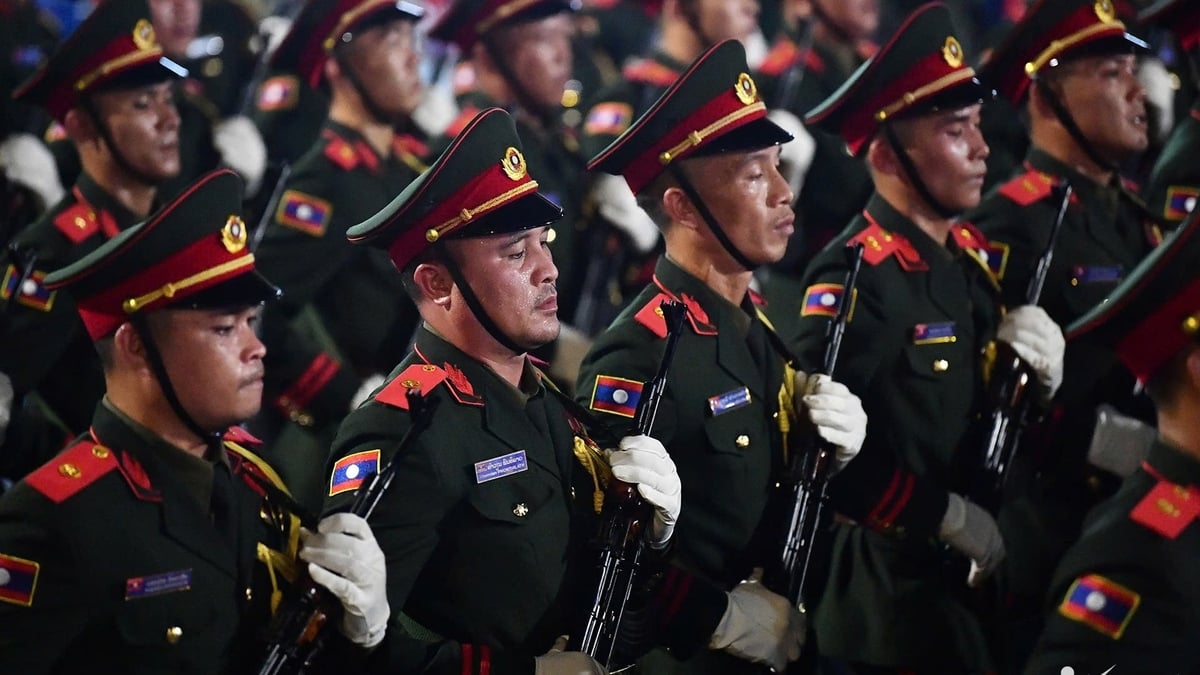

![[Photo] Parade blocks pass through Hang Khay-Trang Tien during the preliminary rehearsal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/456962fff72d40269327ac1d01426969)

![[Photo] Images of the State-level preliminary rehearsal of the military parade at Ba Dinh Square](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/807e4479c81f408ca16b916ba381b667)

Comment (0)