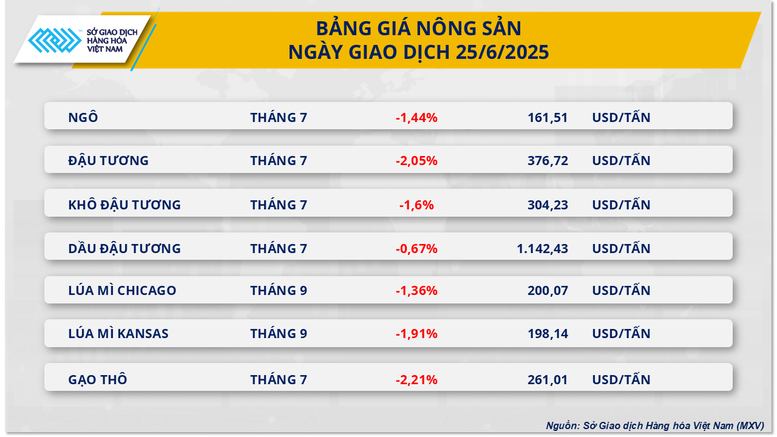

Corn prices extend decline into fourth session

Closing yesterday's trading session, the agricultural market experienced a fiery trading session with prices of all 7 commodities in the group decreasing. In particular, corn prices continued to weaken for the 4th consecutive session, losing 1.44% to 161.5 USD/ton, the lowest price since late October 2024. According to MXV, this sharp decline was mainly due to supply and demand pressure, and investors tended to close positions due to the contract conversion date.

In Brazil, agribusiness consultancy Agroconsult said on June 24 that production is estimated to hit a record 123.3 million tonnes of corn in the second crop, the main crop that accounts for 80% of Brazil's annual corn output.

In the US, early next week (June 30), the US Department of Agriculture (USDA) will report on the planted area. However, experts estimate that the US corn area in 2025 will reach 38.6 million hectares, an increase of about 2 million hectares compared to last year. Warm weather and heavy rain in the US Midwest are considered to create ideal conditions such as in greenhouse growing systems, supporting the growth of corn.

In addition, data from the USDA's weekly report showed that 1.48 million tons of corn were delivered in the week ending June 19, down 12.91% from the previous week but still up 28.07% from the same period last year. Mexico imported the most with over 345,800 tons, followed by Japan with about 249,800 tons.

According to the USDA’s Milled Grains and By-products Production Report, corn used as feedstock for ethanol production decreased in April compared to the previous month. Specifically, total corn consumption for ethanol production and other uses was 12.07 million tons, down 6% from the previous month. Corn use in April included 91.7% for ethanol production and 8.3% for other production.

In addition, the July contract expiration date is approaching, so many traders have closed their positions to take profits, while others have transferred cash flow to the September futures contract (ZCU25), which also contributes to the downward pressure on prices.

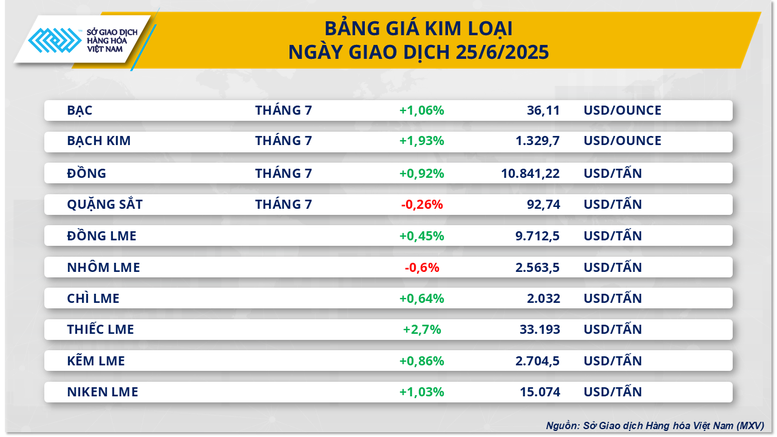

Metal prices increased across the board

On the other hand, the metal market witnessed overwhelming buying power with 8/10 items increasing in price. Of which, platinum price continued to increase by nearly 2% to 1,329 USD/ounce, COMEX copper price extended its increase to the third consecutive session, adding 0.92% to 10,841 USD/ton.

In South Africa, which accounts for more than 70% of global platinum production, mining operations are facing serious challenges as high electricity costs, coupled with inefficient rail and port systems, disrupt operations.

South Africa’s platinum production is expected to fall 6% this year to 3.9 million ounces, according to the World Platinum Investment Council (WPIC). Flooding in the first quarter and declining production at older mines have severely reduced supply from the country.

On the other hand, platinum demand from the jewelry industry is forecast to increase by 5% this year, reaching 2.1 million ounces. WPIC forecasts that the global platinum market will face a third consecutive year of deficit, with a shortfall of about 966,000 ounces. This supply-demand imbalance is expected to continue to be a strong support factor for platinum prices in the coming time.

Meanwhile, COMEX copper prices continued to be supported by concerns about the risk of local supply shortages in the US if Washington expands tariffs on imported copper. In addition, copper prices were also supported by information about short-term global supply shortages.

Source: https://baochinhphu.vn/sac-do-tiep-tuc-ap-dao-chi-so-mxv-index-roi-khoi-vung-2200-diem-102250626134550753.htm

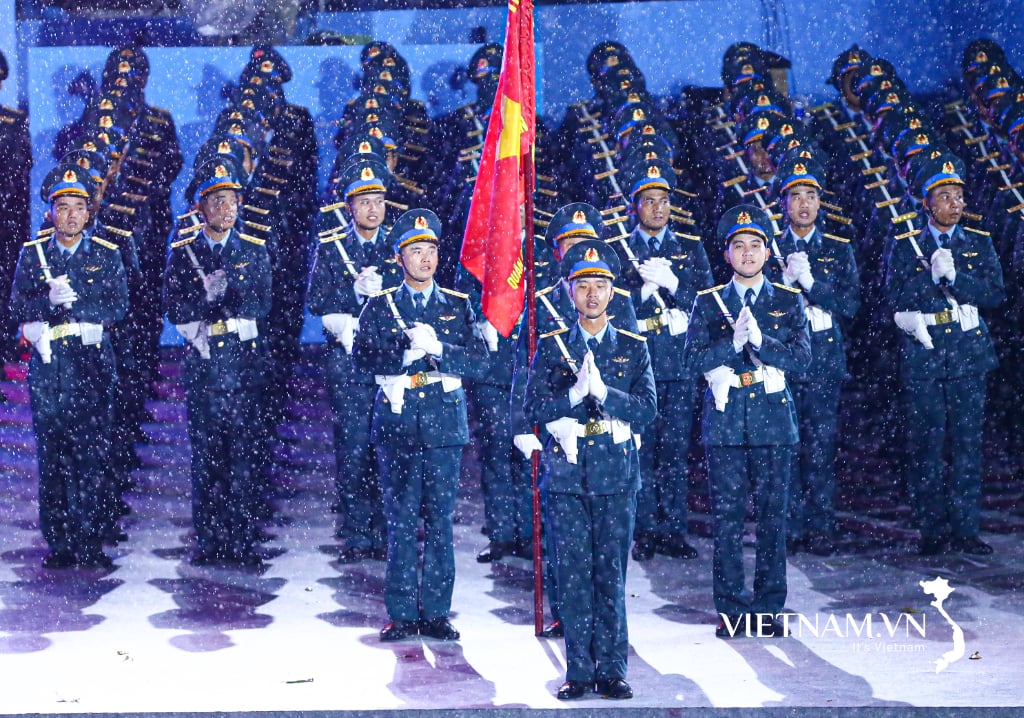

![[Photo] Cuban artists bring "party" of classic excerpts from world ballet to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/797945d5d20b4693bc3f245e69b6142c)

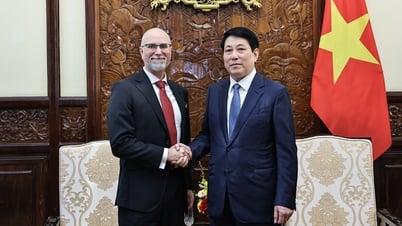

![[Photo] General Secretary To Lam receives Australian Ambassador to Vietnam Gillian Bird](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/ce86495a92b4465181604bfb79f257de)

Comment (0)