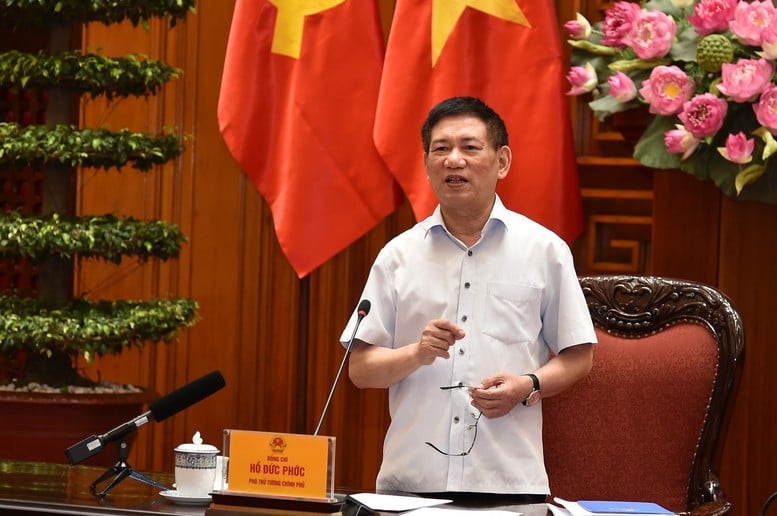

Deputy Prime Minister Ho Duc Phoc meets with ministries, branches, associations, securities and real estate enterprises on the draft Law on Personal Income Tax (replacement) - Photo: VGP/Tran Manh

Speaking at the opening of the meeting, Deputy Prime Minister Ho Duc Phoc emphasized the importance and impact of the draft Law on Personal Income Tax (replacement) on people's lives as well as production and business activities of enterprises and the stock market, which has received great public attention.

The Deputy Prime Minister requested that associations, businesses, and representatives of ministries and branches give frank and responsible comments to contribute to completing the draft law with the highest quality before submitting it to competent authorities for consideration and decision.

Expected amendment and supplement of 30/35 articles of the current Law on Personal Income Tax

According to the report of the Ministry of Finance , the purpose of promulgating the Law on Personal Income Tax (replacement) is to expand the tax base; review, amend and supplement regulations on taxpayers and taxable income; study and adjust the threshold and personal income tax rates for some types of income to ensure consistency with the nature of each type of income and the regulatory objectives of personal income tax.

Study to adjust the family deduction level for taxpayers and dependents; amend and supplement regulations related to some specific deductions to suit the new context; reduce the number of tax brackets of the progressive tax rate schedule applied to income from salaries and wages to contribute to simplifying the tax schedule.

Research, amend and supplement regulations on personal income tax exemption and reduction to suit the country's socio-economic development requirements in the coming period and international practices, contributing to implementing the Party and State's policies on attracting high-tech human resources, achieving the goals of green growth and sustainable development.

Simplify the implementation of corporate income tax policies for both taxpayers and tax authorities, preventing tax evasion and tax avoidance.

Effectively overcome shortcomings and difficulties arising from the implementation of the current Personal Income Tax Law to ensure transparency and ease of law implementation.

After review, the draft Law on Personal Income Tax (replacement) is expected to amend and supplement 30 out of 35 articles of the current Law on Personal Income Tax (accounting for 86%).

At the same time, rearrange and reorganize the content and order of the Articles, edit the wording of some contents to make them suitable and consistent with the amendment and supplementation of related contents, ensuring the strictness, ease of understanding and implementation of the law after it is promulgated.

In addition, review and supplement regulations assigning authority to the Government to specify some contents in accordance with practical situations arising in each period, ensuring that the implementation of the Law is not entangled, stable and long-term.

Deputy Prime Minister Ho Duc Phoc asked associations, businesses, and representatives of ministries and sectors to give frank and responsible comments to contribute to completing the draft law with the highest quality before submitting it to competent authorities for consideration and decision - Photo: VGP/Tran Manh

Proposing 6 contents for amendment and completion; 3 additional contents in the draft Law

Firstly, perfecting regulations related to personal income taxable income and tax calculation for each type of taxable income.

Second, perfect the personal income tax exemptions to ensure they are consistent with reality and transparent in implementation.

Third, perfect the regulations on calculating personal income tax for business individuals; review the taxable revenue for the income of business households and individuals to suit the practical situation; adjust the tax rates for some income from the provision of software products and services; digital information content products and services on entertainment, electronic games, digital movies, digital photos, digital music, digital advertising.

Fourth, amend and supplement regulations related to deduction levels when calculating personal income tax.

Fifth, adjust and reduce the number of tax brackets of the Progressive Tax Schedule applicable to resident individuals with income from wages and salaries.

Sixth, review, amend and supplement regulations on tax calculation period, tax deduction, time for determining taxable income; amend and supplement regulations on responsibilities of organizations and individuals paying income and responsibilities of taxpayers.

Deputy Minister of Finance Cao Anh Tuan speaks at the meeting - Photo: VGP/Tran Manh

The draft Law on Personal Income Tax (replacement) also proposes to add 3 contents: (1) Add regulations on other income groups subject to personal income tax; (2) Add some regulations on tax exemption and reduction of personal income tax; (3) Add other specific deductions.

Regarding decentralization and delegation of authority, to suit the arising reality and avoid difficulties in implementation, the draft Law supplements the authority of the Government and the Ministry of Finance and some contents such as: Adjusting the family deduction level, the threshold of business revenue not subject to personal income tax; the scope of determining deductible charitable and humanitarian contributions, other specific deductions; the level of contribution to participate in supplementary pension insurance; low income level to determine dependents eligible for family deduction; the level of temporary deduction of personal income tax for individuals' casual income;... and on the conditions and criteria for determining individuals as experts, scientists, high-tech human resources, highly qualified human resources; the content, concept, criteria, conditions, content of innovative start-up activities... to have a basis for determining tax exemption and reduction incentives for individuals arising from these organizations.

Representatives of associations, corporations and businesses give comments on issues related to calculating personal income tax from real estate and securities - Photo: VGP/Tran Manh

After listening to the direction of Deputy Prime Minister Ho Duc Phoc and the report of the Ministry of Finance, representatives of associations, corporations and enterprises gave comments on the contents related to calculating personal income tax from real estate and securities such as: Time of calculating personal income tax on income from dividends in cash and shares; calculating tax on securities transactions, bonus shares, transfer of listed securities; tax calculation method; applying personal income tax to investment activities through investment funds;...

Representatives of associations and enterprises also gave their opinions on calculating personal income tax related to capital contribution in real estate; tax rates and roadmap for calculating personal income tax related to real estate transfer; tax solutions to keep real estate prices at a reasonable level, consistent with real life, bringing the real estate market to develop healthily and sustainably, preventing speculation and price inflation;...

Associations and businesses also contributed opinions on adjusting the family deduction level to suit the living standards of the majority of people, the reality of the country and each province;...

At the meeting, representatives of the Ministry of Construction, Ministry of Home Affairs, Ministry of Justice, and Vietnam General Confederation of Labor emphasized the need for personal income tax policies to be designed so that the real estate market can develop healthily and effectively, ensuring harmony of interests among entities.

Deputy Prime Minister Ho Duc Phoc requested the Ministry of Finance to study and absorb reasonable comments to design truly suitable regulations, develop a draft Law on Personal Income Tax (replacement) with the highest quality, submit it to competent authorities for consideration and decision, and ensure feasibility after promulgation - Photo: VGP/Tran Manh

Representatives of ministries and branches also commented on the following contents: Supplementing other tax-exempt income, especially issues related to Resolution 57-NQ/TW; reasonable securities tax methods to develop the market; taxing personal income from salaries; proposing to assign the Government to regulate family deductions, as well as some contents that need to be specified in detail to ensure flexibility and suitability with the country's development practices; ...

At the meeting, Deputy Minister of Finance Cao Anh Tuan thanked the opinions of associations, businesses and ministries, and discussed and explained some contents that representatives of businesses and associations were interested in contributing.

Receive reasonable comments and complete the Law project with the highest quality.

Concluding the meeting, Deputy Prime Minister Ho Duc Phoc thanked the businesses and associations for their very useful, important, frank and highly constructive comments.

Deputy Prime Minister Ho Duc Phoc emphasized that the Personal Income Tax Law involves many people and has a profound impact on people's lives and business and production activities of enterprises, so it needs to be carefully studied and assessed when designing and proposing new regulations and policies.

Deputy Prime Minister Ho Duc Phoc requested the Ministry of Finance to study and absorb reasonable comments, especially those related to real estate transfer tax; stocks, dividends, bonus shares; family deductions, etc. to design truly suitable regulations, develop a draft Law on Personal Income Tax (replacement) with the highest quality, submit it to competent authorities for consideration and decision, and ensure feasibility after promulgation./.

Tran Manh

Source: https://baochinhphu.vn/pho-thu-tuong-ho-duc-phoc-hop-voi-cac-doanh-nghiep-hiep-hoi-ve-du-an-luat-thue-thu-nhap-ca-nhan-thay-the-102250731165411877.htm

Comment (0)