Sacombank has just announced information about shareholders owning 1% or more of charter capital. The total ownership ratio of Chairman Duong Cong Minh and his family at Sacombank is 3.95% of charter capital.

How many shares do Mr. Duong Cong Minh and his family own at Sacombank?

Sacombank has just announced information about shareholders owning 1% or more of charter capital. The total ownership ratio of Chairman Duong Cong Minh and his family at Sacombank is 3.95% of charter capital.

According to the list published by Sacombank, there are 5 shareholders owning more than 1% of shares, including 4 organizations and 1 individual.

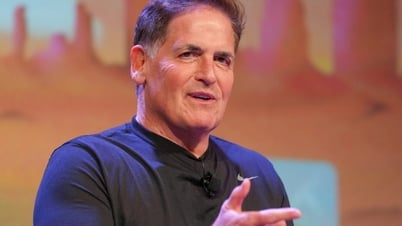

These shareholders own more than 267.5 million shares, equivalent to 14.2% of Sacombank's capital. The only individual shareholder on the list is none other than Mr. Duong Cong Minh, Chairman of Sacombank's Board of Directors, with more than 62.56 million shares (equivalent to 3.32% ownership).

|

| By the end of the third quarter of 2024, Sacombank's total assets will be at VND 702,986 billion. |

At the same time, Mr. Minh's related person, Ms. Duong Thi Liem (his sister), owns 11.86 million shares (equivalent to 0.63% of capital at Sacombank). Thus, the total ownership ratio of Mr. Minh and his sister at Sacombank is 3.95% of charter capital, equivalent to 74.4 million shares.

In addition, this list also includes familiar names such as Pyn Elite Fund, the organization that holds the largest number of shares in Sacombank with 125.9 million shares, equivalent to 6.68% of the bank's charter capital. This investment also accounts for the largest proportion in the portfolio of this foreign fund, equivalent to about 20%, or 1/5 of the portfolio.

Not only Sacombank, Pyn Elite Fund also invests in 6 other banks: MB, TPBank, HDBank , VietinBank and OCB.

The list of shareholders owning more than 1% of Sacombank also includes two foreign funds including Tianhong Vietnam Thematic Fund (QDII) holding 30.25 million shares or 1.71% of capital; SCB Vietnam Alpha Fund Not For Retail Investors owns 25.55 million shares, equivalent to 1.36% of Sacombank's capital. Tianhong Vietnam Thematic Fund (QDII) is an investment fund under the Qualified Domestic Institutional Investor (QDII) program, allowing Chinese investors to access the Vietnamese stock market and related assets. This fund is managed by Tianhong Asset Management, a management company in China.

SCB Vietnam Alpha Fund Not For Retail Investors is a special investment fund provided by SCB Asset Management (SCBAM) - a fund management company of Siam Commercial Bank (SCB) in Thailand.

At the same time, in the list of shareholders owning more than 1% of Sacombank, there is also an organization called Norges Bank holding 20.4 million shares or 1.13% of Sacombank's capital. Norges Bank is the central bank of Norway and manages the Global National Pension Fund and the bank's own foreign exchange reserves. Thus, in total, these 4 organizational shareholders hold more than 205.08 million STB shares, equivalent to owning more than 10.88% of the bank's charter capital.

Meanwhile, Ms. Nguyen Duc Thach Diem, Permanent Vice President and General Director, owns 76,320 STB shares, equivalent to 0.004% of Sacombank's capital, according to Sacombank's management report for the first 6 months of 2024. Mr. Pham Van Phong, Vice President of Sacombank , holds 19,680 shares, equivalent to 0.001% of capital. Mr. Nguyen Xuan Vu, member of Sacombank's Board of Directors, also holds only 833 shares. Mr. Phan Dinh Tue, member of Sacombank's Board of Directors, holds 142,895 shares, equivalent to 0.007%...

The above information disclosure of Sacombank is to comply with Article 49 of the Law on Credit Institutions on public disclosure of information of shareholders owning 1% or more of charter capital.

According to the Law on Credit Institutions 2024, related persons for organizations and individuals are more expanded than before. At the same time, according to the Law on Credit Institutions 2024, the ownership limit for shareholders who are organizations is reduced from 15% to 10%, and for shareholders and related persons is reduced from 20% to 15%. In case this group owns shares exceeding the limit according to the new regulations, it will still be maintained but not increased, except in the case of receiving dividends in shares.

In the first 9 months of 2024, Sacombank achieved a profit of VND 8,094 billion, an increase of 18.3% over the same period. Compared to the target set for the whole year (VND 10,600 billion in pre-tax profit), this bank has achieved 76.4% of the whole year plan after 9 months. However, Sacombank has not yet reflected the revenue from the sale of Phong Phu Industrial Park in its financial report for the third quarter of 2024. Meanwhile, an analysis report updated on August 2 by Vietcap Securities forecasts that Sacombank will record VND 2,000 billion in non-interest income from the sale of debts related to Phong Phu Industrial Park in the second half of 2024.

By the end of the third quarter of 2024, Sacombank's total assets stood at VND702,986 billion, up 4.2% compared to the beginning of the year. Sacombank's customer loans increased by 8.9% compared to the beginning of the year to VND525,500 billion, equivalent to the credit growth of the entire economy . Customer deposits increased by 11%, to nearly VND566,700 billion. The ratio of bad debt to outstanding loans increased from 2.28% at the beginning of the year to 2.47%.

Source: https://baodautu.vn/ong-duong-cong-minh-va-nguoi-nha-so-huu-bao-nhieu-co-phan-tai-sacombank-d231712.html

![[Photo] Overcoming the heat, practicing to prepare for the parade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/21/b93392e8da8243b8a32040d19590e048)

![[Maritime News] Wan Hai Lines invests $150 million to buy 48,000 containers](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/20/c945a62aff624b4bb5c25e67e9bcc1cb)

Comment (0)