This event, if it takes place as expected, will open up opportunities to attract billions of dollars in foreign capital flows from ETF funds and global institutional investors.

In that context, Masan Group's MSN is one of the bright stocks, not only thanks to its solid business foundation but also because it meets the criteria of capitalization, liquidity and foreign ownership ratio.

Consumers shop for Masan Consumer products (Photo: Masan).

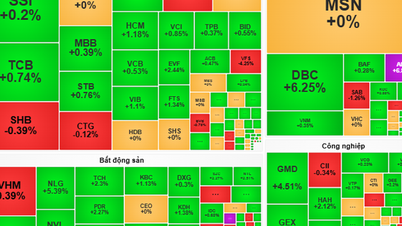

Stocks break out, expecting to welcome foreign capital

2025 is the time to strive for the Vietnamese stock market to be upgraded from a frontier market to an emerging market according to the approved Stock Market Development Strategy to 2030. International financial institutions and experts all believe that when upgraded, the Vietnamese stock market will attract a large amount of capital, promoting growth in market size and liquidity.

According to analysis by SSI Research, the scenario of upgrading to Emerging Market could help Vietnam attract about 1 billion USD from ETF funds. In the list of stocks that are likely to benefit greatly, MSN is forecast to attract about 91.89 million USD. This is a remarkable figure for a code in the consumer - retail sector, which is highly appreciated by international investors due to the long-term growth potential of the Vietnamese market.

With a market capitalization of over VND124,000 billion, high liquidity and a large foreign ownership ratio, MSN meets most of the criteria of emerging market indices. Masan's presence in many essential sectors from FMCG, retail, to food - beverage, processed meat also makes this stock a top choice for funds looking for a balance between growth and stability.

Consumers shop for MEATDeli cured meat (Photo: Masan).

On August 11, MSN shares had an explosive trading session when they closed at VND82,000/share, up nearly 7% compared to the previous session. The matched volume reached nearly 30 million units, the highest level since listing, reflecting strong cash flow from both domestic and international investors.

Technically, MSN has surpassed the resistance level of VND 80,500 and broken above the upper Bollinger Band, a signal that the short-term uptrend is being consolidated. The sudden trading volume along with the strong price increase opens up the possibility of forming a new price level.

Solid business foundation, many organizations positively evaluate

In the first half of 2025, Masan recorded net revenue of VND42,163 billion and profit after tax before minority interests (NPAT Pre-MI) of VND2,602 billion, up 82.6% year-on-year, completing more than 50% of the yearly plan.

Masan's core business segments all showed positive results. Specifically, in the retail segment, WinCommerce (WCM) achieved revenue of VND17,915 billion, up 13.4%, Pre-MI profit reached VND68 billion, marking the fourth consecutive profitable quarter. By the end of the second quarter, WCM opened a net 318 stores in 6 months, completing 80% of the annual target, of which nearly 75% of the new stores were located in rural areas.

In the FMCG sector, Masan Consumer (MCH) has been affected in the short term by disruptions to the GT (traditional retail) channel due to the new tax policy. In response, MCH has urgently implemented strategic initiatives to transform its distribution model, reduce dependence on large traditional retailers and promote direct distribution channels.

Chilled meat is produced using European technology at the MEATDeli chilled meat processing factory complex (Photo: Masan).

In Masan's meat segment, Masan MEATLife (MML) recorded revenue of VND4,409 billion, up 25.6%, profit of VND364 billion, with the processed meat segment growing in double digits and benefiting from high pork prices.

Masan High-Tech Materials (MHT) achieved revenue of VND1,614 billion, up 27.9%, profit of VND6 billion, improved VND400 billion compared to the same period thanks to strong increase in APT and bismuth prices.

Maintaining a sustainable growth momentum, many major securities companies recommend “buying” MSN with significant upside potential. Specifically, VCBS set a target price of VND93,208/share, about 14% higher than the closing price on August 11, based on growth prospects at WCM, MCH, MML, MHT and the synergy effect from the integrated consumer ecosystem.

KBSV values MSN by SoTP method at VND100,000/share, forecasting that core business segments will maintain double-digit growth and profit margins will continue to improve.

Meanwhile, VCI emphasized that MSN is a leading consumer-retail stock, supported by a strategy of network expansion, improving operational efficiency and optimizing product portfolio, and set a target price for MSN at VND101,000/share.

With the strategy of developing an integrated consumer - retail - technology ecosystem, expanding network scale and optimizing operational efficiency, and the support of foreign capital when the market upgrades, MSN can maintain its appeal to both domestic and foreign investors in the medium and long term.

Source: https://dantri.com.vn/kinh-doanh/nhieu-trien-vong-cho-co-phieu-nganh-tieu-dung-ban-le-tu-viec-nang-hang-thi-truong-20250812144040540.htm

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

![[Photo] Hanoi: Authorities work hard to overcome the effects of heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/380f98ee36a34e62a9b7894b020112a8)

Comment (0)