| Raw material supply increases, why is the livestock industry still facing difficulties? The livestock industry is changing, the cost 'bottleneck' is gradually being removed |

However, behind this short-term optimism, perhaps businesses in the industry also need to be more cautious because the overall picture still contains many potential risks.

Although global economic growth still faces many challenges; and there are still many pressures from politics and logistics, it is undeniable that the livestock industry has undergone positive recovery steps. In Vietnam, the export value of livestock products continues to increase by 4.8% compared to 2023, showing that our country is still looking for opportunities to expand the market and increase product value in the international market.

Sustainable growth or the times?

While some other manufacturing industries are still struggling to find solutions, Vietnam’s livestock industry has great potential for development, thanks to policies aimed at supporting the development of large-scale enterprises instead of small-scale livestock households. However, dependence on foreign raw material supplies remains a major threat to the industry when facing fluctuations in the international market.

The problem is aggravated when most of the important raw materials such as breeds, feed, and nutrition need to be imported. This situation directly affects production costs, making it difficult for Vietnamese livestock products to compete with international rivals or, more closely, FDI enterprises.

Returning to the picture of the whole industry in the first 3 months of the year, we see that most of the pressure on businesses has cooled down thanks to the reduction in raw material costs for animal feed production. In the first quarter of 2024, Vietnam imported 4.85 million tons, equivalent to 1.65 billion USD, although it increased by 6.4% in volume but decreased sharply by 12.3% in value compared to the same period in 2023. In which, the main raw materials include: corn, wheat, soybean meal.

|

| Vietnam's annual corn imports |

Thus, the sharp decline in world raw material prices has contributed to the growth of the livestock industry in the first quarter of 2024. However, the industry's dependence on imports also raises questions about sustainable and stable development if international agricultural prices increase again. In particular, the end of the second quarter is an important period that businesses need to pay attention to because commodity prices often fluctuate strongly.

Cyclical calculation of raw material prices

Corn prices traded on the Chicago Board of Trade (CBOT) link at the MXV have dropped about 35% year-on-year. The decline in agricultural prices in general comes from a more positive outlook on supplies as production in major producing countries such as the US, Brazil, and Argentina has recovered after consecutive crop losses in the past few years.

Farmers in the United States are now in their third week of corn planting, with 6% of their total acreage planted as of April 16. Once the progress reaches about 50%, the market will quickly focus on the summer weather outlook, and the psychological factor often creates a rally in agricultural prices in the second quarter of each year.

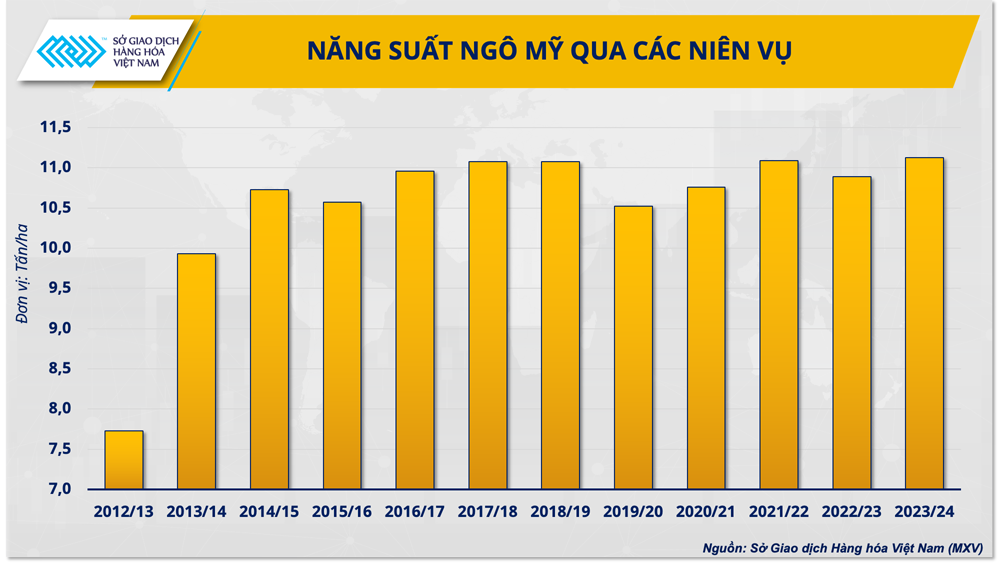

According to the US Department of Agriculture (USDA) report at the end of March, the US corn area this year is expected to reach 36.4 million hectares, much lower than the 38.3 million hectares in the 2023-2024 crop year. However, the yield is expected to increase to 11.13 tons/ha from 10.89 tons/ha last year, offsetting the reduced area. In the coming months, yield risks will be the most important factor determining the outlook for US corn supplies.

|

| US corn yield over crop years |

Statistically, for the Chicago July corn contract, prices have hit summer highs in June in 15 of the past 24 years. The frequency of peaks in May and April is 5 and 4 years, respectively. The same is true for soybeans. Although they are commodities that are heavily dependent on fundamental factors such as consumption, imports, and weather, agricultural prices appear to be cyclical.

|

| Mr. Pham Quang Anh, Director of Vietnam Commodity News Center |

Explaining the above trend, Mr. Pham Quang Anh, Director of the Vietnam Commodity News Center, said: “For a leading producing country like the US, heat waves in the summer often mean that crops can be damaged, especially during the most important development period in May and June. At this time, agricultural organizations and international news agencies will evaluate and make production forecasts after considering the impact of the weather. The discrepancies in figures often create uncertainty and boost the prices of animal feed ingredients.”

Potential risks for purchases in Q3

Apart from the US, the outlook for agricultural production in other major exporting countries is less optimistic. Brazil has completed planting its second corn crop, accounting for about 75% of the country’s total output, and is now in a critical stage of development before the start of harvest in June. Meanwhile, Argentina is harvesting and has progressed 15% as of April 11. Major Argentine grain exchanges have sharply cut their corn production forecasts.

The outlook for corn prices after the USDA's April World Agricultural Supply and Demand report is quite difficult, according to Mr. Pham Quang Anh. CBOT corn prices will hardly fall sharply in the near future as concerns about the crop in South America are still dominating the market.

|

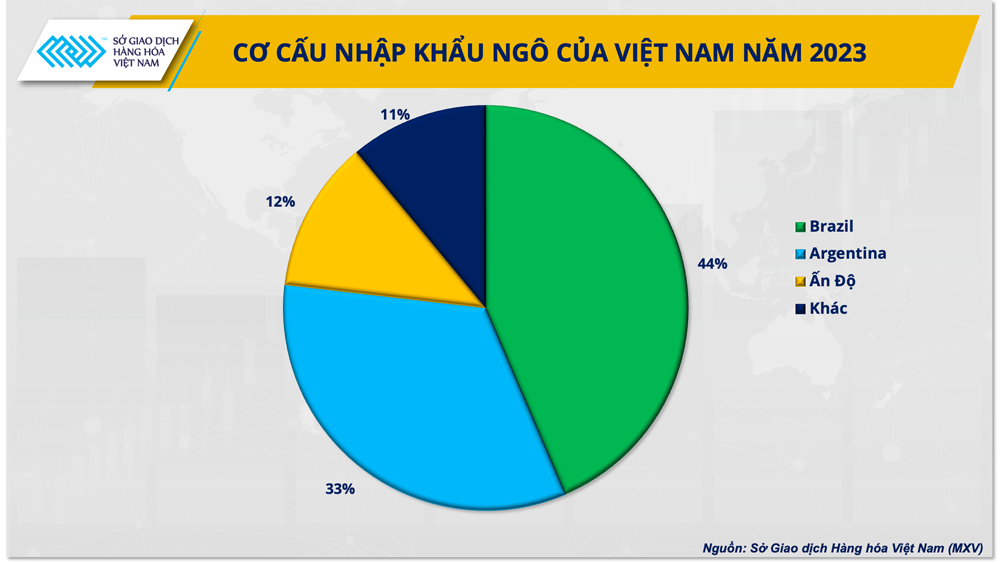

| Vietnam's corn import structure in 2023 |

For Vietnam, which still depends on imported corn supplies, animal feed businesses need to closely monitor the crop situation in Argentina and Brazil, as these are the largest corn suppliers to our country. Furthermore, with the fluctuations and risks of weather in the US as well as the cyclical nature of the past, businesses should balance and ensure raw material sources for the third quarter before the potential price increase in June to ensure stable feed ingredient costs.

Source

![[Photo] The 9th Party Congress of the National Political Publishing House Truth](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/ade0561f18954dd1a6a491bdadfa84f1)

![[Photo] Close-up of modernized Thu Thiem, connecting new life with District 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/d360fb27c6924b0087bf4f288c24b2f2)

![[Photo] General Secretary To Lam meets with the Group of Young National Assembly Deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/618b5c3b8c92431686f2217f61dbf4f6)

Comment (0)