SGGPO

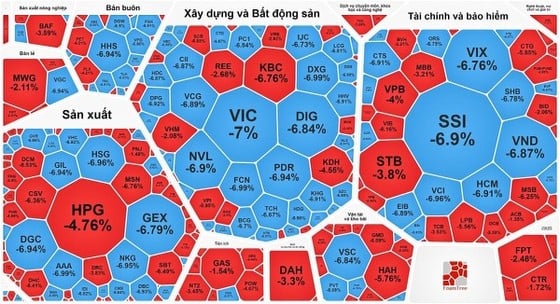

Another sell-off session by domestic investors caused the VN-Index to fall close to the short-term bottom at 1,150 points. Meanwhile, foreign investors unexpectedly returned to net buy a record of nearly VND709 billion on the HOSE floor.

|

| Stocks were scattered on the floor in the first trading session of the week, September 25. |

The stock market in the first trading session of the week, September 25, in the morning session, it seemed that the market could balance after 2 sessions of deep decline last weekend, because investors were calmer. However, selling pressure was still high, causing the market to quickly fall into a state of sell-off.

In the afternoon session, the "trigger" for the sell-off was triggered, causing investors to sell regardless in panic. Meanwhile, the bottom-fishing force was not strong enough, causing the market to have no support, so it fell deeply, and the market was submerged in red. Real estate and securities stocks were all over the floor.

VN-Index closed the first session of the week at the lowest price of the day, close to the 1,150 point mark after falling nearly 40 points.

Bluechip stocks also recorded many codes hitting the floor such as SHS VIC, GVR, SSI, many other codes also decreased deeply and only 3 codes kept the green color: SSB increased by 1.96%, VJC increased by 0.41%, VNM increased by 0.13%.

A series of real estate stocks also hit the floor such as: DIG, CEO, DRH, DXS, DXG, NVL, HDC, HDG, HQC, LDG, NBB, NLG, PDR, QCG, SZC...

Similarly, the securities group also had a series of stocks hitting the floor price such as: HCM, CTS, FTS, MBS, ORS, SHS, VCI, VDS, VIX, VND...

Although banking stocks did not hit the floor, many stocks fell very deeply, such as: CTG down 5.85%, TCB down 3.53%, VPB down 4%, MBB down 3.21%, BID down 2.06%...

Not only the main stock groups, many other stock groups such as seafood, oil and gas, public investment, and steel are also not out of the market's falling trajectory.

At the end of the trading session, VN-Index decreased by 39.85 points (3.34%) to 1,153.2 points with 495 stocks decreasing, 45 stocks increasing and 24 stocks remaining unchanged.

At the end of the session at Hanoi Stock Exchange, HNX-Index also decreased by 11.65 points (4.79%) to 231.5 points with 169 stocks decreasing, 46 stocks increasing and 35 stocks remaining unchanged.

The market in a sell-off session caused VN-Index to lose nearly 4% but liquidity was quite low because bottom-fishing power was not high, the total transaction value in the whole market was only nearly 27,400 billion VND.

While domestic investors were selling off, foreign investors returned to buy stocks after a series of strong net selling before. The total value of foreign net buying in the whole market was more than 802 billion VND, of which the HOSE floor accounted for nearly 709 billion VND.

The stocks that foreign investors bought the most were mainly pillar stocks such as HPG (VND 109.46 billion), SSI (VND 102.18 billion), VHM (VND 83.39 billion), VNM (VND 69.58 billion)...

Source

Comment (0)