Gold price today 06/24/2025

At the time of survey at 4:30 a.m. on June 24, 2025, the gold price was listed by some businesses specifically as follows:

The price of SJC gold bars was listed by Saigon Jewelry Company Limited, Bao Tin Minh Chau , DOJI Group and PNJ at 117.7-119.7 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117-119.7 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118.7-119.7 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions.

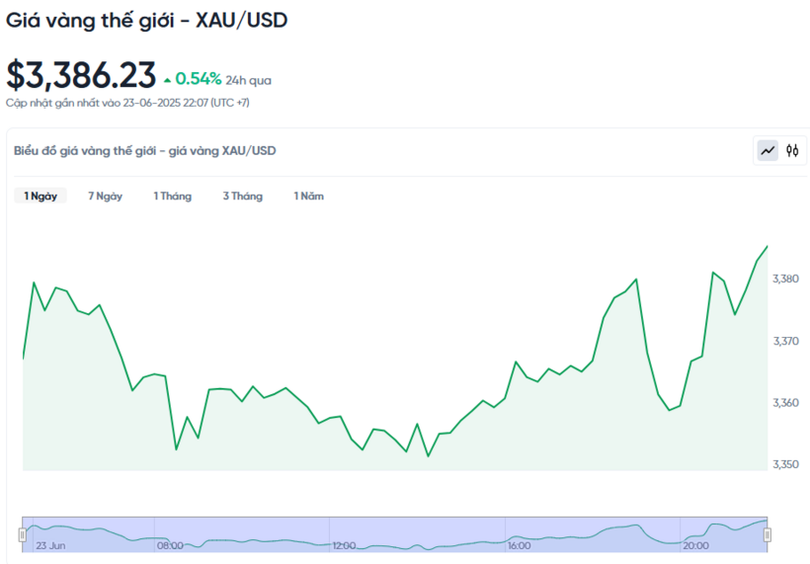

World gold price today June 24, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,386.23 USD/ounce. Today's gold price is unchanged compared to yesterday. Converted according to the USD exchange rate on the free market (26,324 VND/USD), the world gold price is about 107.4 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is about 12.3 million VND/tael higher than the international gold price.

World gold price developments in the past 24 hours.

Commenting on the market developments, Mr. Bart Melek - Head of Commodity Strategy at TD Securities said: "If inflation does not increase significantly due to the existing tariffs, it will mean a greater risk appetite from investors. Therefore, the demand for gold as a safe-haven asset may cool down somewhat in the short term." He predicted that gold prices will remain relatively stable, fluctuating in a range of around $75.

Gold has long been seen as a safe haven in times of uncertainty and as a hedge against inflation. However, high interest rates tend to dampen the appeal of gold because it does not yield interest. Investors are now awaiting data on the personal consumption expenditures (PCE) index, the Federal Reserve's preferred inflation gauge, due later this week.

Earlier, at last week's meeting, the Fed decided to keep interest rates in the range of 4.25% - 4.50% and signaled that it could consider cutting interest rates later this year. However, Chairman Jerome Powell remained cautious, saying that factors such as tax policy and the economic response are currently unclear.

Besides gold, other precious metals markets also tended to increase. Spot silver increased 0.4% to $36.14/ounce, platinum increased 2.1% to $1,291.50/ounce, and palladium increased 2% to $1,070.09/ounce - the highest level since June 12.

Source: https://baohatinh.vn/gia-vang-hom-nay-2462025-dung-yen-ca-2-chieu-post290444.html

Comment (0)