Gold price today 1/8/2025

At the time of survey at 4:30 a.m. on August 1, 2025, the price of gold bars was listed by some businesses specifically as follows:

The price of SJC gold bars was listed by Saigon Jewelry Company, Bao Tin Minh Chau, DOJI Group and PNJ at 119.7-121.2 million VND/tael (buy - sell), a decrease of 300,000 VND/tael in both buying and selling directions compared to yesterday.

Meanwhile, the price of SJC gold at Phu Quy was traded by businesses at 119.4-121.4 million VND/tael (buy - sell), the gold price decreased by 100,000 VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120.6-121.4 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 100,000 VND/tael for both buying and selling.

Regarding ring gold, the price of 9999 Hung Thinh Vuong round ring gold at DOJI is listed at 115.8-118.3 million VND/tael (buy - sell); the price decreased by 300,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell); down 300,000 VND/tael in both buying and selling directions compared to yesterday.

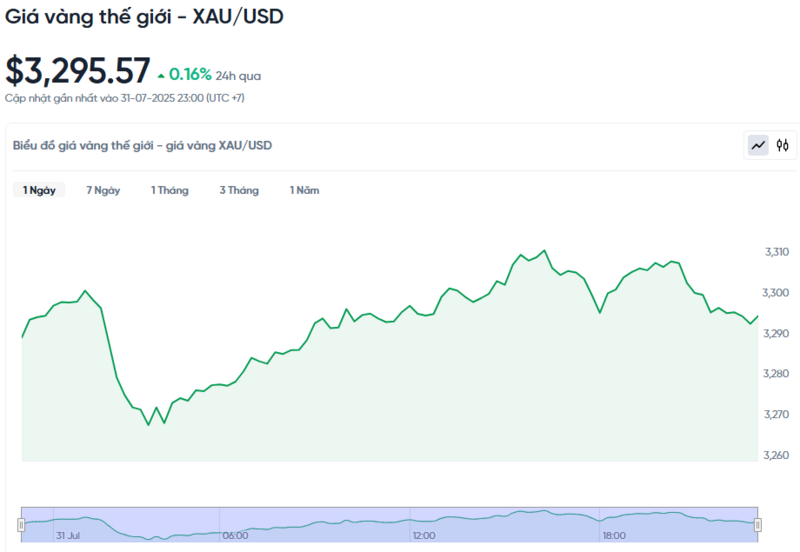

World gold price today August 1, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. today, Vietnam time, was at 3,295.57 USD/ounce. Today's gold price increased by 0.16% compared to yesterday. Converted according to the USD exchange rate on the free market (26,452 VND/USD), the world gold price is 105.1 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is about 16.1 million VND/tael higher than the international gold price.

“We are seeing increased trade uncertainty as we get closer to August 1st… safe-haven demand for gold is starting to pick up,” said Peter Grant, vice president and senior metals strategist at Zaner Metals. He said the current average price is hovering around $3,312 an ounce and if gold can break above its peak this week, it would be a further positive signal.

A day earlier, President Trump unexpectedly announced a series of new tariffs on imports from Brazil, South Korea and copper products, as part of a pressure campaign ahead of the tariff hike deadline on August 1. Inflation in the US also recorded a 0.3% increase in June as import tariffs began to increase the cost of goods, higher than the 0.2% increase in May after adjustment.

Meanwhile, the US Federal Reserve (Fed) decided to keep interest rates unchanged at its meeting on Thursday. However, subsequent statements by Fed Chairman Jerome Powell have reduced market expectations for a possible rate cut in September. Gold often benefits in a low-interest-rate environment because it is a non-yielding asset.

Investors are now waiting for the US non-farm payrolls report, due on Friday, for further clues on the Fed's future interest rate policy direction.

In other precious metals, spot silver fell 1.3% to $36.66 an ounce - its lowest since July 7. Platinum fell 0.5% to $1,306.98 an ounce, while palladium rose 0.9% to $1,215.79 an ounce.

Kitco Metals expert Jim Wyckoff explained that the silver price drop may have been influenced by the sell-off sentiment that has spread to the copper market, which has suffered a sharp decline over the past two days. President Trump unexpectedly announced a 50% tariff on copper pipe and wire products on Wednesday, causing the price of US copper on the COMEX to fall more than 20%.

Source: https://baohatinh.vn/gia-vang-hom-nay-182025-giam-nhe-ca-2-chieu-mua-ban-post292863.html

Comment (0)