Domestic gold price today June 26, 2025

As of 4:30 p.m. on June 26, 2025, the domestic gold bar price increased by half a million VND compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 118-120 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118-120 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.2-120 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 400 thousand VND/tael for buying and 500 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118-120 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117.2-120 million VND/tael (buy - sell), gold price increased by 400 thousand VND/tael in buying direction - increased by 500 thousand VND/tael in selling direction.

As of the afternoon of June 26, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115-117 million VND/tael (buy - sell); the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell); the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, June 26, 2025 is as follows:

| Gold price today | June 26, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 118 | 120 | +500 | +500 |

| DOJI Group | 118 | 120 | +500 | +500 |

| Red Eyelashes | 119.2 | 120 | +400 | +500 |

| PNJ | 118 | 120 | +500 | +500 |

| Bao Tin Minh Chau | 118 | 120 | +500 | +500 |

| Phu Quy | 117.2 | 120 | +400 | +500 |

8,000 ▲500K

| 1. DOJI - Updated: June 26, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,000 ▲500K | 120,000 ▲500K |

| AVPL/SJC HCM | 118,000 ▲500K | 120,000 ▲500K |

| AVPL/SJC DN | 118,000 ▲500K | 120,000 ▲500K |

| Raw material 9999 - HN | 109,500 ▲500K | 112,000 ▲500K |

| Raw material 999 - HN | 109,400 ▲500K | 111,900 ▲500K |

| 2. PNJ - Updated: June 26, 2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,800 | 12,000 |

| PNJ 999.9 Plain Ring | 11,420 | 11,700 |

| Kim Bao Gold 999.9 | 11,420 | 11,700 |

| Gold Phuc Loc Tai 999.9 | 11,420 | 11,700 |

| 999.9 gold jewelry | 11,350 | 11,600 |

| 999 gold jewelry | 11,338 | 11,588 |

| 9920 jewelry gold | 11,267 | 11,517 |

| 99 gold jewelry | 11,244 | 11,494 |

| 750 Gold (18K) | 7,965 | 8,715 |

| 585 Gold (14K) | 6,051 | 6,801 |

| 416 Gold (10K) | 4,091 | 4,841 |

| PNJ Gold - Phoenix | 11,420 | 11,700 |

| 916 Gold (22K) | 10,386 | 10,636 |

| 610 Gold (14.6K) | 6,341 | 7,091 |

| 650 Gold (15.6K) | 6,805 | 7,555 |

| 680 Gold (16.3K) | 7,153 | 7,903 |

| 375 Gold (9K) | 3,615 | 4,365 |

| 333 Gold (8K) | 3,093 | 3,843 |

| 3. SJC - Updated: June 26, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,000 ▲500K | 120,000 ▲500K |

| SJC gold 5 chi | 118,000 ▲500K | 120,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,000 ▲500K | 120,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,800 ▲300K | 116,300 ▲300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,800 ▲300K | 116,400 ▲300K |

| Jewelry 99.99% | 113,800 ▲300K | 115,700 ▲300K |

| Jewelry 99% | 110,054 ▲297K | 114,554 ▲297K |

| Jewelry 68% | 71,933 ▲204K | 78,833 ▲204K |

| Jewelry 41.7% | 41,501 ▲125K | 48,401 ▲125K |

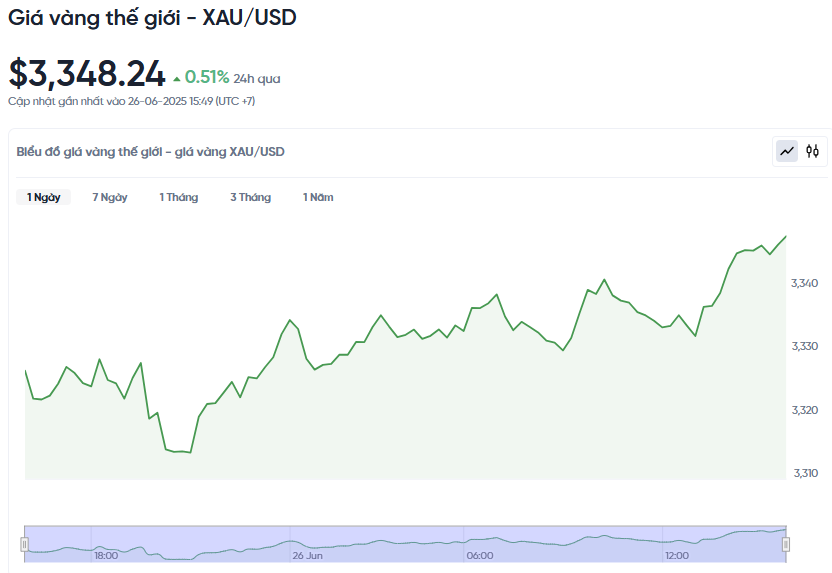

World gold price today June 26, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 p.m. on June 26, Vietnam time, was 3,348.24 USD/ounce. Today's gold price increased by 17.04 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,290 VND/USD), the world gold price is about 109.61 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 10.39 million VND/tael higher than the international gold price.

World gold prices recorded a slight increase as the US dollar weakened and new concerns about the stability of US monetary policy began to spread. Specifically, spot gold increased by 0.51%, while US gold futures increased by 0.2%, reaching 3,349.30 USD/ounce.

The main reason supporting gold prices this time is the information that US President Donald Trump is considering replacing Federal Reserve Chairman Jerome Powell, possibly as early as September or October. These speculations raise concerns about the Fed's independence in conducting monetary policy, a key factor in maintaining confidence in financial markets. In that context, investors tend to seek gold as a safe haven.

Meanwhile, the US dollar fell to its lowest level since March 2022, making gold more attractive to international investors. In addition, the market is still closely watching developments around US interest rate policy. In his Senate testimony on Wednesday, Mr. Powell said that President Trump's tax policies could have a one-time impact on prices, but that persistent inflation remains a real risk and the Fed should be cautious when considering further rate cuts.

According to KCM Trade expert Tim Waterer, Trump's desire for a more dovish Fed chairman could increase the possibility of the US entering a cycle of aggressive interest rate cuts, thereby putting pressure on the USD. In a recent statement, Trump even called Powell "terrible" and said he was considering three or four other candidates for the Fed's leadership position. Some sources also revealed that Trump is considering the possibility of announcing Powell's successor as early as September or October this year.

In addition, the market is waiting for the US quarterly GDP report to be released today, along with the personal consumption expenditure (PCE) index, an important inflation measure of the Fed, scheduled to be released on Friday. These data will greatly affect whether the Fed will continue to cut interest rates in the near future.

Geopolitically, the ceasefire between Israel and Iran appears to be holding. At the NATO summit, Trump hailed the swift end to the 12-day conflict and said he would seek a commitment from Iran in upcoming talks aimed at ending its nuclear ambitions.

In addition to gold, other precious metals markets also recorded increases. Spot silver edged up 0.1% to $36.34 an ounce. Platinum rose 1.8% to $1,379.58 an ounce. Meanwhile, palladium rose sharply by 3.4% to $1,093.70 an ounce.

Gold Price Forecast

Gold prices are still expected to continue to increase in the coming time, especially when the US Federal Reserve (Fed) is planning to cut interest rates not only this year but also in the following years. The continued weakening of the USD is also a positive factor for gold prices, according to market principles. In addition, the demand for gold from central banks around the world remains high.

However, after the gold price has increased sharply for more than a year, profit-taking activities have also begun to appear more and more. Some forecasts say that if the geopolitical situation cools down and the US-China trade war is no longer tense, the gold price may adjust sharply down by 5-10%, down to about 3,100 USD, or even lower than 3,000 USD/ounce.

In the long term, many institutions remain positive on gold. They believe that gold can continue its upward trend, with an expected price of $3,500 to $4,000 per ounce by 2026. Over the past decades, gold has shown itself to be an asset with a sustainable upward trend over time.

The current gold market shows remarkable stability. Although investor sentiment has shifted from geopolitical risk concerns to focusing on the Fed's monetary policy, gold prices have maintained a slight upward momentum, reflecting a very strong buying base.

The ceasefire between Israel and Iran continues to hold, helping to reduce safe-haven demand, which typically boosts gold prices. However, it is worth noting that gold prices have not fallen along with this development, but have actually risen beyond the weakening of the US dollar, indicating that buying power from both individual and institutional investors remains strong.

The divergence between the falling demand for safe havens and the continued buying of gold reflects a clear shift in market sentiment. Instead of reacting passively to the crisis, gold investors are now more proactive, betting on the Fed’s near-term monetary policy adjustments.

The market’s focus now is on Fed Chairman Jerome Powell’s congressional testimony, with his testimony before the Senate Banking Committee being closely watched after his initial testimony in the House of Representatives. Investors are reshaping their expectations for the path of interest rate policy following the testimony, with the market now pricing in a 24.8% chance of a rate cut at the Fed’s July meeting, according to the CME FedWatch tool.

Source: https://baonghean.vn/gia-vang-chieu-nay-26-6-2025-gia-vang-trong-nuoc-va-the-gioi-tang-nhe-nua-trieu-dong-khi-dong-usd-suy-yeu-10300671.html

![[Photo] Cuban artists bring "party" of classic excerpts from world ballet to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/797945d5d20b4693bc3f245e69b6142c)

![[Photo] General Secretary To Lam receives Australian Ambassador to Vietnam Gillian Bird](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/ce86495a92b4465181604bfb79f257de)

Comment (0)