Domestic gold price this afternoon August 24, 2025

As of 3:00 p.m. this afternoon, August 24, 2025, the domestic gold bar price last week increased to a record high. Specifically:

DOJI Group listed SJC gold price at 125.6-126.6 million VND/tael (buy - sell), the price remained unchanged in both buying and selling compared to yesterday. Gold bar price increased by 2.1 million VND/tael in both buying and selling compared to the end of last week.

At the same time, the price of SJC gold was listed by Saigon Jewelry Company Limited - SJC at 125.6-126.6 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 23 yesterday. An increase of 2.1 million VND/tael in both buying and selling directions compared to the same period last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 126-126.6 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to the end of last week, the gold price increased by 2 million VND/tael for buying and 2.1 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 125.6-126.6 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to the same period yesterday. The price increased by 2.1 million VND/tael in both buying and selling directions compared to last week.

SJC gold price at Phu Quy is traded by businesses at 124.6-126.6 million VND/tael (buy - sell), gold price is unchanged in both buying and selling directions compared to yesterday, gold price increased by 1.9 million VND/tael in buying direction - increased by 2.1 million VND/tael in selling direction compared to last week.

.jpg)

As of 3:00 p.m. on August 24, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 118.8-121.8 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; increased by 2.3 million VND/tael in both buying and selling directions compared to the end of last week.

Bao Tin Minh Chau listed the price of gold rings at 118.7-121.7 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; increased by 1.9 million VND/tael in both buying and selling directions compared to last week.

The latest gold price list this afternoon, August 24, 2025 is as follows:

| Gold price this afternoon | August 24, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 125.6 | 126.6 | - | - |

| DOJI Group | 125.6 | 126.6 | - | - |

| Red Eyelashes | 126 | 126.6 | - | - |

| PNJ | 125.6 | 126.6 | - | - |

| Bao Tin Minh Chau | 125.6 | 126.6 | - | - |

| Phu Quy | 124.6 | 126.6 | - | - |

| 1. DOJI - Updated: August 24, 2025 15:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 125,600 | 126,600 |

| AVPL/SJC HCM | 125,600 | 126,600 |

| AVPL/SJC DN | 125,600 | 126,600 |

| Raw material 9999 - HN | 111,000 | 112,000 |

| Raw material 999 - HN | 110,900 | 111,900 |

| 2. PNJ - Updated: August 24, 2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 125,600 | 126,600 |

| PNJ 999.9 Plain Ring | 118,500 | 121,500 |

| Kim Bao Gold 999.9 | 118,500 | 121,500 |

| Gold Phuc Loc Tai 999.9 | 118,500 | 121,500 |

| PNJ Gold - Phoenix | 118,500 | 121,500 |

| 999.9 gold jewelry | 117,400 | 119,900 |

| 999 gold jewelry | 117,280 | 119,780 |

| 9920 jewelry gold | 116,300 | 118,800 |

| 99 gold jewelry | 116,300 | 118,800 |

| 916 Gold (22K) | 107,430 | 109,930 |

| 750 Gold (18K) | 82,580 | 90,080 |

| 680 Gold (16.3K) | 74,180 | 81,680 |

| 650 Gold (15.6K) | 70,590 | 78,090 |

| 610 Gold (14.6K) | 65,790 | 73,290 |

| 585 Gold (14K) | 62,790 | 70,290 |

| 416 Gold (10K) | 42,530 | 50,030 |

| 375 Gold (9K) | 37,610 | 45,110 |

| 333 Gold (8K) | 32,220 | 39,720 |

| 3. SJC - Updated: 8/24/2025 3:00 PM - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 125,600 | 126,600 |

| SJC gold 5 chi | 125,600 | 126,620 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 125,600 | 126,630 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 118,500 | 121,100 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 118,500 | 121,000 |

| Jewelry 99.99% | 118,500 | 120,100 |

| Jewelry 99% | 114,410 | 118,910 |

| Jewelry 68% | 74,326 | 81,826 |

| Jewelry 41.7% | 42,736 | 50,236 |

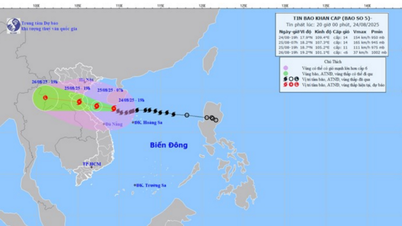

World gold price this afternoon August 24, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 3:00 p.m. on August 24, Vietnam time, was 3,371.58 USD/ounce. The gold price this afternoon remained unchanged compared to yesterday and increased by 35.4 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (26,520 VND/USD), the world gold price is about 107.8 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.8 million VND/tael higher than the international gold price.

Domestic gold prices have seen notable fluctuations over the past week, at times setting new records. On August 18, the price of SJC gold bars increased by VND500,000/tael, returning to VND125 million for selling. After a day of stability, on August 20, the gold price was adjusted down by VND200,000/tael for both buying and selling. The buying and selling prices were adjusted to VND123.8 - 124.8 million/tael.

In particular, on August 21, the gold price surpassed the old record when it increased sharply by 600,000 VND/tael. The buying and selling prices reached 124.4 - 125.4 million VND/tael. This price remained stable the following day. Overall, the price of SJC gold bars at the end of the week was 2.1 million VND/tael higher than the same time last week. The price of gold rings also increased sharply following the same trend as the price of gold bars.

Global gold demand in the second quarter increased 3% year-on-year to 1,249 tonnes worth $132 billion, a 45% increase in value. Investment flows through ETFs were particularly strong, with global holdings up 16% to 3,616 tonnes as of June 30. Total assets under management increased 64% year-on-year to $383 billion.

KCM Trade expert Tim Waterer said that gold prices are currently affected by many different factors. The possibility of a peace agreement between Russia and Ukraine could reduce the demand for gold as a safe haven, which has been a key factor in the recent increase in gold prices.

Gold has long been seen as a safe investment, attracting cash flows whenever the economy shows signs of instability or volatility. This year, the impact of tariffs and inflation has pushed the price of the precious metal to record highs. This trend has also spurred the development of gold ETFs, making it easier for investors to protect their portfolios against risk.

Joe Cavatoni, CEO of the World Gold Council, said the gold market is seeing unprecedented interest, especially from gold-backed ETFs. According to statistics, global gold ETFs received $3.2 billion in inflows in July, heading for their second-strongest year ever.

World gold prices rose sharply at the end of the week after Fed Chairman Jerome Powell signaled that an interest rate cut could come next month. In his speech, Powell showed a delicately neutral stance. He noted the risks of rising inflation and slowing economic growth, and said that while the risks were balanced, an adjustment in US monetary policy may be necessary.

Powell said that while the U.S. economy remains resilient, risks are starting to mount. The economy is facing new challenges as higher import tariffs reshape the global trading system. Tighter immigration policies have slowed labor force growth.

At the same time, Powell stressed that inflation risks remain a major concern. He said the impact of tariffs on consumer prices is clear and that he expects these effects to accumulate in the coming months.

Gold Price Forecast

Gold prices are still in a sideways phase and have not broken out of the trading range they have been in for the past four months. However, recent comments from US Federal Reserve Chairman Jerome Powell have created a clear sense of optimism in the market, with both professional and public investors expecting gold prices to rise next week.

According to the latest survey of 13 market analysts, there is no opinion that gold prices will fall. Up to 8 experts, equivalent to 62%, predict gold prices will increase. The remaining five, accounting for 38%, believe that gold prices will be stable next week.

A similar optimism was also expressed in an online investor poll conducted by Kitco, with 194 respondents, or 59%, expecting gold prices to rise. About 18% predicted a fall and 23% said prices would remain flat.

Michael Brown, Senior Market Analyst at Pepperstone, said that while Powell's comments could boost gold's rally, there are still unanswered questions about the upcoming policy direction.

While gold may not break out immediately, Brown remains bullish on the metal’s long-term prospects. “Especially as President Trump continues to criticize the Fed, further undermining the notion of monetary policy independence and increasing the appeal of hard assets, there is a good chance that gold will hit new record highs before the end of the year,” he added.

Gold prices are expected to set a new record in the world market by the end of this year, with the expected price reaching 3,600 USD/ounce. Ventura Securities said that this increase is driven by global economic challenges, geopolitical risks and strong investment demand.

Comex gold prices could hit $3,600 by year-end, driven by strong inflows into ETFs, steady central bank purchases and active participation of retail investors in the Indian gold market, said NS Ramaswamy, Head of Commodities at Ventura.

Ole Hansen of Saxo Bank said the environment of yield and a weaker US dollar will be favorable for gold. He said prices need to break above $3,450 an ounce to reach records above $3,500.

Chantelle Schieven of Capitalight Research said gold prices remain well supported but gains may be limited as expectations of a rate cut have been priced in. The market needs further impetus from a shift in the Fed's stance, particularly its focus on the labor market rather than inflation.

Source: https://baonghean.vn/gia-vang-chieu-nay-24-8-2025-tang-gia-ky-luc-10305057.html

Comment (0)