Domestic gold price today June 16, 2025

As of 4:30 p.m. on June 16, 2025, the domestic gold bar price turned down to below 120 million. Specifically:

DOJI Group listed the price of SJC gold bars at 117.6-119.6 million VND/tael (buy - sell), a decrease of 200 thousand VND/tael in buying - a decrease of 700 thousand VND/tael in selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 117.6-119.6 million VND/tael (buy - sell), a decrease of 200 thousand VND/tael in buying - a decrease of 700 thousand VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118.5-119.5 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 500 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 117.6-119.6 million VND/tael (buy - sell), the price decreased by 200 thousand VND/tael in buying direction - decreased by 700 thousand VND/tael in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117-119.6 million VND/tael (buy - sell), gold price remains unchanged in buying direction - decreased 400 thousand VND/tael in selling direction.

.png)

As of the afternoon of June 16, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115-117 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.3 million VND/tael (buy - sell); an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, June 16, 2025 is as follows:

| Gold price today | June 16, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 117.6 | 119.6 | -200 | -700 |

| DOJI Group | 117.6 | 119.6 | -200 | -700 |

| Red Eyelashes | 118.5 | 119.5 | -500 | -500 |

| PNJ | 117.8 | 119.6 | -200 | -700 |

| Bao Tin Minh Chau | 117.8 | 119.6 | -200 | -700 |

| Phu Quy | 117 | 117.8 | - | -400 |

| 1. DOJI - Updated: June 16, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 117,600 ▼200K | 119,600 ▼700K |

| AVPL/SJC HCM | 117,600 ▼200K | 119,600 ▼700K |

| AVPL/SJC DN | 117,600 ▼200K | 119,600 ▼700K |

| Raw material 9999 - HN | 109,500 | 114,000 |

| Raw material 999 - HN | 109,400 | 113,900 |

| 2. PNJ - Updated: June 16, 2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,760 | 11,960 |

| PNJ 999.9 Plain Ring | 11,500 | 11,700 |

| Kim Bao Gold 999.9 | 11,500 | 11,700 |

| Gold Phuc Loc Tai 999.9 | 11,500 | 11,700 |

| 999.9 gold jewelry | 11,350 | 11,600 |

| 999 gold jewelry | 11,338 | 11,588 |

| 9920 jewelry gold | 11,267 | 11,517 |

| 99 gold jewelry | 11,244 | 11,494 |

| 750 Gold (18K) | 7,965 | 8,715 |

| 585 Gold (14K) | 6,051 | 6,801 |

| 416 Gold (10K) | 4,091 | 4,841 |

| PNJ Gold - Phoenix | 11,500 | 11,700 |

| 916 Gold (22K) | 10,386 | 10,636 |

| 610 Gold (14.6K) | 6,341 | 7,091 |

| 650 Gold (15.6K) | 6,805 | 7,555 |

| 680 Gold (16.3K) | 7,153 | 7,903 |

| 375 Gold (9K) | 3,615 | 4,365 |

| 333 Gold (8K) | 3,093 | 3,843 |

| 3. SJC - Updated: June 16, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 117,600 ▼200K | 119,600 ▼700K |

| SJC gold 5 chi | 117,600 ▼200K | 119,620 ▼700K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 117,600 ▼200K | 119,630 ▼700K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,900 ▲200K | 116,400 ▲200K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,900 ▲200K | 116,500 ▲200K |

| Jewelry 99.99% | 113,900 ▲200K | 115,800 ▲200K |

| Jewelry 99% | 110,153 ▲198K | 114,653 ▲198K |

| Jewelry 68% | 72,001 ▲136K | 78,901 ▲136K |

| Jewelry 41.7% | 41,543 ▲83K | 48,443 ▲83K |

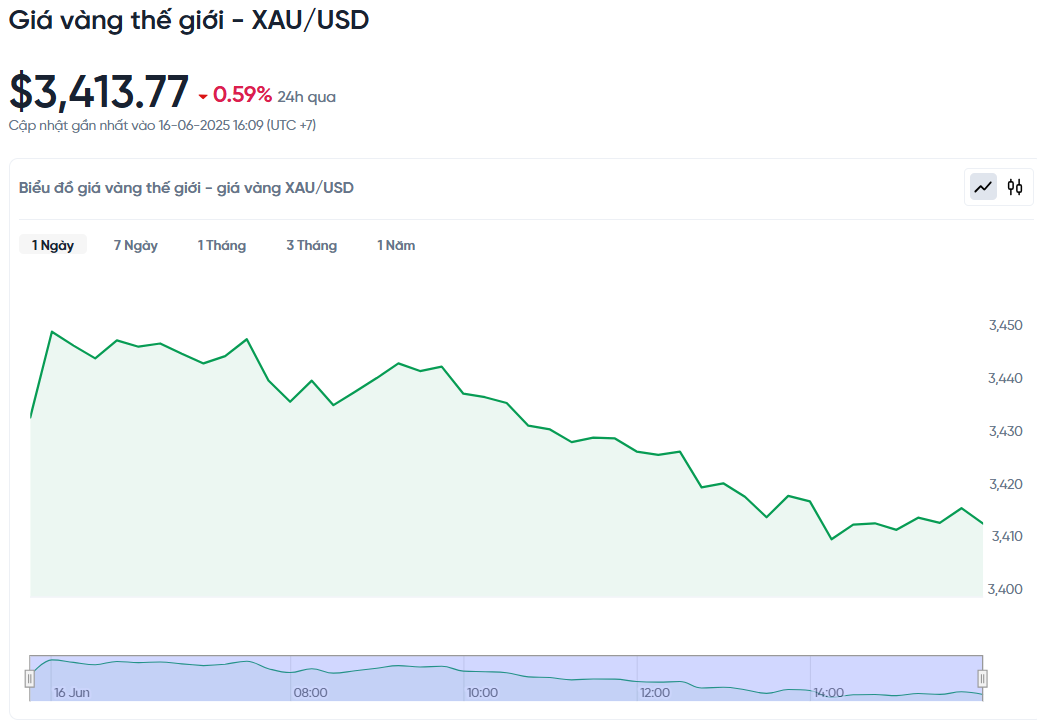

World gold price today June 16, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 p.m. on June 16, Vietnam time, was 3,413.77 USD/ounce. Today's gold price decreased by 20.11 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,242 VND/USD), the world gold price is about 112.74 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 6.86 million VND/tael higher than the international gold price.

Gold prices fell slightly as investors took advantage of the opportunity to take profits after rising sharply to near a two-month high. Rising tensions between Israel and Iran over the weekend raised concerns that the conflict could spread across the region, causing demand for gold to surge.

Specifically, spot gold prices fell 0.5% to $3,414.32 an ounce after hitting their highest level since April 22. US gold futures also fell 0.5% to $3,434.80 an ounce.

Kelvin Wong, Asia-Pacific market analyst at OANDA, said tensions between Iran and Israel have increased political risk, boosting demand for gold as a hedge against instability.

According to him, the gold price has surpassed the $3,400 threshold and is maintaining an upward trend in the short term. The next resistance level is forecast to be $3,500 and if the situation continues to escalate, the gold price may surpass this level to set a new peak.

Israel and Iran continued to attack each other on Sunday, killing and wounding scores of civilians, raising fears of a wider war in the region. Both sides even warned each other's citizens to be on guard against further attacks.

US President Donald Trump also expressed hope that Israel and Iran can find a peaceful solution, but he acknowledged that sometimes countries have to go through conflict to reach an agreement. In the current volatile environment, gold is often seen as a safe haven asset, helping investors protect the value of their assets from political and economic risks.

This week, markets will be watching a series of monetary policy meetings of major central banks, most notably the US Federal Reserve meeting on Wednesday. The Fed is expected to keep interest rates unchanged, but investors are waiting for signals on the possibility of a rate cut in the near future. The market currently expects the Fed to have two interest rate cuts before the end of the year, possibly starting in September, especially when recent inflation data shows that prices are rising more slowly.

Meanwhile, other precious metals also recorded positive fluctuations. Silver prices increased 0.2% to $36.36/ounce, platinum increased 1.5% to $1,245.67/ounce, and palladium also increased 1.5% to $1,043.53/ounce.

Gold Price Forecast

Wall Street analysts remain bullish on gold prices, but individual investors are more cautious, especially as the market enters a volatile period, according to a recent Kitco News survey.

Barchart expert Darin Newsom commented that a series of unstable factors from political tensions in the Middle East to the internal situation in the US are causing investors to continue to seek gold as a safe haven. In addition, the tendency of some countries to sell USD also contributes to increasing demand for gold.

Some experts believe that gold prices could retest the peaks set in April. Marc Chandler, CEO of Bannockburn Global Forex, said that gold’s role as a safe haven asset has become more evident than ever amid growing global uncertainty. He said that after the recent correction, gold prices have the opportunity to retest the record level of nearly $3,500 an ounce if geopolitical risks persist.

However, some other experts are more cautious about the gold price increase this week. Some even believe that gold prices will fall quickly after the political instability news passes. If the price increase is to continue, the world political situation must become more unstable.

"The Israel-Iran conflict could keep gold above $3,400, but it's unlikely to push prices higher without a new escalation. History shows that geopolitical rallies are often difficult to sustain over the long term," said Ole Hansen, head of commodity strategy at Saxo Bank.

Investors are cautiously waiting after the Israeli airstrike, said Naeem Aslam, chief investment officer at Zaye Capital Markets. He highlighted the importance of oil prices and Iran's response: "If Iran retaliates strongly, especially if it threatens oil supplies through the Strait of Hormuz, gold could explode on hedging demand. On the other hand, if tensions ease, gold's rally could stall."

The main event this week is the Fed's monetary policy meeting. In addition to the Fed, the Swiss National Bank (SNB) and the Bank of England (BoE) will also make interest rate decisions this week. These developments have a knock-on effect on gold prices, which are highly sensitive to global monetary policies.

The current situation poses a difficult problem for the Fed as it has to balance inflation control and economic stability in an unstable geopolitical environment. Their decisions can create strong fluctuations in gold prices, especially when combined with risk factors from the Middle East. Investors need to closely monitor these developments to have appropriate strategies.

Source: https://baonghean.vn/gia-vang-chieu-nay-16-6-2025-gia-vang-trong-nuoc-va-the-gioi-giam-manh-do-chot-loi-10299764.html

![[Infographic] Circular guiding the functions, tasks and powers of the provincial Department of Culture, Sports and Tourism and the commune-level Department of Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/29/877f24989bb946358f33a80e4a4f4ef5)

Comment (0)