Domestic gold price today June 15, 2025

As of 2:30 p.m. on June 15, 2025, the domestic gold bar price closed the week at over 120 million. Specifically:

DOJI Group listed the price of SJC gold bars at 117.8-120.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling compared to yesterday. The gold price increased by 2.9 million VND/tael in buying - increased by 3.1 million VND/tael in selling compared to last week.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 117.8-120.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. The gold price increased by 2.9 million VND/tael in buying direction - increased by 3.1 million VND/tael in selling direction compared to last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119-120 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to last week, the gold price increased by 3 million VND/tael for buying and 2.8 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 117.8-120.3 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday, the price increased by 2.9 million VND/tael in buying direction - increased by 3.1 million VND/tael in selling direction compared to last week.

SJC gold price in Phu Quy is traded by businesses at 117-120 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions. Gold price increased by 2.5 million VND/tael in buying direction - increased by 2.8 million VND/tael in selling direction compared to last week.

As of the afternoon of June 15, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115-117 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday; the price increased by 2.5 million VND/tael in both buying and selling directions compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; increased by 3 million VND/tael in both buying and selling directions compared to last week.

The latest gold price list today, June 15, 2025 is as follows:

| Gold price today | June 15, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 117.8 | 120.3 | - | - |

| DOJI Group | 117.8 | 120.3 | - | - |

| Red Eyelashes | 119 | 120 | - | - |

| PNJ | 117.8 | 120.3 | - | - |

| Bao Tin Minh Chau | 117.8 | 120.3 | - | - |

| Phu Quy | 117 | 120 | - | - |

| 1. DOJI - Updated: June 15, 2025 14:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 117,800 | 120,300 |

| AVPL/SJC HCM | 117,800 | 120,300 |

| AVPL/SJC DN | 117,800 | 120,300 |

| Raw material 9999 - HN | 109,500 | 114,000 |

| Raw material 999 - HN | 109,400 | 113,900 |

| 2. PNJ - Updated: June 15, 2025 14:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,780 | 12,030 |

| PNJ 999.9 Plain Ring | 11,400 | 11,680 |

| Kim Bao Gold 999.9 | 11,400 | 11,680 |

| Gold Phuc Loc Tai 999.9 | 11,400 | 11,680 |

| 999.9 gold jewelry | 11,320 | 11,570 |

| 999 gold jewelry | 11,308 | 11,558 |

| 9920 jewelry gold | 11,237 | 11,487 |

| 99 gold jewelry | 11,214 | 11,464 |

| 750 Gold (18K) | 7,943 | 8,693 |

| 585 Gold (14K) | 6,034 | 6,784 |

| 416 Gold (10K) | 4,078 | 4,828 |

| PNJ Gold - Phoenix | 11,400 | 11,680 |

| 916 Gold (22K) | 10,358 | 10,608 |

| 610 Gold (14.6K) | 6.323 | 7,073 |

| 650 Gold (15.6K) | 6,786 | 7,536 |

| 680 Gold (16.3K) | 7.133 | 7,883 |

| 375 Gold (9K) | 3.604 | 4,354 |

| 333 Gold (8K) | 3,083 | 3,833 |

| 3. SJC - Updated: June 15, 2025 14:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 117,800 | 120,300 |

| SJC gold 5 chi | 117,800 | 120,320 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 117,800 | 120,330 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,700 | 116,200 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,700 | 116,300 |

| Jewelry 99.99% | 113,700 | 115,600 |

| Jewelry 99% | 109,955 | 114,455 |

| Jewelry 68% | 71,865 | 78,765 |

| Jewelry 41.7% | 41,460 | 48,360 |

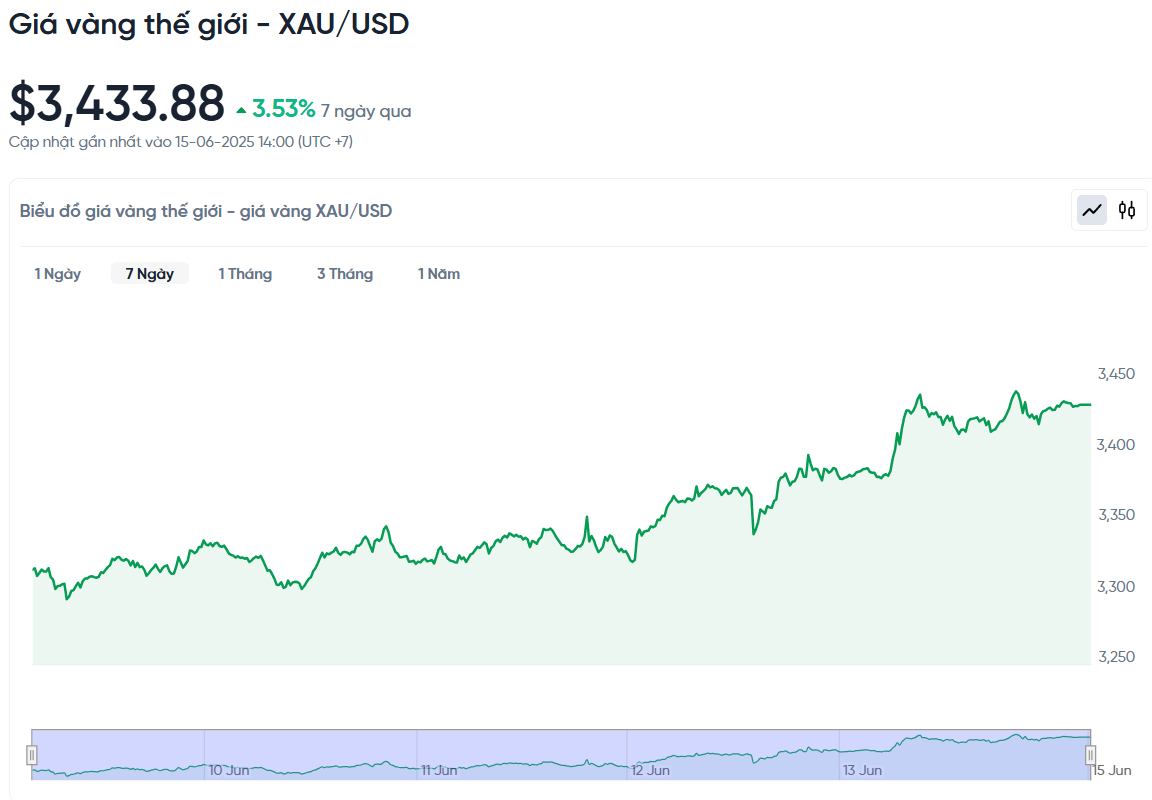

World gold price today June 15, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 2:30 p.m. on June 15, Vietnam time, was 3,433.88 USD/ounce. Today's gold price remained unchanged from yesterday but increased by 117.02 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (26,223 VND/USD), the world gold price is about 112.66 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 7.64 million VND/tael higher than the international gold price.

The world gold price is on a strong rise amid escalating tensions in the Middle East and the sudden depreciation of the USD. This shows a clear shift of capital flows looking for safe havens amid current uncertainties.

The new conflict in the Middle East has sent investors rushing to buy gold as a safe investment. After Israel's preemptive strike, the stock market plummeted while oil prices surged. Notably, gold prices reached their highest level since hitting a record high of $3,500 an ounce in April. Surprisingly, however, bond yields and the US dollar barely moved.

Gold prices rose 3.7% this week, while the US dollar continued its downward trend, falling 1% and hitting a three-year low. The weakness of the greenback in the current context is quite unusual, because the US economy is considered a stable pillar of the global economy.

John Ciampaglia of Sprott Asset Management points out an interesting paradox. Although gold prices have risen more than 25% over the past year, retail participation has been very limited. Central banks, especially China with its de-dollarization strategy, have been the main force driving prices.

The market is also witnessing a major shift in investment behavior. While gold prices continue to hit new highs, US Treasury bonds, traditionally considered safe havens, are losing their appeal. The USD Index (DXY) has fallen by 9%, a staggering drop given the current uncertainty.

Gold has now broken through a key resistance level at $3,400 an ounce but is still trading below the record $3,500 an ounce set in April. Experts predict that in the long term, gold will continue to be supported by favorable cyclical factors and market structures in the second half of 2025.

Roukaya Ibrahim, commodity strategist at BCA Research, said their portfolio models still favor precious metals like silver and platinum, but gold remains the dominant player. All three precious metals have strong momentum in the current period.

'We see a strong correlation between equities and bonds, which is putting pressure on investors to seek new diversification. In this context, gold is positioned to benefit from a variety of market scenarios,' Ms Ibrahim added.

Investors should be cautious about buying at current levels, as conflict-driven rallies are often difficult to sustain. Once tensions ease or the market shifts to other themes, gold prices could fall quickly. The big risk next week is that renewed tensions could push up inflation, forcing the Federal Reserve to keep interest rates at neutral levels.

Gold Price Forecast

According to the latest survey from Kitco News, industry experts are very optimistic about the prospects of gold, while retail investors are somewhat cautious despite the good increase in gold prices.

This week, 14 experts participated in the Kitco News survey. Wall Street continued to show optimism thanks to cooling inflation data and tensions in the Middle East. Of those, 10 experts (71%) predicted that gold prices would rise next week, just one expert (7%) said prices would fall, and the remaining three (21%) expected gold to stay flat.

Meanwhile, Kitco’s online poll of 253 voters showed mixed sentiment among retail investors. 146 (58%) said gold prices would rise, 54 (21%) said they would fall, and 53 (21%) thought prices would be stable next week.

Gold prices are set to rise, says Rich Checkan, chairman and CEO of Asset Strategies International. With Israel’s attack on Iran escalating global tensions, there is no doubt where gold will head next week.

Gold is likely to continue its uptrend and test the April highs, said Marc Chandler, CEO of Bannockburn Global Forex. After a recent correction, gold is showing signs of being ready to attack the record high around $3,500. These geopolitical uncertainties are likely to persist beyond next week.

CPM Group analysts say it is unlikely that gold will fall below $3,200 or even $3,000 in the coming months, admitting that their initial forecast of a summer correction has been completely overturned by complex geopolitical factors and unresolved tariff issues.

Jim Wyckoff, senior analyst at Kitco, agrees. He predicts that gold prices will continue to rise thanks to positive technical signals and increased safe-haven demand in the market.

"The Israel-Iran conflict could keep gold above $3,400, but it's unlikely to push prices higher without further escalation. History shows that geopolitical rallies are difficult to sustain in the long term," said Ole Hansen, head of commodity strategy at Saxo Bank.

Investors are cautiously waiting after the Israeli airstrike, said Naeem Aslam, chief investment officer at Zaye Capital Markets. He highlighted the importance of oil prices and Iran's response: "If Iran retaliates strongly, especially if it threatens oil supplies through the Strait of Hormuz, gold could explode on hedging demand. On the other hand, if tensions ease, gold's rally could stall."

Source: https://baonghean.vn/gia-vang-chieu-nay-15-6-2025-gia-vang-trong-nuoc-va-the-gioi-tang-hon-3-trieu-tuan-qua-10299677.html

Comment (0)