Domestic gold price today 7/16/2025 latest

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 118.6 | ▼500K | 120.6 | ▼500K |

| DOJI Group | 118.6 | ▼500K | 120.6 | ▼500K |

| Red Eyelashes | 119.4 | ▼100K | 120.6 | ▼100K |

| PNJ | 114.7 | ▼500K | 117.6 | ▼600K |

| Vietinbank Gold | 120.6 | ▼500K | ||

| Bao Tin Minh Chau | 118.6 | ▼500K | 120.6 | ▼500K |

| Phu Quy | 117.9 | ▼500K | 120.6 | ▼500K |

As of 5:30 p.m. on July 16, 2025, the domestic gold bar price continued to decrease sharply compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy - sell), a decrease of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.6-120.6 million VND/tael (buy - sell), a decrease of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.4-120.6 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 100 thousand VND/tael for buying and remained the same for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by the enterprise at 118.6-120.6 million VND/tael (buy - sell), the price decreased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117.9-120.6 million VND/tael (buy - sell), gold price decreased 500 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 5:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 115.1-118.1 million VND/tael (buy - sell); down 500,000 VND/tael in both buying and selling directions compared to early this morning. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.3-118.3 million VND/tael (buy - sell); down 500 thousand VND/tael in both buying and selling directions compared to early this morning. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gemstone Group listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Gold price list this afternoon July 16, 2025 in the country in detail:

| 1. DOJI - Updated: July 16, 2025 17:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 118,600 ▼500K | 120,600 ▼500K |

| AVPL/SJC HCM | 118,600 ▼500K | 120,600 ▼500K |

| AVPL/SJC DN | 118,600 ▼500K | 120,600 ▼500K |

| Raw material 9999 - HN | 108,000 ▼500K | 109,100 ▼500K |

| Raw material 999 - HN | 107,900 ▼500K | 109,000 ▼500K |

| 2. PNJ - Updated: July 16, 2025 17:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| HCMC - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Hanoi - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| Hanoi - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Da Nang - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| Da Nang - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Western Region - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| Western Region - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Jewelry gold price - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| Jewelry gold price - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Jewelry gold price - Southeast | PNJ | 114,700 ▼500K |

| Jewelry gold price - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,700 ▼500K |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,700 ▼500K | 117,600 ▼600K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,700 ▼500K | 117,600 ▼600K |

| Jewelry gold price - Jewelry gold 999.9 | 114,200 ▼400K | 116,700 ▼400K |

| Jewelry gold price - Jewelry gold 999 | 114,080 ▼400K | 116,580 ▼400K |

| Jewelry gold price - Jewelry gold 9920 | 113,370 ▼390K | 115,870 ▼390K |

| Jewelry gold price - Jewelry gold 99 | 113,130 ▼400K | 115,630 ▼400K |

| Jewelry gold price - 750 gold (18K) | 80,180 ▼300K | 87,680 ▼300K |

| Jewelry gold price - 585 gold (14K) | 60,920 ▼230K | 68,420 ▼230K |

| Jewelry gold price - 416 gold (10K) | 41,200 ▼160K | 48,700 ▼160K |

| Jewelry gold price - 916 gold (22K) | 104,500 ▼360K | 107,000 ▼360K |

| Jewelry gold price - 610 gold (14.6K) | 63,840 ▼240K | 71,340 ▼240K |

| Jewelry gold price - 650 gold (15.6K) | 68,510 ▼260K | 76,010 ▼260K |

| Jewelry gold price - 680 gold (16.3K) | 72,010 ▼270K | 79,510 ▼270K |

| Jewelry gold price - 375 gold (9K) | 36,410 ▼150K | 43,910 ▼150K |

| Jewelry gold price - 333 gold (8K) | 31,160 ▼130K | 38,660 ▼130K |

| 3. SJC - Updated: 7/16/2025 5:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,600 ▼500K | 120,600 ▼500K |

| SJC gold 5 chi | 118,600 ▼500K | 120,620 ▼500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,600 ▼500K | 120,630 ▼500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,200 ▼400K | 116,700 ▼400K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,200 ▼400K | 116,800 ▼400K |

| Jewelry 99.99% | 114,200 ▼400K | 116,100 ▼400K |

| Jewelry 99% | 110,450 ▼396K | 114,950 ▼396K |

| Jewelry 68% | 72,205 ▼272K | 79,105 ▼272K |

| Jewelry 41.7% | 41,668 ▼166K | 48,568 ▼166K |

World gold price today 7/16/2025 latest

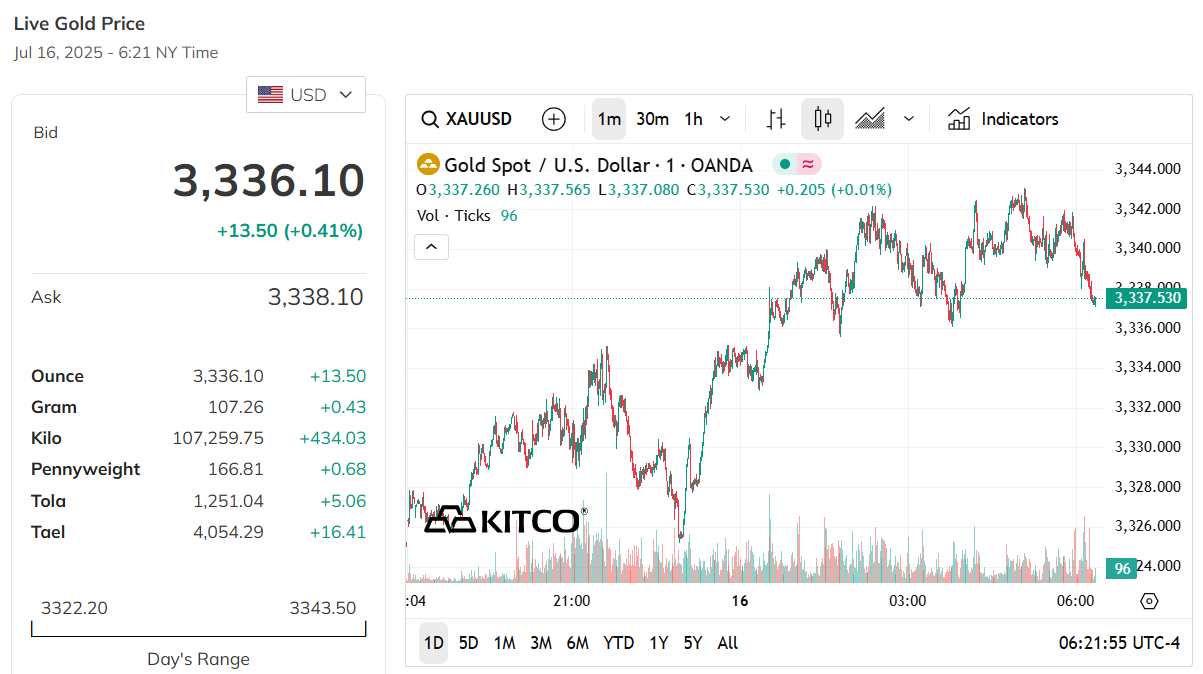

World gold price, at 5:20 p.m. on July 16, 2025 (Vietnam time), the world spot gold price was at 3,336.1 USD/ounce. Today's gold price increased by 13.5 USD. Converted according to the USD exchange rate at Vietcombank (26,320 VND/USD), world gold is priced at about 110.11 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (118.6-120.6 million VND/tael), the current SJC gold price is about 10.49 million higher than the international gold price.

Gold rose 0.5% to $3,339.88 an ounce at 0644 GMT, while U.S. gold futures edged up 0.3% to $3,346.70 an ounce, Reuters reported. The gains were driven by a weakening dollar from a one-month peak and a decline in the yield on 10-year U.S. government bonds from multi-week highs, making gold a more attractive option for investors holding other currencies.

Mr. Brian Lan, CEO of GoldSilver Central (Singapore), said:

"Many countries are still negotiating with the US on tariff policies. There is still a lot of uncertainty in the market, and gold is being sought as a safe haven asset."

Uncertainty has been heightened by US President Donald Trump’s threat to impose 30% tariffs on imports from Mexico and the European Union starting August 1. However, he has also left the door open for further negotiations. US inflation data for June showed consumer prices rose the most in five months, weighed down by tariffs, prompting the Federal Reserve to delay a rate cut until September.

Dallas Fed President Lorie Logan stressed that the Fed needs to maintain interest rates at current levels to control inflation, especially amid pressure from the Trump administration’s tariff policies. In a low-interest-rate environment, gold – considered a safe-haven asset – tends to increase in price.

The market is now waiting for the US Producer Price Index (PPI) data, scheduled to be released at 12:30 GMT on July 16, for further clues on inflation trends and monetary policy. Gold prices this afternoon, July 16, 2025, on the world market continued to be supported by macroeconomic factors such as a weakening USD, falling bond yields and the sentiment of seeking safe assets amid policy uncertainty. Investors need to closely monitor upcoming economic data, especially PPI, to predict the short-term gold price trend.

News, gold price trends today 7/17/2025

Gold price forecast for June 17, 2025 shows that the market is experiencing many notable fluctuations. The world gold price in the morning session of July 16, 2025 increased slightly thanks to the weakening USD and the decrease in US bond yields. This makes gold more attractive to investors, especially when trade tensions between the US and partners such as Mexico and Europe have not been clearly resolved. These uncertainties have caused many people to seek gold as a safe haven.

In addition, the high inflation data in June also affected the monetary policy decision of the US Federal Reserve (Fed). The Fed is likely to keep interest rates unchanged in the coming time to control inflation, which also contributed to the volatility of gold prices. Investors are waiting for more new economic data, such as the producer price index (PPI), to be able to predict more accurately the next trend of gold prices.

In the domestic market, gold prices are often directly affected by world developments. Therefore, with the current situation, domestic SJC gold prices may decrease slightly in the morning trading session on June 17, 2025. Gold buyers should closely monitor economic information to make reasonable decisions, avoiding being affected by unexpected fluctuations in the market.

In summary, the gold price on June 17, 2025 is forecasted to continue to fluctuate complicatedly due to global economic factors and US monetary policy. This is the time when investors need to consider carefully before trading, and closely monitor economic news to seize the best opportunities.

Source: https://baodanang.vn/du-bao-gia-vang-ngay-17-7-2025-lieu-gia-vang-trong-nuoc-co-dot-bien-moi-khi-dong-usd-va-loi-suat-trai-phieu-suy-yeu-3297011.html

![[Maritime News] More than 80% of global container shipping capacity is in the hands of MSC and major shipping alliances](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/6b4d586c984b4cbf8c5680352b9eaeb0)

Comment (0)