Only 9.3% of businesses have access to loans

The report “Credit for SMEs: Opportunities and Risks” recently released by FiinGroup (a financial solutions provider – PV) has outlined the financial health, risk level and access to capital of the SMEs sector in Vietnam.

The data shows that 9.3% of SMEs have bank loans, much lower than the rate of 56.1% in large enterprises. This fact shows that credit barriers are still a bottleneck for SMEs' ability to expand production, invest and improve competitiveness.

Fiin Group's report also said that in terms of risk, SMEs tend to increase significantly in the years from 2022-2024, with a peak of nearly 60% of enterprises having high to very high risk levels.

The problem of SMEs having difficulty accessing capital has also been reflected by the business community many times. Mr. Nguyen Duc Xuan - Chairman of the Board of Directors of Ha Thanh Investment and Trade Joint Stock Company said: The company has won bids to supply medical equipment and wants to access bank loans. However, borrowing capital is not favorable because the company does not have collateral.

When working, the bank proposed a solution: the enterprise proves that it won the bid, but the investor cannot guarantee the loan for the winning enterprise. In the end, the enterprise "relies" on a large enterprise with economic capacity, which means that the enterprise itself loses the opportunity to develop.

Mr. Nguyen Duc Linh - Director of Khanh Linh Company Limited (specializing in dried fruits and vegetables in Ho Chi Minh City) said that the company has recently received a short-term loan of 500 million VND in working capital (preferential interest rate of about 6%) and 500 million VND in medium and long-term capital to purchase machinery (interest rate of 9%).

“After a long time of knocking on the doors of many banks, the company still could not get a loan because the collateral was located in a suspended planning area. Fortunately, thanks to timely guidance from all levels, along with the flexibility of the bank in lending without collateral with feasible production and business plans, we have the capital to continue developing,” Mr. Linh shared.

Solution to the problem

According to data from the State Bank, credit continued to grow significantly. As of July 29, system-wide credit increased by 9.8% compared to the end of 2024, up 19.75% over the same period, both of which are positive growth rates compared to recent years. Credit continues to focus on the production and business sectors and support industry groups - sectors that are the driving force of economic growth.

However, paradoxically, many businesses, especially small and medium enterprises, still continuously complain about accessing bank capital.

According to experts, although credit has increased, credit flows are not evenly distributed among sectors and types of enterprises. In fact, most credit capital often flows to large enterprises, reputable corporations or real estate projects, while small and medium enterprises - which account for a large proportion of the economy - have little access. Banks often prioritize lending to customers with high-value mortgaged assets and good credit records, putting small enterprises lacking collateral at a disadvantage.

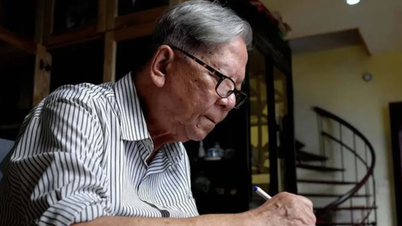

According to Nguyen Van Than, Chairman of the Vietnam Association of Small and Medium Enterprises, in the current context, commercial banks tend to prioritize lending to large enterprises. This is not difficult to understand, because banks are also under heavy pressure on revenue and profit. “Commercial banks, after all, are also enterprises and to ensure business efficiency, they are forced to choose customers with transparent records and full collateral. This is how banks balance profit growth and risk control. Maintaining proactive business on the basis of efficiency and safety is a vital factor, especially after the fluctuations in the market in recent times,” said Mr. Than.

Economist - Dr. Le Xuan Nghia said that currently, the Vietnamese stock market is poor in both goods and quality, leading to businesses depending mainly on credit capital flows.

Dr. Nghia said that in the US, instead of having a Ministry of Industry or a Ministry of Large Enterprises, they have established a Ministry of Small Enterprises to promote the development of this group of enterprises - a force that plays an important role in the economy. From there, Mr. Nghia said that Vietnam needs to consider building a stronger and more specialized support mechanism for SMEs.

Meanwhile, Dr. Nguyen Quoc Hung - Vice Chairman and General Secretary of the Vietnam Banking Association said that the production and business activities of enterprises are greatly affected by the general difficulties of the economy, leading to exhausted resources, so they are not eligible to borrow capital from banks.

Furthermore, many businesses have mortgaged assets that are facing legal problems, lack of certificates, suspended planning, disputes, etc., which makes them unable to meet the loan conditions. At the same time, many businesses do not meet the conditions of transparent financial status, so banks have difficulty considering granting credit.

Therefore, Mr. Hung said that it is necessary to drastically restructure strategy, organization, operation, finance and corporate governance to improve competitiveness, asset growth, financial transparency and operational information as a basis for credit institutions to appraise loans.

Source: https://baolaocai.vn/doanh-nghiep-loay-hoay-bai-toan-von-post879779.html

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum and offer incense to commemorate Heroes and Martyrs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/17/ca4f4b61522f4945b3715b12ee1ac46c)

Comment (0)