At the end of the session on August 11, the VN-Index closed at 1,596.8 points.

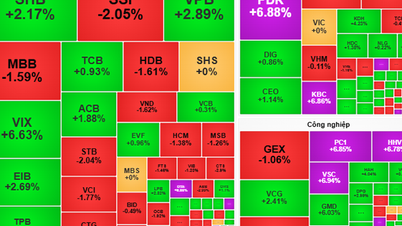

Opening the stock trading session on August 11, VN-Index increased by 6 points compared to the reference level, maintaining a stable growth momentum. From mid-morning, strong demand appeared in large-cap stocks such as MSN, GVR, FPT and banking groups (notably MBB,ACB ), helping the index quickly conquer the 1,600-point mark. Public investment stocks (CII, HHV) and real estate stocks (DIG, PDR, NVL) also recorded positive cash flow.

In the afternoon session, the VN-Index's growth slowed down due to increased profit-taking pressure in some large-cap stocks in the banking group and Vingroup group (VIC, VHM...). However, from the second half of the session, demand gradually rebalanced thanks to the strong rebound of some codes such as SSI (up 5.63%) along with the return of cash flow in consumer and securities stocks. Thanks to that, the VN-Index maintained the 1,595 point mark. Liquidity of the whole market remained high, reaching more than 45,000 billion VND.

At the end of the session, VN-Index closed at 1,596.8 points, up nearly 12 points, equivalent to 0.75%.

Vietcombank Securities Company (VCBS) said that active cash flow in the session of August 11 showed signs of decreasing compared to previous sessions, although the VN-Index at times exceeded the 1,600 point threshold.

After a long period of increase, this index is facing the risk of correction due to profit-taking activities in stocks that have increased sharply in price. Therefore, VCBS recommends that investors closely monitor market developments, continue to hold stocks in their portfolios, only partially disburse stocks that still have room to increase when the market fluctuates, and at the same time adhere to the discipline of not chasing high prices.

According to Dragon Capital Securities Company (VDSC), due to the advantage leaning towards stock demand, the market may reach new highs, heading towards the resistance zones of 1,620 points and 1,650 points in the coming time, alternating with slight increases and decreases.

"Investors can expect the market to expand its upward momentum, but need to closely observe supply and demand, and consider taking short-term profits with stocks that have increased sharply to the resistance zone. On the buying side, investors need to limit chasing stocks that have increased in price, instead, they should accumulate stocks with stable price increases" - VDSC recommends

Source: https://nld.com.vn/chung-khoan-ngay-mai-12-8-khong-nen-mua-duoi-co-phieu-o-vung-gia-cao-196250811172244146.htm

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with New Zealand Parliament Chairman](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/c90fcbe09a1d4a028b7623ae366b741d)

Comment (0)