Before the first trading session of the week, many securities companies predicted that the market could be negatively affected by the escalating war in the Middle East, causing the index representing the Ho Chi Minh City Stock Exchange to make a sharp correction. Most analysis groups recommended that investors temporarily refrain from disbursing, stay out of the market and observe market developments and wait for supporting information from the announcement of second-quarter business results.

In fact, the VN-Index fluctuated in the first minutes and at one point fell more than 10 points compared to the reference. However, this development did not last long. The index then fluctuated around the reference and bounced strongly from the afternoon when money flowed into stocks related to Vingroup Corporation. VIC hit the ceiling price of VND92,800, while VHM increased by 5.4% to VND74,000 to become the main driving force for the index.

VN-Index closed at 1,358 points, up nearly 9 points from the reference. The index representing the large-cap basket (VN30) increased by more than 13 points.

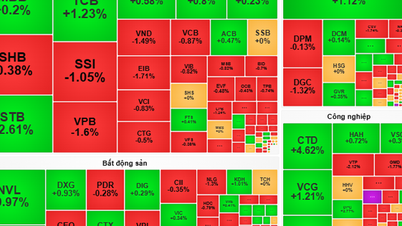

The Ho Chi Minh City Stock Exchange fell into a state of "green skin, red heart", meaning the index increased but the number of stocks decreasing was overwhelming because the cash flow was only focused on a few pillar stocks. Today, 205 stocks closed below the reference, nearly double the number of stocks increasing.

In addition to the Vingroup group, the market was also supported by the excitement of oil and gas stocks with a common increase of more than 2%. The two leading stocks, GAS and PLX, increased by 4.5% and 2.7% respectively, while PVC on the Hanoi Stock Exchange hit its ceiling price.

On the other hand, stocks in other sectors all closed in a pessimistic state. The banking group with OCB, MBB and CTG maintained green while a series of other pillar codes such as VCB, TCB, HDB, BID... closed the session with a decrease of over 0.5%. Eximbank's EIB led the adjustment range when it lost 2.6%, down to 22,900 VND.

The stock group also fell across the board. Pillar codes such as VND, VCI, HCM, SSI traded below reference throughout the session before closing down over 1%. Similarly, HPG and HSG of the steel group fell 0.6% and 1.5% respectively, curbing the index's growth.

Real estate is the group that recorded the strongest differentiation. While some mid- and large-cap stocks such as VHM, NLG, VRE increased, penny stocks such as LDG, KHG, HQC, SCR all decreased by more than 1%.

Liquidity on the Ho Chi Minh City Stock Exchange today reached over VND21,700 billion, down about VND500 billion compared to last weekend. The market did not have any code with a thousand billion in orders. TCB led but only reached VND635 billion, followed by DBC, MBB, HPG, SHB fluctuating at VND550-620 billion.

Foreign investors continued to show pessimistic signals when they net withdrew for 4 consecutive sessions. This group today disbursed 1,650 billion VND while selling more than 1,800 billion VND. Banking stocks such as VPB, SHB, ACB, EIB were under the strongest selling pressure from foreign investors. On the contrary, HPG was the focus of attracting foreign investors' money with a net purchase volume of more than 2.3 million shares.

HA (according to VnE)Source: https://baohaiduong.vn/vn-index-tang-manh-nho-co-phieu-ho-vingroup-414809.html

![[Photo] Prime Minister Pham Minh Chinh holds meeting to launch exhibition of national achievements to celebrate 80th National Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/0c0c37481bc64a9ab31b887dcff81e40)

![[Photo] Prime Minister Pham Minh Chinh chairs the national online conference on combating smuggling, production and trade of counterfeit goods.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/4a682a11bb5c47d5ba84d8c5037df029)

![[Photo] Party Congress of the Central Internal Affairs Commission for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/5bf03821e6dd461d9ba2fd0c9a08037b)

Comment (0)