At the end of the trading session on June 18, VN-Index closed at 1,346 points.

VN-Index opened the trading session on June 18 in green, reaching 1,350 points, but quickly shifted to a state of fluctuation around the reference level in the first 30 minutes.

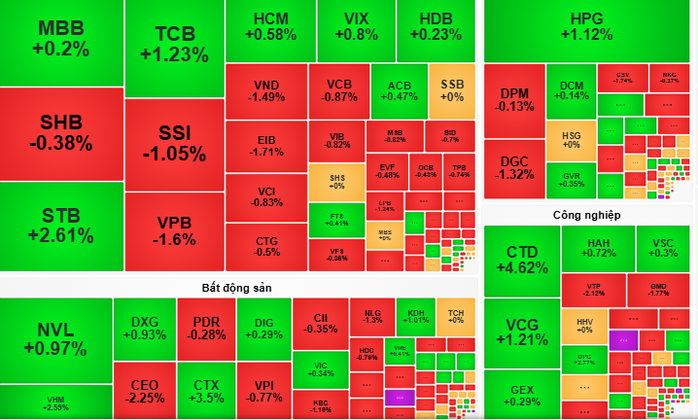

The clear differentiation in blue-chip stocks, especially banking stocks, along with the shift in cash flow between industry groups caused the increase range in the morning session to narrow.

In the afternoon session, selling pressure increased, causing the VN-Index to fall below the reference level and fluctuate in red until the end of the session. Blue-chip stocks continued to be the factor restraining market sentiment. However, thanks to some large-cap stocks such as TCB, HPG, VHM and GAS maintaining green, the index gradually balanced and narrowed the decline.

At the end of the session, VN-Index closed at 1,346 points, down 0.8 points (equivalent to 0.06%). Liquidity on the HOSE floor only reached 20,283 billion VND.

According to VCBS Securities Company, low stock liquidity shows that the supply pressure is not too strong, although the market is facing resistance. However, the cash flow is still waiting for a clearer signal. The market is testing the momentum at the old peak, leading to a tug-of-war situation. Therefore, VN-Index needs more time to accumulate before breaking out more strongly.

VCBS Securities Company recommends that investors can continue to hold stocks that are in a stable uptrend, prioritizing stocks with positive business prospects in the second quarter of 2025.

Meanwhile, Dragon Viet Securities Company (VDSC) noted that investors can take profits on stocks that have increased sharply to the resistance zone, and at the same time select and disburse into stocks that attract cash flow during market fluctuations.

Source: https://nld.com.vn/chung-khoan-ngay-mai-19-6-dong-tien-vao-co-phieu-con-han-che-196250618174004791.htm

![[Maritime News] More than 80% of global container shipping capacity is in the hands of MSC and major shipping alliances](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/6b4d586c984b4cbf8c5680352b9eaeb0)

Comment (0)