Entering the trading session on June 16, the market was green and brought VN-Index to the 1,328 point area. The increase slowed down in this area and the market had a period of exploration in the 1,325 - 1,328 point area.

Entering the afternoon session, the probing state continued, but the market had a positive performance at the end of the session and helped the VN-Index close at a high price range.

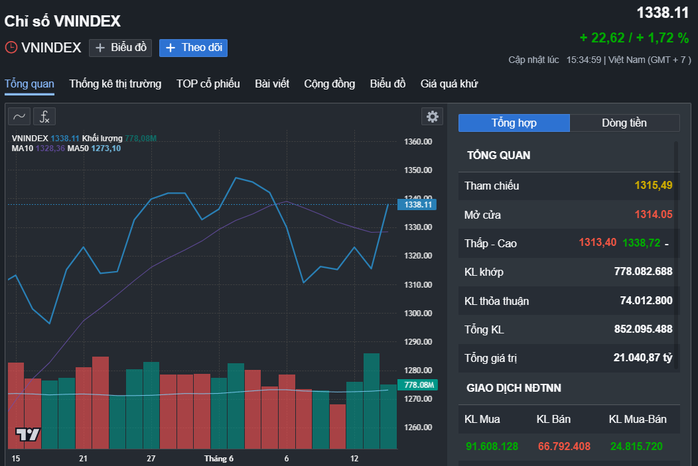

At the end of the session, VN-Index increased by 22.62 points, closing at 1,338.11 points. Order matching liquidity decreased with 778.1 million shares matched on the HOSE floor.

The VN30 basket of large-cap stocks increased by 19.15 points, closing at 1,420 points. In the group, there were 24 stocks that increased in price such as GAS (+7%), PLX (+6.9%), BVH (+4.7%), VPB (+3.6%), TCB (+3.5%) ...

On the contrary, only 4 stocks decreased in price such as VHM (-1.5%), VRE (-0.2%), VJC (-0.2%), VIC (-0.1%).

Market performance over the past month Source: Fireant

With the market’s positive developments, green dominated many groups of stocks gaining points. The oil and gas – petroleum group still stood out with many stocks in the group having strong increases. In addition, technology, chemical, banking groups… also had exciting developments.

In today's trading session, foreign investors continued to net buy on the HOSE with a value of 984.8 billion VND. Of which, they bought many shares of FPT (+314.4 billion VND), VPB (+205 billion VND), HPG (+181.4 billion VND), NVL (+116.6 billion VND)...

On the contrary, they sold heavily stocks of STB (-65.6 billion VND), VCI (-56.8 billion VND), PVD (-54.4 billion VND), HVN (-42.6 billion VND),...

Dragon Viet Securities Joint Stock Company (VDSC) believes that VN-Index will probe the 1,330-1,350 point range in the coming time. Supply and demand signals in this range will have a big impact on the next move of the market.

Therefore, investors can expect the market to increase but need to observe the supply and demand developments at the resistance zone to assess the market status.

"Investors can consider the uptrend to take short-term profits on stocks that are rapidly increasing to the resistance zone and reap the rewards. For new purchases, investors can expect and exploit short-term opportunities in some stocks that are showing good signals from the support zone or have a good continuing growth pattern" - Rong Viet recommends.

According to VCBS Securities Company, VN-Index increased by more than 20 points from the 1,310-point zone with active demand increasing well, showing that this is a reputable support zone in the short term.

VCBS recommends that investors continue to maintain stocks that are in a good uptrend. In addition, investors can select stocks that show signs of consolidating the accumulation price base and attracting cash flow in recent sessions to disburse exploratory funds with the goal of surfing T+. Some notable industry groups include securities, public investment, banking, and retail.

Source: https://nld.com.vn/chung-khoan-ngay-mai-17-6-bon-nhom-nganh-dang-gay-chu-y-1962506161813537.htm

![[Video] More than 100 universities announce tuition fees for the 2025–2026 academic year](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/18/7eacdc721552429494cf919b3a65b42e)

![[Infographic] In 2025, 47 products will achieve national OCOP](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/5d672398b0744db3ab920e05db8e5b7d)

Comment (0)