(Dan Tri) - The strong support zone of 1,240 points, which has been the stronghold of VN-Index in recent sessions, has officially been penetrated. The index plummeted straight to 1,230 points.

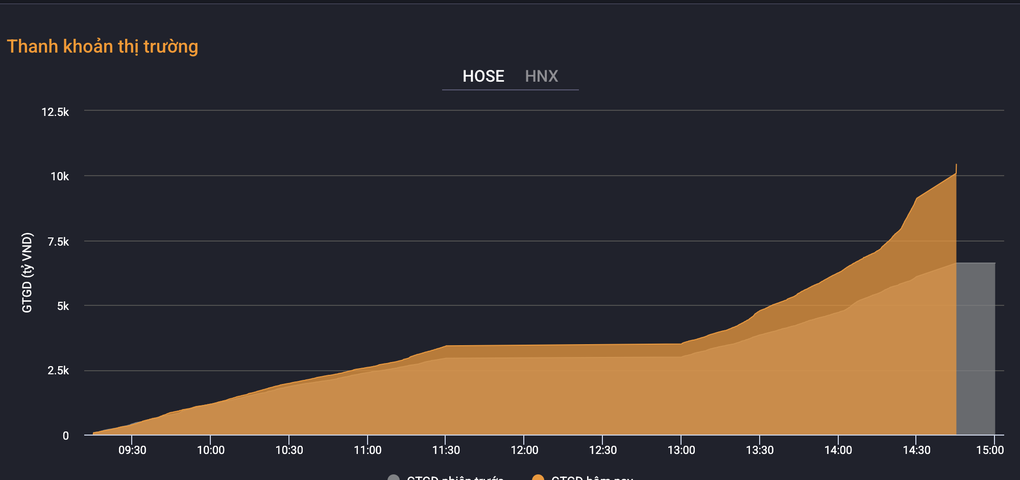

After struggling above the 1,240-point threshold for most of the trading session on November 10 on the basis of exhausted liquidity, after 2:00 p.m., the VN-Index suddenly plummeted, closing at the lowest level of the session.

The HoSE representative index recorded a loss of 15.29 points, equivalent to 1.23%, to 1,230.48 points. Other indexes on the market also plummeted.

VN30-Index decreased by 17.57 points, equivalent to 1.34%. VNMID-Index representing mid-cap stocks decreased by 29.79 points, equivalent to 1.62%; VNSML-Index representing small-cap stocks decreased by 17.86 points, equivalent to 1.27%. On the Hanoi Stock Exchange, HNX-Index decreased by 2.44 points, equivalent to 1.1%; UPCoM-Index decreased by 0.94 points, equivalent to 1.01%.

VN-Index chart over the past 5 days (Screenshot).

The market was dominated by red with 614 stocks falling, outnumbering the 241 stocks rising. Although there was no sell-off as only 30 stocks hit the floor across the market, the fact that the indices closed at session lows showed that selling pressure was still present.

The VN30 basket had 26 stocks falling, many of which fell by more than 1%. BCM was the stock that had the most negative impact on the VN-Index. This stock hit the floor at one point before narrowing its losses, falling 2.1%.

The industry's "big guys" and especially the banking codes decreased sharply. HDB decreased by 3.4%; STB decreased by 3.3%; SSI decreased by 2.9%; MSN decreased by 2.7%; TCB decreased by 2.3%; PLX decreased by 2.3%; GVR decreased by 2.1%; BID decreased by 2.1%; HPG decreased by 1.7%; MBB decreased by 1.6%...

Compared to yesterday's session, liquidity improved significantly, but the figure was still modest. The trading value on HoSE reached VND11,235.11 billion with 499.26 million shares traded; on HNX, it was 47.96 million shares traded, equivalent to VND746.98 billion, and on UPCoM, it was 42.59 million shares, equivalent to VND362.05 billion.

Liquidity improved but still very low (Source: VNDS).

Liquidity was concentrated in financial stocks. SSI matched 21.4 million units, down 2.9%; VIX matched 20.4 million units, down 3.8%; HDB matched 16 million units; STB matched 15.6 million units; NAB matched 11.7 million units; HCM matched 11 million units, down 2.9%.

Securities service stocks fell sharply, with many stocks falling over 2%. VDS fell 5.3%; BSI even hit the floor before closing down 2.8%. However, APG maintained its "purple" color until the end of the session, with 1.7 million units matched and 54,100 shares remaining for ceiling price buy orders.

The real estate sector was covered by the "red" color of falling stocks. Many stocks fell sharply such as FIR down 5.9%; PDR down 5%; TDC down 4.8%; TCH down 4.3%; QCG down 4%; HDC down 3.9%; VPH down 3.8%; DXG down 3.7%; NVL down 3.2%.

Thus, the strong support level around 1,240 points has been penetrated and may soon become a resistance level for the index. The next support level for VN-Index will be the 1,220-1,230 point area.

Source: https://dantri.com.vn/kinh-doanh/vn-index-lao-doc-xuyen-thung-1240-diem-20250110130843093.htm

Comment (0)