After a series of 10 consecutive increasing sessions, the Vietnamese stock market had its first adjustment session. At the close of trading on August 15, the VN-Index fell 10.69 points to 1,630 points, ending a 10-session increasing streak. The HNX-Index fell 2.81 points to 282.34 points, and the UPCoM-Index also lost 0.34 points to 109.61 points.

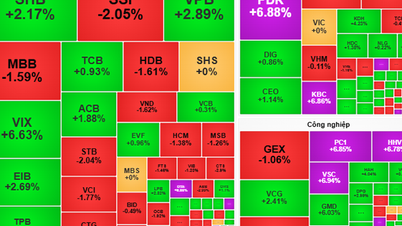

Red dominated as the number of stocks falling in price far outnumbered those rising in price. The entire market had 36 stocks hitting the ceiling, 242 stocks increasing in price, 691 stocks remaining unchanged, 609 stocks falling in price and 27 stocks hitting the floor.

After leading the market yesterday, banking stocks reversed and adjusted. The banking group started the session positively, but was under pressure to take profits towards the end of the session. The developments in this group were also the main reason why the VN-Index fell, especially in the afternoon session. Although a few stocks still closed up, red still dominated this industry group. The top 5 stocks that negatively impacted the VN-Index were all large banks, led by BIDV , VCB, VietinBank, Techcombank and LPBank. On the other hand, Vietjet airline stocks extended their fourth consecutive increase and were the stocks that contributed the most points to the VN-Index.

The positive point is that large cash flows are still being traded on the stock exchange. Market liquidity remains high with a total transaction value of nearly VND66,000 billion, of which HOSE alone recorded VND59,466 billion, equivalent to nearly 2.1 billion shares traded. MBBank and Hoa Phat shares lead in liquidity with a transaction value of over VND3,000 billion. Dozens of stocks attract thousands of billions of cash flows to participate in transactions.

|

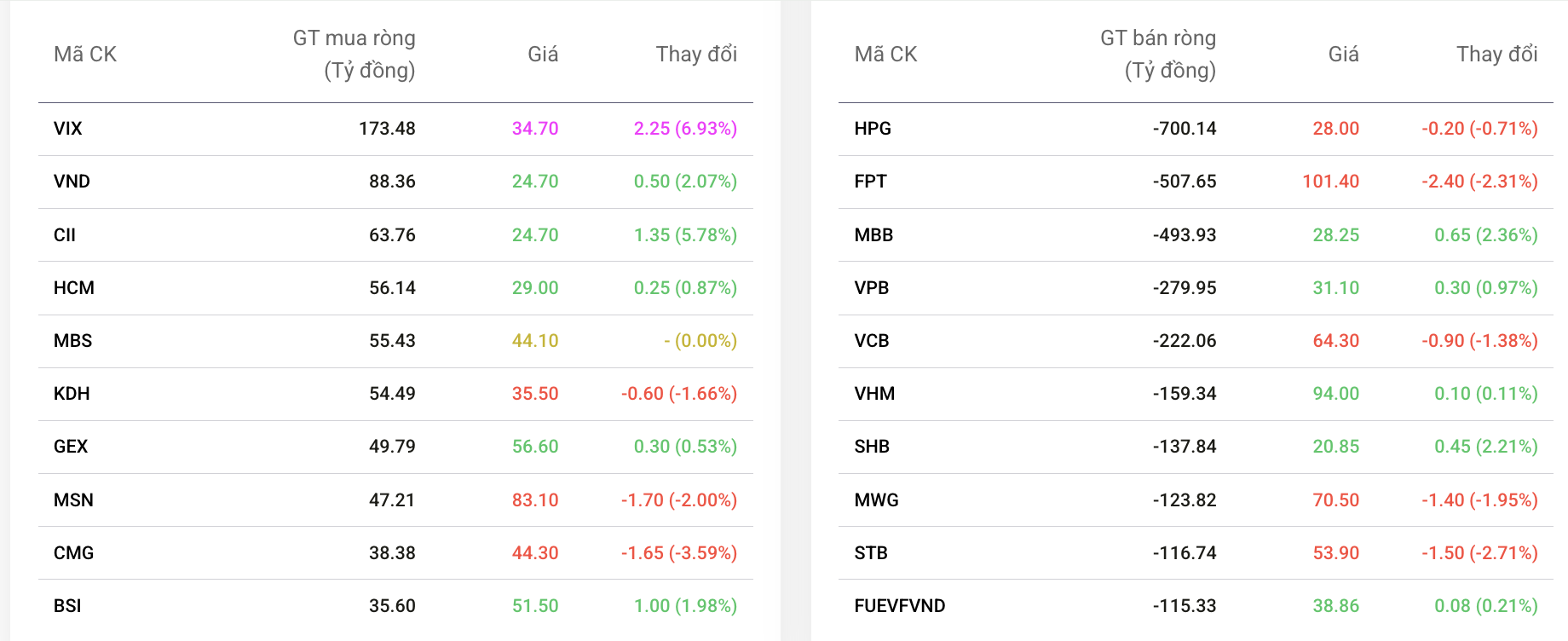

| Top stocks bought/sold the most by foreign investors on August 15 |

Foreign investors continued to sell strongly with a total value of nearly 3,100 billion VND in the whole market. Excluding the sudden session on August 4 with about 10,100 billion VND in net withdrawal by foreign investors, this was the session with the highest net selling level in recent months. The focus of net selling was on pillar stocks, led by HPG (-700 billion VND),FPT (-507 billion VND ), MBB (-494 billion VND ). VPB, VCB, VHM,SHB also suffered strong capital withdrawals. Notably, despite strong net selling by foreign investors, MBB still increased in price by 2.36%, leading the market in transaction value with more than 3,000 billion VND. Although foreign investors sold overwhelmingly, domestic demand remained very strong.

On the other hand, foreign money flowed into the securities group. VIX shares were net bought for more than 173 billion VND, increasing sharply in the session, followed by VND, CII, HCM, MBS. A series of securities stocks attracted foreign money from foreign investors such as VND, HCM, MBS and BSI.

Source: https://baodautu.vn/vn-index-dieu-chinh-ve-1630-diem-sau-10-phien-tang-ap-luc-manh-hon-tu-khoi-ngoai-d360325.html

Comment (0)