World gold is unpredictable

Last week, world gold prices largely ignored the tariff debate as the market's focus shifted to concerns about political interference in the US Federal Reserve (Fed).

Specifically, spot gold started the week at $3,367/ounce, repeatedly testing the resistance zone around $3,375/ounce but failing, adjusting to the short-term support level of $3,342/ounce before gradually weakening and falling to $3,322/ounce by Tuesday afternoon. Since then, the market has entered a sideways phase with a narrow fluctuation range of $3,320-3,342/ounce.

The turning point came on Wednesday morning when rumors emerged that the Trump administration was pressuring Fed Chairman Jerome Powell to resign. Gold prices reacted strongly, jumping from $3,325 an ounce at 10:30 a.m. to $3,363 an ounce in just 45 minutes.

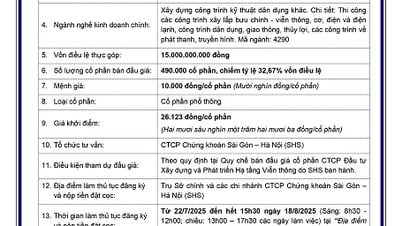

However, when Mr. Trump and officials reassured that there would be no changes to the Fed in the short term, gold prices fell sharply, hitting a weekly low of $3,312/ounce on Thursday morning. This was considered an attractive price range, activating buying pressure to return, helping gold recover to $3,340/ounce in the afternoon session of the same day.

By the end of the week, gold continued to rise, reaching $3,360/ounce. However, after the US announced positive inflation data, gold prices turned around and adjusted slightly, closing the week at $3,348/ounce.

Commenting on the gold price movement next week, UBS commodities analyst Giovanni Staunovo said that investors are still concerned about the independence of the Fed. Currently, that risk has decreased and US economic data remains solid, limiting the rise of gold. However, Mr. Trump wants the Fed to cut interest rates aggressively... this is helping the market maintain its price base.

" Gold is often seen as a safe haven asset during times of uncertainty and performs well in a low interest rate environment ," Giovanni Staunovo stressed.

Meanwhile, Adrian Ash, research director at BullionVault, said that gold may struggle in the short term without any specific policy shock, but the long-term uptrend remains solid thanks to central bank buying and more real money buying physical gold. In the precious metals market, the focus is gradually shifting from gold to silver, platinum and palladium - industrial and growth options.

The latest weekly Kitco News gold survey shows that experts remain cautious on the short-term outlook for gold, while retail investors are back on the bullish side.

Of the 15 analysts surveyed, 8 (53%) predicted that gold prices would increase next week, only 1 (7%) said prices would decrease, and the remaining 6 (40%) said the market would move sideways.

In contrast, an online survey of 223 individual investors found a strong bias towards higher gold prices. Specifically, 138 people (62%) expected prices to rise, while 38 people (17%) predicted prices to fall and 47 people (21%) thought prices would remain flat.

Domestic gold fluctuates little

Expert Tran Duy Phuong said that domestic gold prices will fluctuate less in the coming time because world gold prices will be more stable, without sharp increases like in the first 6 months of the year. It is even possible that world gold prices will decline slightly, returning to the level before the sharp increase in the fourth quarter of 2025.

Mr. Phuong also affirmed that the tariff issue will no longer have a strong impact on world gold prices in the second half of 2025, instead it will be the issue of the Fed cutting the basic interest rate of the USD.

Giving advice to domestic investors at this time, Mr. Phuong said that those who bought gold in the past with the purpose of hoarding assets do not need to worry too much about selling at this time because over time, the price of gold will increase.

For those who buy gold for investment, the current price range is ideal for selling gold for profit.

" To determine the time to sell gold, investors need to plan their expected profit level and should be satisfied with the planned profit level and not regret thinking that the gold price will continue to increase, " said Mr. Phuong.

For example, he said, we buy gold at 100 million VND/tael and set a profit target of 10 million VND/tael. So, when the gold price reaches 110 million VND or 118 million VND/tael as it is now, the profit target is guaranteed, or even exceeded, then investors should sell to take profit.

" You shouldn't think that the gold price will increase and regret not selling it. That's very risky in a volatile context ," Mr. Phuong analyzed.

Experts also recommend that gold investors need to be careful and research the market thoroughly to ensure they buy gold when the price is at its lowest possible level and sell when the price is at its highest or reaches their interest rate expectations.

Sharing the same view, economic expert Nguyen Tri Hieu said that investors with idle money should not focus all their money on gold but should allocate it to many different channels such as stocks, real estate, bank deposits, etc.

On the contrary, for those who have gold reserves and want to sell it to make a profit, they can calculate whether the current profit level is suitable for their set goals or not.

“ If you invest in gold to make a profit, you need to set a target of how much profit you will make each year. That way, you can calculate the price of gold you want to sell at, and when you reach your profit target, you can sell to take profit ,” Mr. Hieu advised.

Source: https://baolangson.vn/tuan-toi-nha-dau-tu-vang-nen-mua-vao-hay-ban-ra-5053733.html

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)