Mobilization and lending growth are good.

According to the State Bank of Region 8, as of April 30, 2025, the capital mobilized in Nghe An (excluding the Development Bank) reached VND 287,070.47 billion, an increase of VND 16,617 billion, equivalent to 6.14%. Mobilization in Nghe An accounted for 59.6% of the capital mobilized in Region 8 (including Nghe An, Ha Tinh , Quang Binh).

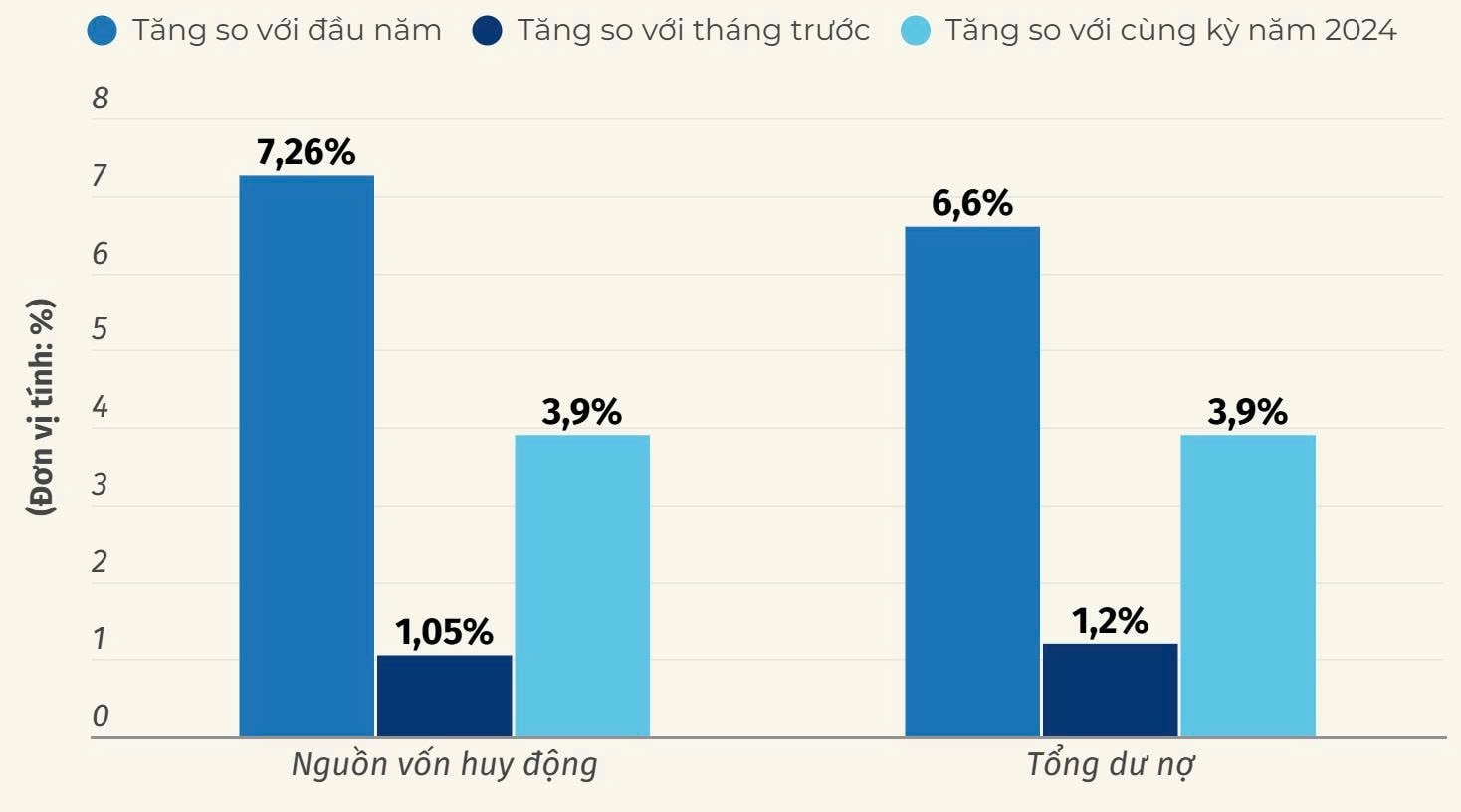

As of May 31, 2025, mobilized capital (excluding the Development Bank) of Nghe An increased by 7.26% compared to the beginning of the year, up 1.05% compared to the previous month. Total outstanding loans of credit institutions and credit institution branches in Nghe An are estimated to increase by 6.6% compared to the beginning of the year, up 1.2% compared to the previous month. Bad debt accounts for 1.63% of total outstanding loans.

At BIDV Phu Dien Bank, in the first 6 months of the year, mobilization reached VND 10,762 billion, up 13%; outstanding loan growth reached VND 12,750 billion, down 1% due to bank customers paying seasonal debts during the agricultural and sugarcane season.

Mr. Nguyen Tien Phuong - Director of BIDV Phu Dien Bank said: "Up to this point, we have achieved the mobilization target for the whole year of 2025. In 2025, the bank set a credit growth target of 10%, reaching outstanding loans of VND 14,860 billion. With the lending cycle in the year focusing on the end of the year, we are confident that we will achieve the set target".

Assessing the situation of capital mobilization and lending in the area, the representative of the State Bank of Region 8 said that since the beginning of the year, capital mobilization in Nghe An has increased by 7.26%, while in the same period last year it only increased by 3.9%; similarly, lending has increased by 6.6% while in the same period last year it was only 3.9%. The lending situation is maintaining a positive momentum in the first 5 months of the year in the context of low interest rates, creating favorable conditions for production, business and stimulating consumption. This is also a solution for Nghe An to maintain the GRDP growth target of 10.5% in 2025 according to Resolution 25 of the Government.

Implementing credit programs under the direction of the Government, the Prime Minister, and the State Bank in each period, banks in Region 8 promote the implementation of credit programs for the agriculture, forestry, and fishery sectors. As of April 30, 2025, the outstanding debt of the Program is 307.8 billion VND.

Regarding the credit program for social housing, workers' housing, renovation and reconstruction of old apartments according to Resolution No. 33/NQ-CP of the Government currently in the provinces of Region 8, Nghe An Provincial People's Committee has announced a list of 4 projects that meet the legal conditions to access loans according to Resolution No. 33/NQ-CP (Nghe An 3 projects, Ha Tinh 1 project). Commercial bank branches in Nghe An have been actively approaching and receiving loan requests from investors, up to now, there has been no outstanding debt of the 120,000 billion VND package.

Outstanding loans serving the National Target Program on New Rural Construction by April 30, 2025 in Nghe An are VND 104,793 billion, accounting for 56.8% of outstanding loans for new rural areas in region 8.

Outstanding loans for cooperatives and cooperative groups in Nghe An are 134 billion 393 million VND.

Maintain stable interest rates

In order to provide timely loans to support local people and businesses to expand production and business, the State Bank of Vietnam, Nghe An branch, continues to implement the State Bank's regulations on interest rates, directs local credit institutions to maintain stable deposit interest rates, reduce costs to reduce lending interest rates. At the same time, monitor the implementation of the announcement of average lending interest rates, the difference between average deposit and lending interest rates, lending interest rates for credit programs, credit packages and other types of lending interest rates.

Strictly complying with the regulations on interest rate management of the Governor of the State Bank, there is no phenomenon of unfair competition or exceeding the ceiling among credit institutions in the area. The maximum interest rate for deposits in VND with a term of less than 6 months, non-term deposits and deposits with a term of less than 1 month is 0.5%/year, deposits with a term from 1 month to less than 6 months is 4.75%/year, for people's credit funds and microfinance institutions it is 5.25%/year; The maximum short-term lending interest rate in VND for some priority sectors is 4%/year.

Mr. Nguyen Dinh Sinh - General Director of Minh Anh Garment Joint Stock Company said: "With the Government's policy, recently, businesses have been supported with interest rates. We do business in the garment sector, so we have to reserve raw materials, salaries, worker bonuses..., which requires better capital. Businesses want banks to base on cash flow to increase access to capital, preparing for the peak production and business season at the end of the year".

Specifically: Interest rates for mobilizing VND deposits are at 0.1-0.5%/year for non-term deposits and deposits with terms of less than 1 month; commonly at 4.5-5.5%/year for deposits with terms from 6 months to less than 12 months; commonly at 5-6%/year for deposits with terms of 12 months or more; Interest rates for mobilizing USD are at 0%/year for deposits of organizations and individuals; Interest rates for short-term VND loans are commonly at 5.5-7.5%/year, medium and long-term loans are commonly at 8-10%/year. Interest rates for short-term USD loans are commonly at 3.5-5%/year; medium and long-term loans are commonly at 5-6.5%/year.

Since the beginning of the year, short-term loans have had an interest rate of only about 5% per year, while medium and long-term loans have been around 7% per year, which is considered "cheap capital". Mr. Nguyen Tien Phuong - Director of BIDV Phu Dien said: "With cheap credit policies and the dynamism of credit institutions in accessing and meeting capital needs for markets such as real estate, consumption, production and business sectors, especially those that are the driving force of the economy, credit will continue to grow well in the coming months".

To achieve the set goals in mobilizing capital for credit growth, currently, credit institutions in Nghe An are proactively developing and implementing solutions to reduce costs, reduce lending interest rates; increase access to capital for businesses and people; implement solutions to support difficulties for businesses and people affected by natural disasters; continue to deploy credit packages to fully and promptly meet capital needs for production and business, serving the living needs and legitimate consumption of people and businesses.

According to the credit growth cycle, most of the loan capital is usually concentrated in the third quarter and accumulated in the last months of the year, so it is assessed that outstanding loans will increase, achieving the set credit growth target. Banks strive to increase credit growth while controlling credit quality, promoting the bank-enterprise connection program...

Source: https://baonghean.vn/tin-dung-tren-dia-ban-nghe-an-tang-truong-tich-cuc-10299628.html

Comment (0)