Many banks have seen a sharp increase in outstanding real estate loans in the first half of this year - Photo: QUANG DINH

The second quarter 2025 financial reports of many commercial banks show that credit growth in the first half of this year was mainly led by the real estate sector.

Banks "pour" money heavily into real estate

One of the clearest examples is Techcombank (TCB). At the end of June 2025, TCB's outstanding customer loans stood at VND700,801 billion, up 12.3% compared to the beginning of the year.

By the end of the second quarter of 2025, outstanding loans for real estate business activities at Techcombank reached VND 227,450 billion, equivalent to 33.62% of the total outstanding credit of the whole bank.

The above outstanding debt level has increased by 21.56% compared to the beginning of the year, nearly double the general credit growth rate of Techcombank in the same period.

Notably, the above figures only reflect loans to economic organizations operating in the real estate sector, not including outstanding loans from individuals such as home purchases and home repairs - which also account for a significant proportion of the bank's credit structure.

Techcombank's financial statement notes also state that margin loans and customer sales advance loans at the end of June were VND33,805 billion, up 30.4% compared to the beginning of the year. This is the loan from TCBS - a securities company under Techcombank, which is consolidated into the parent bank's financial statements according to international practice (IFRS).

Not only Techcombank, many other commercial banks are also recording strong expansion in real estate lending activities.

Like MBBank , this bank also recorded outstanding real estate business loans at VND85,534 billion, up 33.3% compared to the beginning of the year. This led to the ratio of real estate business loans to total outstanding loans from 8.26% to 9.72%.

Margin loans for securities advanced to customers at MB Securities (MBS) are also clearly explained in the bank's report. Accordingly, the outstanding debt in the securities market of MBS was VND 12,795 billion at the end of the second quarter of 2025, an increase of 24.3%.

SHB also recorded real estate debt of VND163,754 billion at the end of the second quarter of 2025, an increase of nearly 28.4% compared to the beginning of the year. The real estate sector accounts for 27.5% of the total outstanding debt of this bank.

Is it worrying?

At HDBank, outstanding loans to the real estate sector reached VND83,125 billion, up 21.7% compared to the beginning of the year and accounting for nearly 16.4% of total outstanding loans. PGBank, VietBank and MSB… are also banks that recorded high real estate credit growth.

At the regular online Government meeting in July with provinces and centrally run cities held on August 7, Ms. Nguyen Thi Hong - Governor of the State Bank - said: Credit for the entire system in the first 7 months of the year increased by about 10% compared to the end of 2024 - a fairly high increase compared to 6% in the same period last year.

Concerned that credit is flowing strongly into real estate and securities, Ms. Hong admitted that the credit growth rate in these two sectors is higher than the average, but that is consistent with the direction of removing difficulties for the real estate market. When the project is cleared of legal obstacles, the need for capital for implementation is inevitable.

In the securities sector, although there is a growth rate, the proportion only accounts for 1.5% of total outstanding debt, not causing systemic risk.

But not everyone is optimistic. A leading expert in the field of financial data warns that the sharp increase in real estate credit while consumption and production have not recovered accordingly could lead to a situation of "out of sync credit flows".

This means that bank capital is pouring heavily into long-term assets while actual demand is not yet stable enough, easily creating fluctuations later if the market is unbalanced or growth is not sustainable.

Meanwhile, the amount of loans (mainly margin) of securities companies in Vietnam is 303,000 billion VND, the highest ever, surpassing when the market peaked at 1,535 points in 2022.

Source: https://tuoitre.vn/tien-chay-manh-vao-bat-dong-san-va-chung-khoan-lo-dien-nhung-ong-lon-cho-vay-khung-20250807213824887.htm

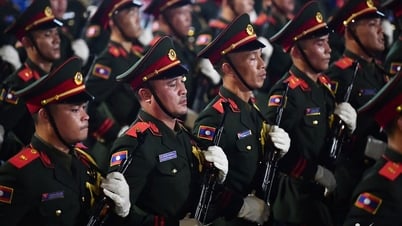

![[Photo] Parade blocks pass through Hang Khay-Trang Tien during the preliminary rehearsal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/456962fff72d40269327ac1d01426969)

![[Photo] Images of the State-level preliminary rehearsal of the military parade at Ba Dinh Square](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/807e4479c81f408ca16b916ba381b667)

Comment (0)