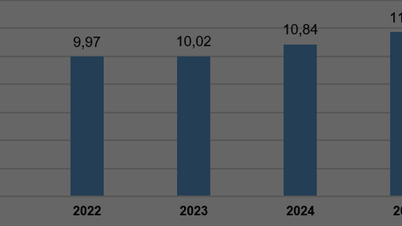

Trading volume increased by 17.7%

According to the Vietnam Mercantile Exchange (MXV), in the second quarter of 2025, the volume of transactions connected with the world grew impressively, up to 17.7% compared to the previous quarter and 30.73% higher than the same period in 2024.

According to the market share rankings for the second quarter of 2025 just announced by MXV, many familiar names still appear, but the rankings have clearly fluctuated.

Accordingly, Gia Cat Loi Commodity Trading Joint Stock Company still maintains its position as the member with the largest market share in commodity brokerage, with a proportion of 37.64%. As one of the first members and having the largest scale of offices and branches in Vietnam, Gia Cat Loi still maintains its "leading" position in the rankings.

In second place is Saigon Futures Joint Stock Company with 14.82% market share. Ho Chi Minh City Commodity Trading Joint Stock Company with 13% market share, in third place. In fourth place is Hitech Finance Joint Stock Company holding 7.98% market share. Huu Nghi International Investment Company Limited also promptly appeared in fifth place with 5.22% market share.

Mr. Nguyen Ngoc Quynh, Deputy General Director of MXV, assessed that the commodity trading market still has a lot of potential for development, especially in the context of many fluctuations.

“With a suitable operating strategy, efforts to improve consulting and analysis capacity, professional and systematic investment, and good adaptation to market fluctuations, there will be many new names on this ranking in the final stage of 2025,” Mr. Quynh commented.

Platinum continues to lead trading volume

According to MXV, both brokerage market share and trading volume of commodities in the second quarter remained stable, without much change. This development shows that the market is in a slight adjustment phase, when investors are still interested in familiar commodities, in the context of no sudden factors that are strong enough to create a major shift in investment strategy.

In the top 10 most traded commodities in the Vietnamese market, platinum is the focus. At the end of the trading session on June 26, platinum price reached 1,399 USD/ounce, marking the highest level since September 2014. This commodity is still attracting special attention from investors and continues to hold the top 1 position when accounting for 21.08% of total trading volume.

Coming in second place is soybean oil with 17.77% of trading volume, as the CBOT soybean oil futures price for July officially surpassed the $1,200/ton mark, setting a record high in nearly two years.

Corn and wheat stopped at 3rd and 4th place, accounting for 11.42% and 10.9% of the total market trading volume, respectively. Both of these commodities increased one place compared to the first quarter of 2025.

On the other hand, soybeans fell three places, stopping at 5th place, accounting for 9.83% of total trading volume, down sharply from 17.7% in the first quarter of 2025. According to data from MXV, August soybean futures prices fell to a 2.5-month low before recovering.

Other commodities such as micro copper, soybean meal, micro silver, Arabica coffee, and copper, occupy the remaining half of the ranking, with proportions of 6.44%, 3.22%, 2.89%, 2.89%, and 2.88%, respectively.

At the end of the second quarter, the MXV-Index tended to increase slightly compared to the first quarter. The main reason was the recovery in prices of some key commodities such as energy (crude oil), metals (copper, aluminum) and coffee. Meanwhile, agricultural products (soybeans, corn) were under pressure to decrease in price due to favorable weather conditions and improved supply.

In addition, in the second quarter, the total number of new accounts opened at MXV increased by 44.87% compared to the first quarter of 2025 and increased by 47.45% compared to the same period last year. This also contributes to reflecting investors' interest in the commodity trading market.

“For me personally, commodity investment is an attractive channel thanks to its high liquidity and the ability to generate profits even in conditions of rising or falling commodity prices. However, to invest effectively, especially in the context of a volatile global economy , investors need to proactively update macroeconomic factors and closely follow information on supply and demand in the international market. This helps make timely decisions, thereby optimizing profits and minimizing risks,” said Mr. Nguyen Thanh An, an investor in Hanoi.

In the coming time, experts predict that raw material prices will continue to fluctuate strongly, which could lead to significant changes in the ranking of globally traded commodities.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-quy-ii-2025-giao-dich-hang-hoa-nguyen-lieu-soi-dong-708108.html

![[OCOP REVIEW] Bay Quyen sticky rice cake: A hometown specialty that has reached new heights thanks to its brand reputation](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/3/1a7e35c028bf46199ee1ec6b3ba0069e)

Comment (0)