At the beginning of the week (June 9), strong selling pressure caused the VN-Index to drop nearly 20 points. After that, the market fluctuated around 1,315 points with low liquidity.

In the trading session on June 13, the heat from the conflict in the Middle East affected the market, causing most stocks to sink into red, pushing the VN-Index to drop 19 points at times.

However, in the last 15 minutes of the session, demand suddenly entered the market strongly, pulling the Ho Chi Minh City Stock Exchange's representative index up 11 points, so the market only fell more than 7 points at closing.

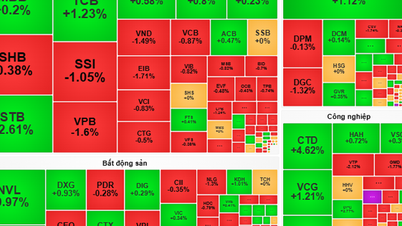

Closing the trading week from June 9 to 13, the VN-Index was at 1,315.49 points, down 14.4 points (-1.08%).

Liquidity decreased. Accumulated for the whole trading week, the average weekly liquidity on the Ho Chi Minh City Stock Exchange reached VND 19,581 billion (-13.6%).

The market opened in red with 12/21 industry groups closing down during the week. Real estate (-8.83%), industrial real estate (-3.8%) and electricity (-2.8%) were the three industry groups under the strongest correction pressure during the week. On the other hand, retail (+4.59%), oil and gas (+3.29%) and fertilizer (+3.04%) were the three industry groups with the strongest increase during the week.

Experts from Vietnam Construction Securities Joint Stock Company believe that in terms of trend, the decline on June 13 was not too negative due to the psychological impact from external factors. Moreover, the decline was narrowed by more than half by the end of the session.

The market closed the week down a total of 1.08%, but the trading volume during the week decreased compared to the previous 4 weeks, and the psychological mark of 1,300 points remained firm, so the previous uptrend was not broken.

"The correction is still likely to pull the VN-Index to the strong support zone of 1,285-1,300 points in the sessions of next week before returning to the uptrend. We continue to maintain our view of holding the portfolio and open new net buying positions when the VN-Index adjusts to the above support zone in the sessions of next week," this expert recommended.

Meanwhile, expert Phan Tan Nhat, Head of Analysis Group of Saigon- Hanoi Securities Joint Stock Company (SHS), said that in the short term, VN-Index is ending its recovery and short-term growth phase after the temporary postponement of tax imposition. VN-Index is moving into an accumulation phase to wait for further updates on the fundamental factors of enterprises.

The market is under pressure to correct to around 1,300 points with quite sudden selling pressure in the last session of the week for many groups of codes. However, the demand for low prices increased quite well when VN-Index decreased sharply.

This expert commented that VN-Index can only improve well when it surpasses around 1,325 points.

June was a volatile month for the market as trade negotiations between the United States and other countries entered their final stages. Meanwhile, tensions in the Middle East were rising.

In the short term, under psychological influence, the market has been under pressure to sell risk prevention from short-term speculative groups, financial services, real estate, or stocks that have had a period of overheating. Investors should continue to consider the structure and balance of their portfolios in the current context.

Experts from ASEAN Securities Joint Stock Company predict that the VN-Index will continue to fluctuate and struggle in the short term. Investors should consider buying points during corrections and fluctuations. Prioritize stocks that are maintaining a short-term uptrend and belong to supported sectors such as banking, securities, real estate, retail, and public investment.

Source: https://hanoimoi.vn/thi-truong-chung-khoan-giam-tuan-thu-2-lien-tiep-705634.html

Comment (0)