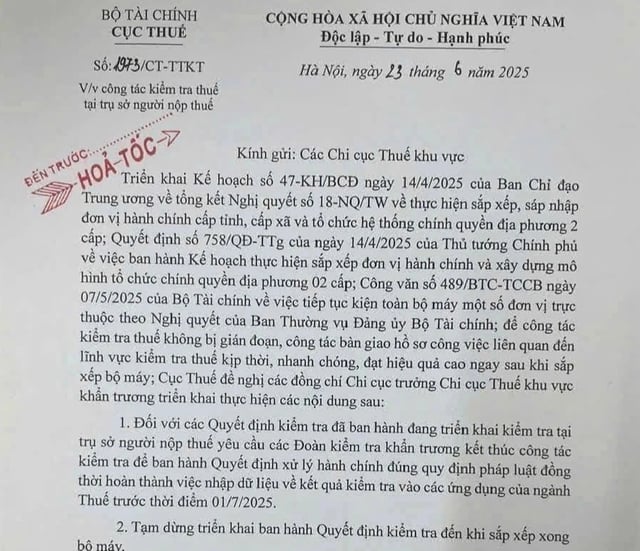

The Tax Department ( Ministry of Finance ) has just sent an urgent dispatch to regional tax branches regarding tax inspection at taxpayers' headquarters.

The Tax Department requested to temporarily suspend tax inspections at taxpayers' headquarters until the apparatus is reorganized. PHOTO: SCREENSHOT

For inspection decisions that have been issued and are being implemented, the Tax Department requires inspection teams to promptly complete the inspection work to issue administrative handling decisions in accordance with legal regulations. At the same time, complete the entry of data on inspection results into tax industry applications before July 1.

The Tax Department also directed regional tax branches to temporarily suspend the issuance of inspection decisions until the apparatus is reorganized.

The above moves aim to ensure that tax inspection work is not interrupted, and that the handover of work documents related to tax inspection is timely, quick, and highly effective right after the organization is reorganized.

In the third draft of the Decree amending and supplementing a number of articles of Decree No. 29/2025/ND-CP stipulating the functions, tasks, powers and organizational structure of the Ministry of Finance, the Ministry submitted to the Government to amend and supplement regulations, reorganizing 20 regional tax branches into 34 provincial and municipal tax branches directly under the Central Government (an increase of 14 units compared to present).

Convert 350 district-level tax teams into 350 basic tax teams under provincial and municipal tax to manage taxes in some commune-level administrative units.

The Tax Department operates at 3 levels: central level, provincial level (tax of provinces and centrally-run cities), and grassroots level (tax of grassroots management of some communes, wards, and special zones); has a seal with the national emblem.

The decree is expected to take effect from July 1./.

According to Decision 970 dated July 14, 2023 of the General Department of Taxation (from March 1, 2025, the Tax Department), tax inspections at taxpayers' headquarters are conducted in cases where there are signs of law violations through tax management work as prescribed in Point d, Clause 1, Article 110 of the Law on Tax Administration and other legal provisions. Inspection at the taxpayer's headquarters for selected cases according to the plan, thematically decided by the head of the superior tax authority; thematically arising inspections during the year decided by the head of the tax authority at the same level (also known as planned, thematic inspections). Inspection at the taxpayer's headquarters for taxpayers that divide, separate, merge, consolidate, convert business types, dissolve, terminate operations, equitize, terminate tax codes, change business locations leading to changes in tax management authorities and cases of surprise inspections, inspections under the direction of competent authorities... |

According to Thanh Nien Newspaper

Source: https://thanhnien.vn/tam-dung-kiem-tra-thue-tai-tru-so-nguoi-nop-thue-185250624162637367.htm

Source: https://baolongan.vn/tam-dung-kiem-tra-thue-tai-tru-so-nguoi-nop-thue-a197600.html

![[Photo] Politburo works with the Standing Committee of Can Tho City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/4/10461762301c435d8649f6f3bb07327e)

![[Photo] Politburo works with the Standing Committee of the Party Committee of the Fatherland Front and Central organizations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/4/6f23e5c0f576484bb02b3aad08f9d26a)

![[Photo] Prime Minister Pham Minh Chinh chairs the thematic meeting on law making in August 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/4/ba42763cd48e4d7cba3481640b5ae367)

![[Photo] Politburo works with the Standing Committee of Lai Chau Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/4/f69437b9ec3b4b0089a8d789d9749b44)

Comment (0)