The banking system is facing difficulties in asset quality due to rapidly increasing bad debts, while Circular 02 on debt restructuring will expire on December 31.

Asset quality is deteriorating.

By the end of the third quarter of 2024, bad debt of the entire credit institution system was at VND 252,000 billion (up 20.7% over the same period last year and up 30.3% over the beginning of the year.

The reason why bad debt has not shown signs of cooling down is because the economy and real estate market are still facing many difficulties in the recovery process. Credit is disbursed in a short time, mainly increasing sharply in the real estate business group - which has a high risk of bad debt.

Meanwhile, small-scale private banking groups do not have many advantages in choosing customers, so their customer base is often a group with poor financial capacity and slower recovery ability than other groups.

The third quarter reports of banks show that group 2 and 4 debt in the third quarter decreased compared to the previous quarter, while groups 3 and 5 both increased by VND8,000 billion (up 6.4% compared to the previous quarter).

Compared to the beginning of the year, debt groups from group 2 to group 4 all increased, especially group 5 debt, increasing by 0.8%, 41.7%, 6.9% and 40.4% respectively.

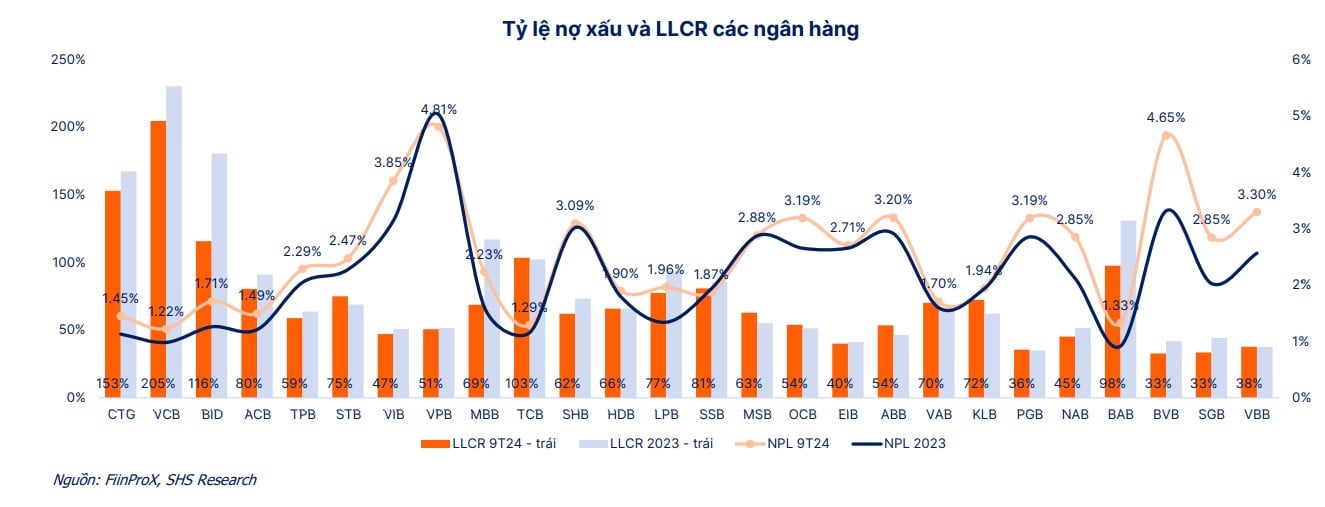

According to Saigon - Hanoi Securities Company (SHS), the increasing bad debt ratio and decreasing bad debt coverage ratio (LLCR) show that the asset quality of the entire system is declining.

The bad debt coverage ratio will be 83% in Q3/2024, far from the peak (143.2%) in Q3/2022.

SHS forecasts that the NPL ratio and LLCR are expected to be more positive at the end of the year when banks often focus on using provisions to clear bad debts.

According to a recent report by Vietcombank Securities Company (VCBS), the narrowing of the industry's reserve buffer in the first half of the year has limited the ability to handle debt in the coming time, especially for banks with high-risk customer files and a high ratio of restructured debt/total outstanding debt.

Banks with a diversified customer base, a solid buffer, and a moderate proportion of real estate loans and corporate bonds in total outstanding credit will be able to control credit costs well.

“Credit risk provisioning costs/loan balance are remaining at an average level since the beginning of 2022, while thin provisioning buffers lead to increased provisioning pressure in the following quarters, especially in banks with low asset quality,” VCBS analyzed.

In addition, the high bad debt ratio is concentrated in the private banking group, especially some retail lending banks.

In the group of state-owned banks, BIDV's bad debt ratio increased sharply compared to the beginning of the year (from 1.26% to 1.71%).

Banks such as VPB, SHB, MSB, BVB, ABB and PGB have a bad debt ratio after 9 months of over 3%.

Regarding the bad debt coverage ratio, in the group of non-state banks, only Techcombank has provisioned over 100%, small and medium-sized banks have lower provision buffers when LLCR is from 40-70%.

Impact of Circular 02 on debt restructuring expiring

Meanwhile, Circular 02 on debt restructuring will expire on December 31, 2024. There is currently no information from the State Bank of Vietnam (SBV) regarding the extension or cessation of Circular 02 according to the planned roadmap.

At the end of the second quarter of 2024, the outstanding debt restructured under Circular 02 was worth VND230,000 billion, up 25.6% compared to the beginning of the year. According to regulations, banks must set aside provisions for restructured debt under Circular 02 according to the correct debt group, the difference compared to the current debt group is set aside at 50% each year, reaching 100% by the end of 2024.

According to SHS, the State Bank's failure to extend Circular 02 may increase the scale of bad debt and reduce the bad debt coverage ratio, but will not affect banks' provisioning.

The expiration of Circular 02 will have different impacts on each bank. Banks with healthy asset quality such as BIDV, Vietcombank, VietinBank, Techcombank, ACB, etc. will be less affected thanks to their solid buffer and good financial health.

Banks with high group 2 debt ratios and low bad debt coverage ratios are expected to be more affected.

However, VCBS believes that the pressure on bad debt in the second half of 2024 is not too great when considering factors such as: Bad debt cooling down along with the recovery of the economy in general; bad debt arising from the impact of Typhoon Yagi is not too large at the present time, but more time is needed to assess.

According to preliminary statistics of the State Bank of Vietnam as of September 20, it is estimated that there is about 116,000 billion VND of outstanding debt in affected provinces and cities. Bad debt on total outstanding debt will be low and will be reflected next year according to the direction of the State Bank of Vietnam for commercial banks on flexibility in debt collection activities, possibly temporarily freezing, deferring/rescheduling debt, reducing interest on loans that have/are about to mature.

Bad debt will also be differentiated among banks. Banks with good asset quality will record moderate levels of bad debt and restructured debt. Banks with a high proportion of corporate credit (including corporate bonds) and low bad debt coverage ratios may face increased bad debt risks and provisioning pressure in 2024-2025.

Source: https://vietnamnet.vn/nhieu-ngan-hang-chiu-ap-luc-no-xau-tang-nhanh-2352250.html

![[Maritime News] Wan Hai Lines invests $150 million to buy 48,000 containers](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/20/c945a62aff624b4bb5c25e67e9bcc1cb)

![[Infographic] Party Committee of the Ministry of Culture, Sports and Tourism: Marks of the 2020 - 2025 term](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/22/058c9f95a9a54fcab13153cddc34435e)

Comment (0)