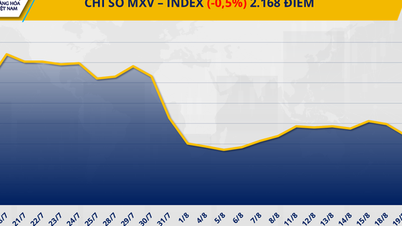

Brent oil price approaches 69 USD/barrel

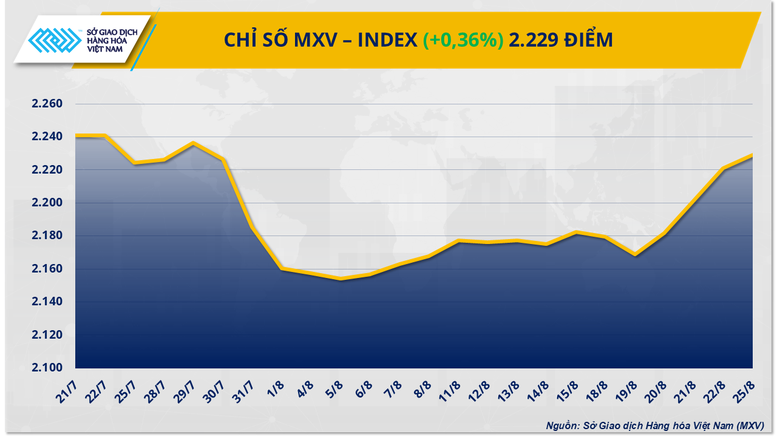

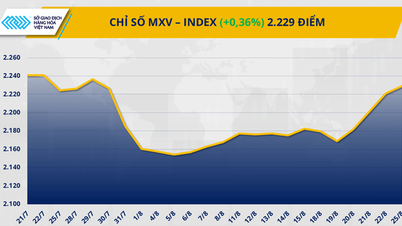

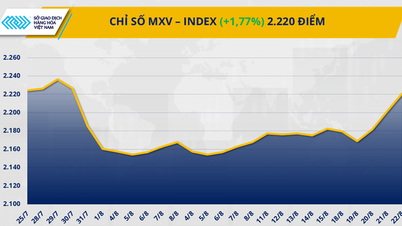

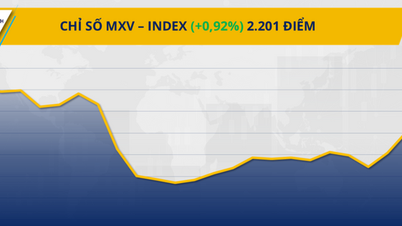

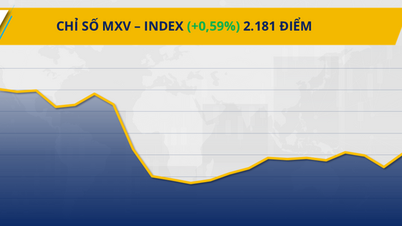

According to MXV, the energy group witnessed the dominant buying power when most prices of many key commodities increased sharply. In particular, the focus of attention was on two crude oil commodities. Specifically, Brent oil price recorded an increase of about 1.58%, up to 68.8 USD/barrel; while WTI oil price stopped at 64.8 USD/barrel, corresponding to an increase of about 1.79%.

Over the weekend, US President Donald Trump continued to assert that he would impose sanctions on Russia if there was no new progress towards a peace agreement within the next two weeks. At the same time, he also increased pressure on India - the world's second-largest crude oil importer - to change its supply from Russia.

According to Phil Flynn, senior analyst at Price Futures Group, investors believe that peace talks are taking longer than expected. In addition, small-scale attacks have disrupted oil supplies from Russia to Slovakia and Hungary, reinforcing concerns about the risk of further escalation of geopolitical tensions in Eastern Europe. However, US Vice President JD Vance expressed optimism about the progress of negotiations between Russia and Ukraine.

Another notable point in the market is the increasing expectation that the US Federal Reserve will decide to cut interest rates after its meeting in September. After the latest comments from Fed Chairman Jerome Powell, the probability of such a move has increased to 85.2%, according to data from the CME FedWatch tool.

On the other hand, forecasts surrounding OPEC+ production levels are creating a drag on oil prices. OPEC+ countries are scheduled to hold a meeting on September 7, amid market speculation that the group may continue to raise production from October.

In another development, natural gas prices in the US market have yet to recover after losing more than 4.5% of their value in the trading session on August 22. Trading on the NYMEX continued to maintain at 2.7 USD/MMBtu, down slightly by 0.07%. Gas consumption demand of power plants in the US has not improved significantly, due to forecasts of mild weather that will reduce people's demand for electricity.

Iron ore prices reverse sharply amid supply disruption risks

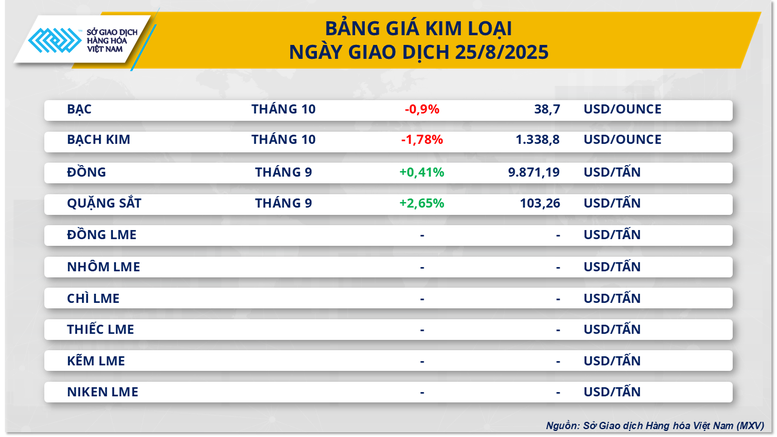

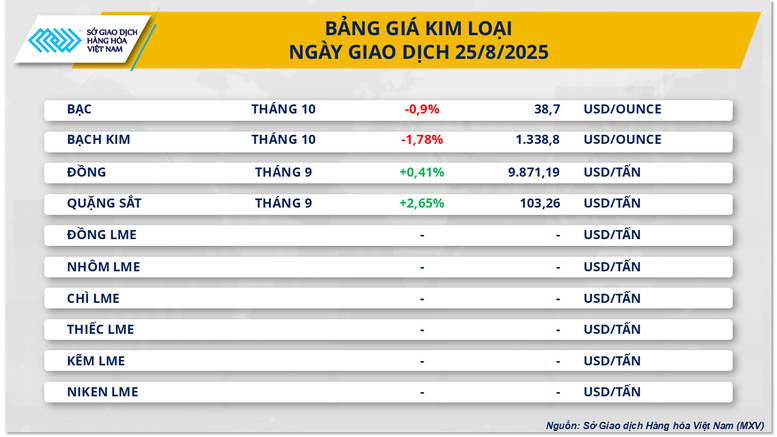

According to MXV, yesterday's trading session recorded a clear divergence when the precious metal group was under strong selling pressure, while most base metals maintained a positive trend. The focus was on iron ore, when the price of the September futures contract on the Singapore exchange reversed and increased by 2.65% to 103.26 USD/ton, erasing the previous decline thanks to unexpected information from the supply source.

Over the weekend, mining giant Rio Tinto announced the suspension of all operations at its SimFer mine, part of the Simandou iron ore project in Guinea, after a serious accident killed a worker. The Simandou Mountains in southeastern Guinea, known for their high-quality iron ore reserves of around 1.5 billion tonnes, are expected to be a strategic source of supply to help reduce the carbon intensity of global steel production. The mine is scheduled to reach a capacity of 60 million tonnes per year by 2028, with the first shipments scheduled for November. The incident has increased the risk of delays to export plans, further tightening short-term supply.

In China - the world's largest iron ore consumer, steel export figures in July continued to be positive, reaching 11.4 million tons, up 5.2% compared to June and nearly 40% compared to the same period in 2024. In the first 7 months, China's steel exports increased by more than 20%, to 75.5 million tons.

Domestically, construction steel prices have rebounded after three consecutive downward adjustments. CB240 coil steel is currently at VND13.3 million/ton, while D10 CB300 rebar is at VND12.99 million/ton. However, data from the Vietnam Customs Department shows that in the first half of August, steel exports fell sharply by 41% compared to the second half of July, to 280,909 tons; while imports increased by 3.6%, reaching 671,230 tons. This reflects improving domestic demand, but exports are under competitive pressure from abundant supply from China.

Source: https://baochinhphu.vn/nang-luong-dan-dat-mxv-index-noi-dai-chuoi-tang-sang-phien-thu-4-102250826091831681.htm

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

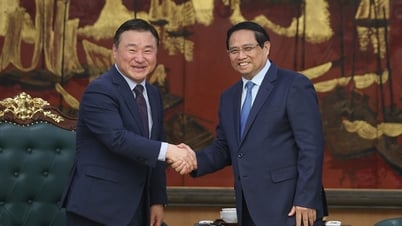

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

Comment (0)