Additional subjects are eligible for a 2% VAT reduction

With 452/453 delegates participating in the vote in favor (accounting for 99.78%), this morning (June 17), the National Assembly officially passed the Resolution on reducing value added tax (VAT).

Accordingly, from July 1, 2025 to December 31, 2026, the VAT rate will be reduced by 2% to 8% for groups of goods and services specified in Clause 3, Article 9 of the Law on Value Added Tax, except for some groups of goods and services such as telecommunications, financial activities, banking, securities, insurance, real estate business, metal products, mining products (except coal), goods and services subject to special consumption tax (except gasoline).

This resolution expands the scope of tax reduction beneficiaries compared to previous resolutions, and extends the application period until the end of 2026.

The subjects added to the list of goods and services eligible for tax reduction include transportation, logistics, goods, and information technology services.

In addition, according to the provisions of the law on VAT, teaching, vocational training and medical services are not subject to VAT, so there is no need to reduce tax.

Services such as finance, banking, securities, and insurance are not subject to VAT and are therefore not subject to tax reduction; meanwhile, telecommunications and real estate services are sectors that have grown in recent times and are also not subject to VAT reduction according to Resolution No. 43.

According to the Government's proposed plan in Submission No. 206 dated April 16, 2025, the reduction in VAT is expected to reduce state budget revenue by about VND 121.74 trillion (of which, in the last 6 months of 2025, it will decrease by about VND 39.54 trillion and in 2026, it will decrease by about VND 82.2 trillion).

However, reducing VAT has the effect of stimulating production, promoting production and business activities, thereby contributing to creating additional revenue for the state budget (including the possibility of increasing revenue from other taxes thanks to the spillover effect of the VAT reduction policy).

In order to compensate for the revenue shortfall due to policy implementation, the Government will focus on directing ministries, central and local agencies to implement a number of solutions.

In particular, strengthening management, reforming administrative procedures, promoting digital transformation in tax management, especially in key areas and areas, land revenue, real estate transfer, e-commerce activities, and business activities on digital platforms.

In particular, expand electronic invoices generated from cash registers in the fields of business, food services, restaurants, chain hotels, gasoline and gold trading... Strive to collect state budget in 2025 about 10% higher than estimated implementation in 2024.

Officially introducing new concepts into the Enterprise Law (amended)

With 455/457 delegates participating in the vote in favor (95.19%), the National Assembly has just passed the Law amending and supplementing a number of articles of the Enterprise Law.

The notable point of this revised law is the addition of regulations on beneficial owners of enterprises.

Accordingly, the beneficial owner of an enterprise is an individual who has actual ownership of the charter capital or has the right to control that enterprise, except for the case of the direct owner representative at an enterprise in which the State holds 100% of the charter capital and the representative of the State capital invested in a joint stock company or a limited liability company with two or more members according to the provisions of law on management and investment of State capital in enterprises.

Enterprises are responsible for collecting, updating and maintaining information on beneficial owners; and providing this information to competent state agencies upon request.

This list includes key information such as: full name; date of birth; nationality; ethnicity; gender; contact address; ownership percentage or controlling rights; and information on legal documents of the individual identified as the beneficial owner.

The law also adds provisions on the issuance of individual bonds by non-public companies. Accordingly, the value of bonds expected to be issued must not exceed 5 times the equity of the issuing organization according to the audited financial statements of the year immediately preceding the year of issuance.

This regulation aims to enhance the financial capacity of issuing enterprises, while limiting bond payment risks for both issuers and investors.

The drafting committee also amended Point b, Clause 2 and Point b, Clause 3, Article 17 of the Enterprise Law in the direction of stipulating that subjects not allowed to establish, contribute capital to and manage enterprises include civil servants and public employees according to the provisions of the Law on Cadres, Civil Servants and the Law on Public Employees, except for cases where it is implemented according to the provisions of the law on science, technology, innovation and national digital transformation.

The Law on Enterprises (amended) takes effect from July 1.

Source: https://vietnamnet.vn/mo-rong-doi-tuong-duoc-giam-2-thue-gia-tri-gia-tang-tu-1-7-2025-2412129.html

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

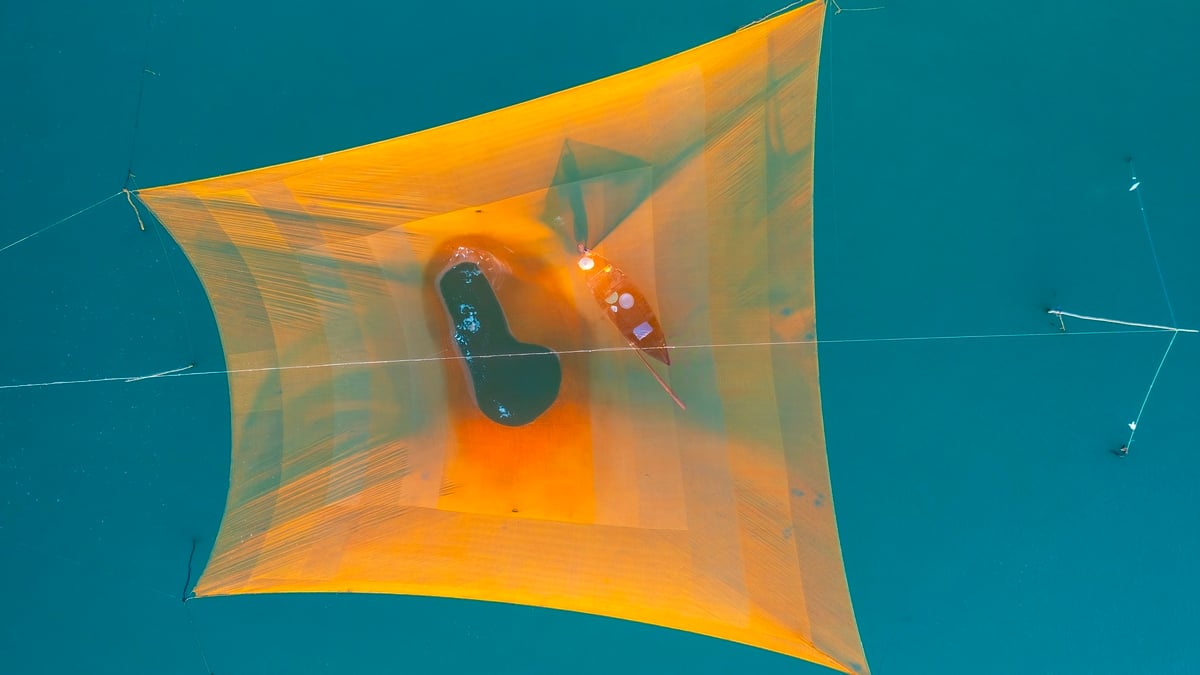

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

Comment (0)