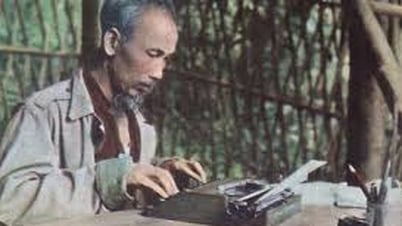

People in Son Thuy commune (Mai Chau) borrow policy capital to raise buffalo for reproduction and improve income.

The family of Mr. Bui Van Hoan, a Muong ethnic in Khan Thuong hamlet, Son Thuy commune, is one of the typical examples. From a household with unstable income, Mr. Hoan boldly borrowed 100 million VND from the loan program for production and business households in difficult areas. Thanks to that, he switched to breeding buffaloes - a model suitable for local conditions, where the source of animal feed is quite abundant. After a period of persistent care, the family's buffalo herd developed well, bringing in a stable income.

"Policy capital is like a life buoy for households like me. Without preferential capital, I cannot develop livestock farming. Low interest rates and reasonable repayment periods are very suitable for people in the highlands," Mr. Hoan shared.

In Tan Thanh commune, the family of Mr. Luong Van Duong (Thai ethnic group in Cai hamlet) was also a poor household. From a loan of 100 million VND from the poor household lending program, he invested in buying breeding buffaloes. In addition to the capital, the family also received advice from the staff of the Social Policy Bank on how to use the capital effectively and build a suitable model. Thanks to the right direction, Mr. Duong's herd of buffaloes has now grown to 6, helping the family's economy to be more prosperous.

Not only households, many ethnic minority youth in Mai Chau district have also found a new direction thanks to policy capital. A typical example is Giang A La (Mong ethnic group, Pa Co commune), who overcame capital barriers to start a community tourism model. Exploiting the advantages of ethnic identity and natural landscape, La invested in a homestay with preferential policy loans. "There is no shortage of ideas for young people who want to start a business, but capital is a big barrier. Thanks to policy capital, I can start and maintain the tourism model. Up to now, my income has been stable, and my family has paid off all the debt to the bank," La shared.

According to Ms. Kha Thi Phuong, Deputy Director of the Transaction Office of the Social Policy Bank of Mai Chau District, the demand for loans from local people is very large. Since the beginning of the year, over 1,900 poor households and policy beneficiaries have received loans, with a total outstanding policy credit balance of over VND493 billion.

"We identify the key task as implementing the credit plan assigned by superiors. Capital is prioritized for communes with many difficulties and ethnic minority households. At the same time, the unit proactively reviews and increases the loan level for households with effective production and business plans, focusing on investing in policy beneficiaries who have not yet had access to capital," the Deputy Director of the District Social Policy Bank emphasized.

Along with that, Mai Chau Social Policy Bank has stepped up coordination with local authorities and entrusted organizations to propagate and mobilize people to use capital for the right purposes. The unit has also gradually deployed Mobile Banking services to create favorable conditions for people, especially in remote areas.

From real stories like the families of Mr. Hoan, Mr. Duong, and Mr. La, it can be seen that policy credit capital is a solid "midwife", helping ethnic minorities in the mountainous district of Mai Chau confidently rise up and build a prosperous and sustainable life right on their homeland.

Written by Dao

Source: https://baohoabinh.com.vn/12/201893/Huyen-Mai-Chau-Chuyen-minh-tu-dong-von-nghia-tinh.htm

Comment (0)