Concerns about handling inventory without invoices

As the owner of a clothing store in Hanoi , Ms. Thu Huong shared that she previously bought inventory from a business household in the market. “Not to mention, I also import goods from China to sell, now I don’t know how to get input invoices for inventory from before June 1st?”, she worried.

Similarly, a textile and clothing business with 20 years of experience is also concerned about applying tax based on revenue due to the risk of having to pay back taxes for previous years.

Sharing with VietNamNet reporter , Mr. Nguyen Van Duoc, Head of Policy Department of Ho Chi Minh City Tax Consultants and Agents Association, General Director of Trong Tin Accounting and Tax Consulting Company Limited, said that in principle, when selling goods, an invoice must be issued, when purchasing goods, there must be an invoice to prove ownership and ensure origin.

Therefore, it is necessary for business households to have input invoices to prove the origin and not counterfeit goods according to regulations.

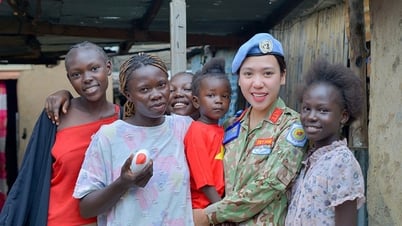

Business households are worried about tax arrears and unsold goods without invoices. How can we ease their worries? Photo: Thach Thao

However, currently, tax authorities mainly determine the tax obligations of business households based on the output revenue of individuals and business households. Input factors are important but not the main factor for tax authorities to collect taxes, but tax authorities also rely on actual revenue from providing services and goods to customers to multiply by the tax payment rate.

Therefore, business households can rest assured that they only need to pay taxes based on sales revenue. Input factors still need to comply with other legal regulations to avoid confiscation if the goods violate the origin and quality.

Mr. Duoc said that when the revenue of individuals and business households increases, for example, previously it was 500 million VND but when applying electronic invoices it increased to 1.5 billion VND, the tax authority will collect tax based on this actual amount from the time the electronic invoices were applied. Whether or not to collect back taxes from previous months needs to be specifically considered.

“There are two cases here. If the actual revenue that the tax authority can prove is 50% higher than the lump-sum tax rate, the taxpayer is likely to be subject to additional tax. If the actual revenue of previous periods does not exceed 50% of the lump-sum revenue, the business household can rest assured that it is not subject to adjustment according to regulations,” Mr. Duoc analyzed.

What did the Tax Department leaders say?

Ms. Nguyen Thi Cuc, President of the Tax Consulting Association, said that according to current regulations, purchased goods must have legal invoices and documents to determine the origin of the product.

However, in the transition period from lump-sum tax to declaration, there is a situation where the inventory of goods of households does not have full legal invoices to handle harmoniously and remove difficulties, and there needs to be an appropriate way to handle it.

Households must review all inventories, eliminating all goods of illegal origin such as counterfeit, contraband, and stolen goods (if any). When switching to paying taxes according to declarations, households will pay taxes on actual sales revenue.

She requested that the tax authority not pursue inventory of goods without sufficient invoices and documents, except for the cases of illegal goods excluded above.

Regarding the issue of tax arrears from previous years, Ms. Cuc said that according to the provisions of the Law on Tax Administration and its implementing guidelines, in case a business household pays tax according to the lump-sum method, if the actual revenue changes by 50% or more compared to the lump-sum level, the tax authority needs to adjust the lump-sum tax level accordingly in the year of conversion.

In case the business household pays tax by declaration method, the business household determines its own revenue and pays tax according to the prescribed rate. The tax authority will conduct inspections and tax collection if there are signs of tax evasion.

From June 1, business households must issue invoices according to new regulations. Thus, there will be cases where the actual revenue issued for invoices will be greater than the revenue declared for tax payment in previous years.

According to Ms. Cuc, to encourage business households to voluntarily convert tax declarations to reflect actual revenue, taxes paid in previous years should not be collected, except in cases of serious violations to evade or cheat on taxes.

At a press conference on June 16, Mr. Mai Son, Deputy Director of the Tax Department, affirmed that the calculation of lump-sum tax for business households is carried out by the tax authority based on tax management data and annual revenue declarations provided by business households. These bases are used to coordinate the assessment and determine the appropriate lump-sum tax rate for the year.

According to Mr. Mai Son, during the operation, if the business household's revenue fluctuates by 50% or more, the household can proactively request the tax authority to review and adjust the tax rate. The adjustment, if any, will only be applied from the time the change occurs onwards.

“This is a regulation of current law. There is no story of tax collection for business households in this case,” Mr. Mai Son emphasized.

Vietnamnet.vn

Source: https://vietnamnet.vn/ho-kinh-doanh-lo-bi-truy-thu-thue-hang-ton-khong-co-hoa-don-xu-ly-the-nao-2411920.html

![[Maritime News] More than 80% of global container shipping capacity is in the hands of MSC and major shipping alliances](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/6b4d586c984b4cbf8c5680352b9eaeb0)

Comment (0)