Domestic gold price today August 23, 2025

Opening the trading session on August 23, the price of SJC 9999 gold increased by 1.2 million VND/tael in both directions, trading at 125.6-126.6 million VND/tael (buy - sell).

The price of 1-5 chi SJC gold rings also increased by 1 million VND, listed at 118.5-121 million VND/tael (buy - sell).

Previously, on August 22, the domestic gold market price of SJC gold bars remained at 124.4-125.4 million VND/tael.

The price of 1-5 chi SJC gold rings closed at 117.5-120 million VND/tael (buy - sell), an increase of 200 thousand VND/tael compared to the previous session.

The price of 9999 gold rings at Doji also increased by 200,000 VND/tael compared to yesterday's closing price, trading at 117.5-120.5 million VND/tael (buy - sell).

World gold price today 8/23/2025

World gold prices increased sharply this morning following comments by Chairman Jerome Powell, which were seen as a “green light” for the possibility of cutting interest rates by 0.25 percentage points at the meeting on September 16-17. At 9:30 a.m. today (August 23, Vietnam time), spot gold was at $3,370/ounce, up $27/ounce from last night.

At 8:00 p.m. (August 22, Vietnam time), the spot gold price was at $3,343/ounce. The gold futures price for September 2025 delivery on the Comex New York floor reached $3,345/ounce.

Markets are on edge ahead of Federal Reserve Chairman Jerome Powell's highly anticipated speech at the Kansas City Fed's annual Jackson Hole symposium.

The bond market is betting on the Fed cutting interest rates in September, but the decision could depend on upcoming economic data, including jobs and inflation reports.

Mohamed El-Erian, chief economic adviser at Allianz, said this year's Jackson Hole symposium revealed the Fed's dilemma, with challenges that are almost impossible to solve.

El-Erian said the Fed chairman faces a big challenge. Inflation has consistently exceeded the Fed's 2% target for the past four years. Recent data suggest inflation could continue to rise.

At the same time, there is mounting evidence that the labor market is weakening, directly undermining the second pillar of the Fed’s “dual mandate.” Powell’s constant focus on the unemployment rate, which has remained steady at just over 4%, seems to be relying too much on a single data point.

In addition, Mr. Powell and the Fed face increasing political pressure from the Trump administration, which risks undermining their independence.

According to CME's FedWatch interest rate tracker, the market expects a 75% chance that the Fed will cut interest rates by 0.25 percentage points by September 2025.

Crude oil prices rose slightly, trading around $63.75 a barrel. At the same time, the yield on 10-year US Treasury bonds also rose to 4.337%.

In Europe, European Central Bank (ECB) officials signaled that interest rates would remain unchanged in September. Eurozone growth and inflation remain on track, with price pressures expected to ease gradually from 2026.

Meanwhile, in Asia, Chinese stocks were more positive, with the Shanghai Composite Index up 1.45% and the Shenzhen component index up 2.07%. The surge was driven by capital shifting from bonds to stocks, along with improved market sentiment due to the easing of trade tensions with the US.

Gold Price Forecast

According to Jason Pride, Director of Investment Strategy and Research at Glenmede, Mr. Powell is likely to hint that US economic data is weakening enough to consider a rate cut, which could support gold prices in the future.

Tim Waterer, chief market analyst at KCM Trade, said that gold prices are being affected by a number of intertwined factors. He said that the possibility of a peace agreement between Russia and Ukraine still exists. This could reduce the demand for safe havens - which has been one of the main drivers of gold prices in recent times.

Meanwhile, the strengthening US dollar is attracting inflows, putting downward pressure on precious metals. However, Mr. Waterer noted that if the Fed Chairman conveys a more dovish message in his upcoming speech, this could lead to a weakening of the US dollar.

In that scenario, gold prices are likely to rebound due to the inverse relationship typically seen between the two assets.

Source: https://vietnamnet.vn/gia-vang-hom-nay-23-8-2025-sjc-va-nhan-tron-nguoc-dong-vot-len-dinh-ky-luc-2435115.html

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

![[Photo] Hanoi: Authorities work hard to overcome the effects of heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/380f98ee36a34e62a9b7894b020112a8)

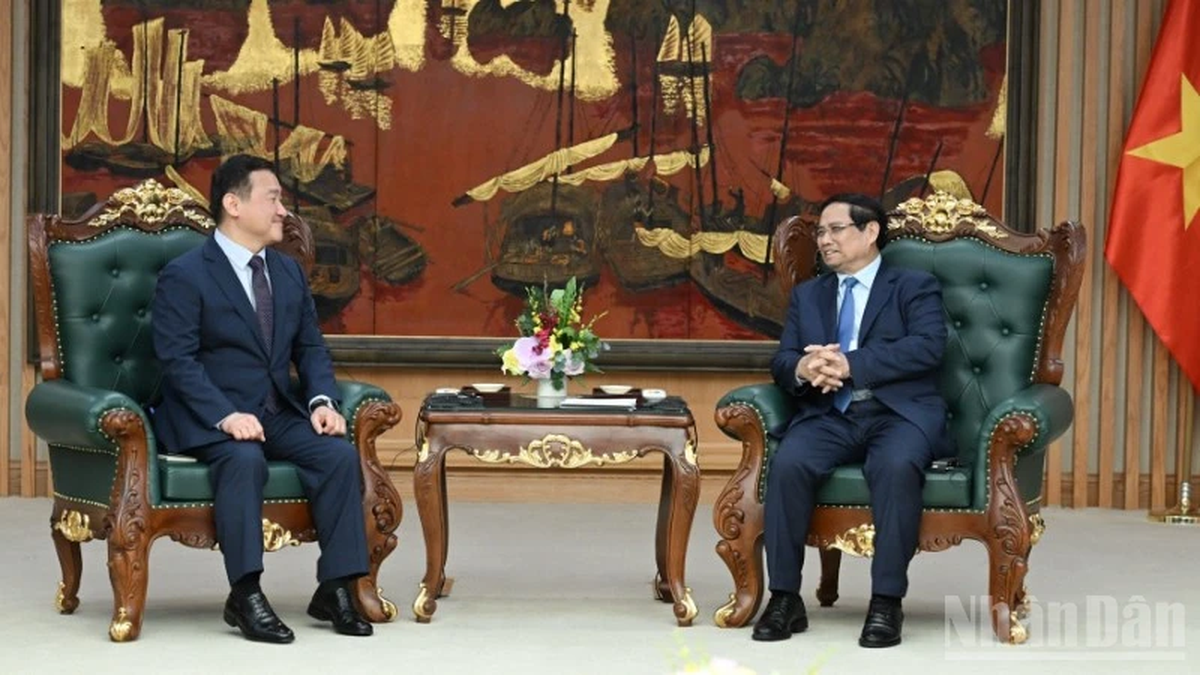

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

Comment (0)