Domestic gold price today August 17, 2025

As of 1:00 p.m. today, August 17, 2025, the domestic gold bar price remained unchanged compared to yesterday. Specifically:

The price of SJC gold bars listed by DOJI Group is at 123.5-124.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 123.5-124.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 16 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 124-124.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for buying - unchanged for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 123.5-124.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 122.7-124.5 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 1:00 p.m. on August 17, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.5-119.5 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.8-119.8 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, August 17, 2025 is as follows:

| Gold price today | August 17, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 123.5 | 124.5 | - | - |

| DOJI Group | 123.5 | 124.5 | - | - |

| Red Eyelashes | 124 | 124.5 | +200 | - |

| PNJ | 123.5 | 124.5 | - | - |

| Bao Tin Minh Chau | 123.5 | 124.5 | - | - |

| Phu Quy | 122.7 | 124.5 | - | - |

| 1. DOJI - Updated: August 17, 2025 1:00 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 123,500 | 124,500 |

| AVPL/SJC HCM | 123,500 | 124,500 |

| AVPL/SJC DN | 123,500 | 124,500 |

| Raw material 9999 - HN | 109,300 | 110,300 |

| Raw material 999 - HN | 109,200 | 110,200 |

| 2. PNJ - Updated: August 17, 2025 1:00 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 123,500 | 124,500 |

| PNJ 999.9 Plain Ring | 116,600 | 119,500 |

| Kim Bao Gold 999.9 | 116,600 | 119,500 |

| Gold Phuc Loc Tai 999.9 | 116,600 | 119,500 |

| PNJ Gold - Phoenix | 116,600 | 119,500 |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 jewelry gold | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3. SJC - Updated: August 17, 2025 1:00 PM - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 123,500 | 124,500 |

| SJC gold 5 chi | 123,500 | 124,520 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 123,500 | 124,530 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,600 | 119,200 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,600 | 119,100 |

| Jewelry 99.99% | 116,400 | 118,200 |

| Jewelry 99% | 112,529 | 117,029 |

| Jewelry 68% | 73,334 | 80,534 |

| Jewelry 41.7% | 42,244 | 49,444 |

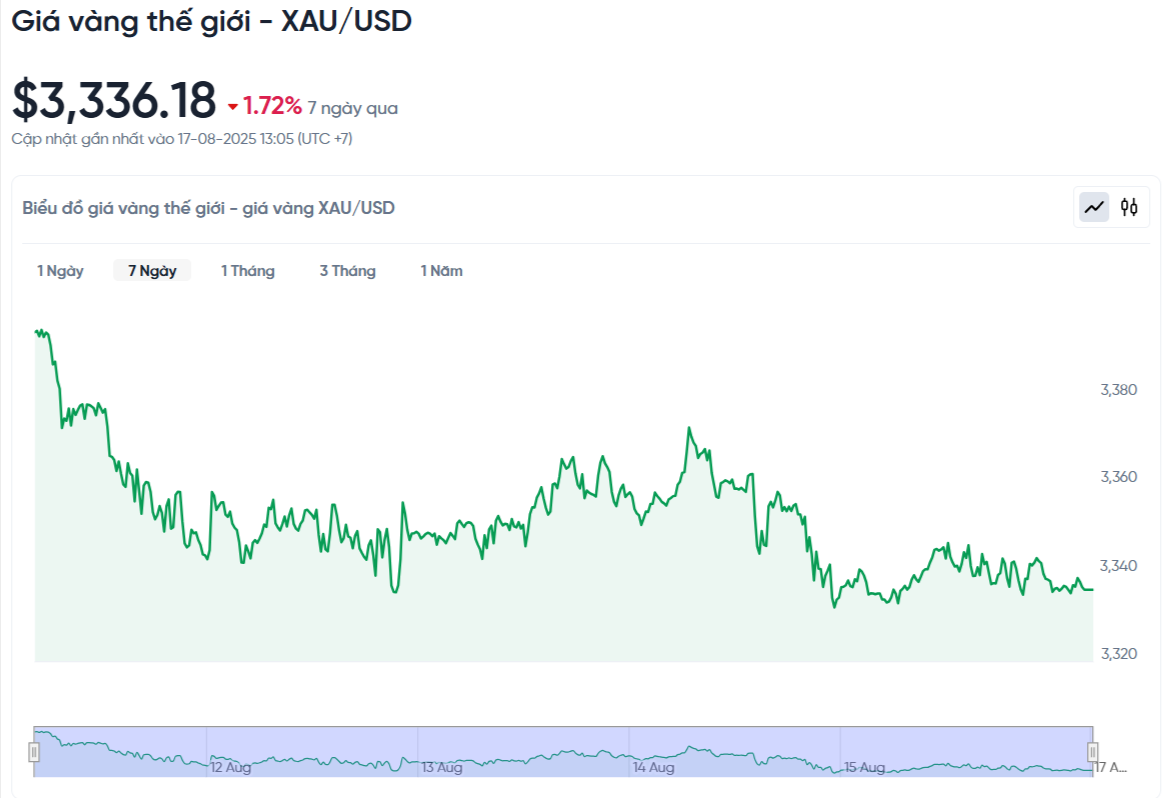

World gold price today August 17, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 1:00 p.m. on August 17, Vietnam time, was 3,336.18 USD/ounce. Today's gold price decreased by 5.5 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,450 VND/USD), the world gold price is about 106.39 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.11 million VND/tael higher than the international gold price.

The US-Russia summit is attracting great attention from the market. According to Bloomberg, the US wants to reach a ceasefire agreement in Ukraine, while Russia sees this as an opportunity to strengthen its position through negotiations.

The developments from this conference may affect investor sentiment, especially safe assets such as gold. If geopolitical tensions ease, many people may sell gold to take profits, causing the price of gold to fall. That is why today's gold price has tended to go down.

Specifically, spot gold prices decreased by 0.17% and decreased by 1.8% for the whole week. Meanwhile, US gold futures for December delivery decreased slightly by 0.02% to 3,382.6 USD/ounce.

The meeting between US President Donald Trump and his Russian counterpart Vladimir Putin took place in a rather open atmosphere. The two leaders shook hands and traveled together in a car, showing positive signs before entering into discussions. If progress is made, Russia-Ukraine tensions could ease, causing gold prices to fall further.

Mr. Tran Duy Phuong, Director of Golden Fund Gold and Gemstone Company, said that domestic gold prices are mainly affected by supply and demand. The supply of SJC gold bars and raw gold is currently quite limited, so even though world prices fluctuate strongly, domestic gold prices are unlikely to fall sharply.

For example, if the world gold price drops by 10 USD, the domestic price may only drop by 1-2 million VND/tael. Currently, the domestic gold market is waiting for the State Bank's move and developments in the international market.

Factors that once supported gold prices, such as Russia-Ukraine tensions and the Middle East, are no longer as strong as before. Currently, the main driver is the expectation that the Fed will cut interest rates twice by the end of the year. However, since this information was predicted in advance, the impact may not be too big.

Currently, the gap between domestic and international gold prices is quite large, about 16-17 million VND. The Government and the State Bank can apply measures to increase supply, helping to narrow this gap to about 10 million VND. However, reducing the gap to just a few million is very difficult.

Buying SJC gold at this time is risky. If the domestic gold price adjusts, investors may lose 5-6 million VND. If the world price continues to decrease, the loss may be greater. Therefore, investors should consider carefully before deciding. They can consider other types of gold with more reasonable prices to minimize risks.

Gold Price Forecast

According to the latest survey from Kitco News, the majority of experts on Wall Street predict that gold prices will continue to move sideways in the near future. Meanwhile, the majority of individual investors remain optimistic that gold prices can increase.

This week, 10 experts participated in the Kitco News survey. The results showed that only 1 person predicted gold prices to increase, 1 person predicted prices to decrease, and the remaining 8 people believed that gold prices will continue to fluctuate within a narrow range.

From the perspective of retail investors, the online survey results with 183 votes showed that 63% (115 people) expected gold prices to increase, 18% (33 people) predicted a decrease and 19% (35 people) thought prices would stabilize.

Gold prices are influenced by a variety of factors, from inflation to interest rates to geopolitical volatility. Strong PPI (producer price index) data could push the Fed’s PCE inflation higher in July, said Ole Hansen of Saxo Bank. If inflation picks up, the Fed will be more cautious before deciding to cut interest rates, which could impact gold prices.

The strength of the US dollar also has a big impact on gold. When the US dollar rises, gold becomes more expensive for foreign investors, reducing demand and driving down prices. Conversely, a weak US dollar makes gold cheaper, stimulating buying and pushing up prices.

Ryan McIntyre from Sprott Inc. predicts that gold prices could fluctuate sharply as the market assesses the full impact of the US debt. In addition, the strong buying of gold by central banks since the Russia-Ukraine conflict is also an important factor helping to support high gold prices and increase investor confidence.

UOB's Heng Koon How predicts that gold prices could hit $3,700 an ounce by the middle of next year, thanks to a weaker dollar and continued safe-haven demand. In the short term, gold prices could be volatile due to geopolitical events. FXTM's Lukman Otunuga believes that the US-Russia summit in Alaska could cause significant changes.

Experts from ANZ commented that economic and geopolitical risks may increase in the second half of the year, making gold a safer investment channel. They are optimistic about the gold price outlook due to factors such as trade tensions, a slowing global economy, easy US monetary policy and continued depreciation of the USD.

This week, markets are focused on inflation and the financial health of U.S. consumers. Next week, attention will shift to the Federal Reserve, with several important events. Most notable are the minutes of the July FOMC meeting and Fed Chairman Jerome Powell's speech at the Jackson Hole conference on Friday.

Source: https://baonghean.vn/gia-vang-hom-nay-17-8-gia-vang-trong-nuoc-o-muc-rat-cao-the-gioi-giam-nhe-10304579.html

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum and offer incense to commemorate Heroes and Martyrs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/17/ca4f4b61522f4945b3715b12ee1ac46c)

Comment (0)