Domestic gold price today June 18, 2025

As of 4:30 p.m. on June 18, 2025, the domestic gold bar price remained unchanged compared to yesterday. Specifically:

The price of SJC gold bars listed by DOJI Group is at 117.6-119.6 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 117.6-119.6 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118.5-119.5 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 117.6-119.6 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117-119.6 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions.

As of the afternoon of June 18, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115-117 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 114.8-117.8 million VND/tael (buy - sell); down 200 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, June 18, 2025 is as follows:

| Gold price today | June 18, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 117.6 | 119.6 | - | - |

| DOJI Group | 117.6 | 119.6 | - | - |

| Red Eyelashes | 118.5 | 119.5 | - | - |

| PNJ | 117.8 | 119.6 | - | - |

| Bao Tin Minh Chau | 117.8 | 119.6 | - | - |

| Phu Quy | 117 | 117.8 | - | - |

| 1. DOJI - Updated: June 18, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 117,600 | 119,600 |

| AVPL/SJC HCM | 117,600 | 119,600 |

| AVPL/SJC DN | 117,600 | 119,600 |

| Raw material 9999 - HN | 110,000 ▲400K | 112,000 |

| Raw material 999 - HN | 109,900 ▲400K | 111,900 |

| 2. PNJ - Updated: June 18, 2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,760 | 11,960 |

| PNJ 999.9 Plain Ring | 11,400 | 11,680 |

| Kim Bao Gold 999.9 | 11,400 | 11,680 |

| Gold Phuc Loc Tai 999.9 | 11,400 | 11,680 |

| 999.9 gold jewelry | 11,320 | 11,570 |

| 999 gold jewelry | 11,308 | 11,558 |

| 9920 jewelry gold | 11,237 | 11,487 |

| 99 gold jewelry | 11,214 | 11,464 |

| 750 Gold (18K) | 7,943 | 8,693 |

| 585 Gold (14K) | 6,034 | 6,784 |

| 416 Gold (10K) | 4,078 | 4,828 |

| PNJ Gold - Phoenix | 11,400 | 11,680 |

| 916 Gold (22K) | 10,358 | 10,608 |

| 610 Gold (14.6K) | 6.323 | 7,073 |

| 650 Gold (15.6K) | 6,786 | 7,536 |

| 680 Gold (16.3K) | 7.133 | 7,883 |

| 375 Gold (9K) | 3.604 | 4,354 |

| 333 Gold (8K) | 3,083 | 3,833 |

| 3. SJC - Updated: June 18, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 117,600 | 119,600 |

| SJC gold 5 chi | 117,600 | 119,620 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 117,600 | 119,630 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,700 | 116,200 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,700 | 116,300 |

| Jewelry 99.99% | 113,700 | 115,600 |

| Jewelry 99% | 109,955 | 114,455 |

| Jewelry 68% | 71,865 | 78,765 |

| Jewelry 41.7% | 41,460 | 48,360 |

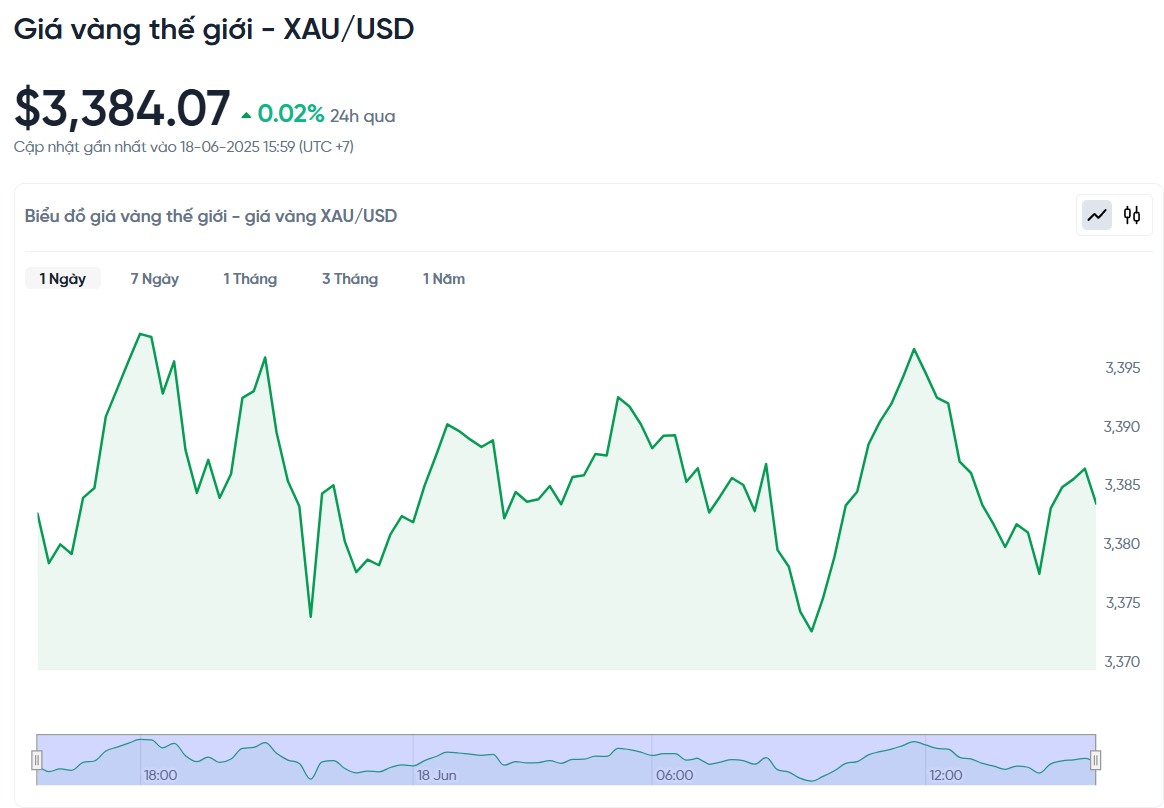

World gold price today June 18, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 p.m. on June 18, Vietnam time, was 3,384.07 USD/ounce. Today's gold price increased by 0.83 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,243 VND/USD), the world gold price is about 111.75 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 7.85 million VND/tael higher than the international gold price.

World gold prices were quiet as investors temporarily suspended trading before the US Federal Reserve (Fed) announced its monetary policy decision. At the same time, the market is also closely monitoring the tension between Israel and Iran, which is escalating day by day. Specifically, spot gold prices increased by 0.02%. US gold futures prices also decreased by 0.1% to 3,405.10 USD/ounce.

All eyes are now on the Fed's two-day policy meeting, which ends today. While the Fed is expected to keep interest rates unchanged, investors are looking for signs of a possible rate cut in the near future. Fed Chairman Jerome Powell's speech after the meeting will also be a key highlight.

Traders are cautious ahead of the Fed's decision, while risk appetite in the stock market has picked up slightly, putting pressure on gold prices, said Ricardo Evangelista of brokerage firm ActivTrades. Specifically, S&P 500 futures rose 0.2%, while Nasdaq futures rose about 0.3%.

Geopolitical tensions remain supportive of gold prices. Iran and Israel continued to launch new missile attacks on Wednesday, marking the sixth consecutive day of fighting. The US is also increasing its military presence in the Middle East by sending more fighter jets and extending the deployment of existing forces.

Although gold prices may fall in the next six months due to profit-taking pressure or a change in the investment environment, strong demand from central banks and Chinese investors will help limit the decline and keep gold prices stable above the $3,000/ounce threshold, according to Hamad Hussain, an expert at Capital Economics.

In other precious metals, silver was unchanged at $37.22 an ounce. Platinum rose 1.1 percent to $1,276.73, while palladium edged up 0.1 percent to $1,053.25 an ounce.

Gold Price Forecast

Gold prices are facing strong profit-taking pressure but have not fallen much thanks to the bottom-fishing cash flow that appears every time the price falls. In addition to geopolitical factors, investors are paying special attention to the US Federal Reserve's (Fed) policy meeting and Chairman Jerome Powell's speech, which are considered key factors in determining the next trajectory of the precious metal.

Most economists expect the Fed to keep interest rates unchanged at this meeting. However, many expect Mr. Powell to hint at a possible rate cut later this year, especially after a series of data showing easing inflation and slowing US economic growth.

If the Fed proves more dovish than expected, gold prices could gain momentum, possibly even surpassing the record $3,500/ounce mark when combined with geopolitical risks. Conversely, if the Fed is not talking about easing, gold’s appeal could wane as investors adjust their expectations.

From a technical perspective, FXTM expert Lukman Otunuga believes that the uptrend on the daily chart is still intact. He assessed that if the gold price closes the week above $3,430/ounce, gold is likely to advance to $3,500 and beyond. Conversely, losing the $3,430 mark could pull the gold price back to the $3,400 area, or even $3,360.

The Fed is currently facing a difficult problem: controlling inflation while maintaining stable growth in the context of escalating tensions in the Middle East. Any new signal from the Fed, when combined with geopolitical risks, can create major fluctuations for the gold market. Therefore, investors need to closely monitor developments to adjust their strategies in time.

In the long term, gold prices remain supported by the prospect of a weaker US dollar and the risk of high global inflation.

Source: https://baonghean.vn/gia-vang-chieu-nay-18-6-2025-gia-vang-trong-nuoc-va-the-gioi-dang-cho-doi-fed-10299880.html

Comment (0)