Domestic gold price this afternoon August 17, 2025

As of 5:00 p.m. this afternoon, August 17, 2025, the domestic gold bar price remained unchanged compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 123.5-124.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. The price increased by 300 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to last week.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 123.5-124.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 16 yesterday. The price increased by 300 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to the closing price on August 10 last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 124-124.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for buying - unchanged for selling. Compared to last week, the gold price increased by 600 thousand VND/tael for buying - increased by 100 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 123.5-124.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the same period yesterday; the price increased by 300 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to the same period last week.

SJC gold price at Phu Quy is traded by businesses at 122.7-124.5 million VND/tael (buy - sell), gold price is unchanged in both buying and selling directions compared to yesterday, gold price increased by 500 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to last week.

As of 5:00 p.m. on August 17, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.5-119.5 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday; the price decreased by 1 million VND/tael in buying direction - decreased by 500 thousand VND/tael in selling direction compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 116.8-119.8 million VND/tael (buy - sell); unchanged in both buying and selling compared to yesterday; down 1 million VND/tael in both buying and selling compared to last week.

The latest gold price list this afternoon, August 17, 2025 is as follows:

| Gold price this afternoon | August 17, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 123.5 | 124.5 | - | - |

| DOJI Group | 123.5 | 124.5 | - | - |

| Red Eyelashes | 124 | 124.5 | - | - |

| PNJ | 123.5 | 124.5 | - | - |

| Bao Tin Minh Chau | 123.5 | 124.5 | - | - |

| Phu Quy | 122.7 | 124.5 | - | - |

| 1. DOJI - Updated: August 17, 2025 17:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 123,500 | 124,500 |

| AVPL/SJC HCM | 123,500 | 124,500 |

| AVPL/SJC DN | 123,500 | 124,500 |

| Raw material 9999 - HN | 109,300 | 110,300 |

| Raw material 999 - HN | 109,200 | 110,200 |

| 2. PNJ - Updated: August 17, 2025 17:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 123,500 | 124,500 |

| PNJ 999.9 Plain Ring | 116,600 | 119,500 |

| Kim Bao Gold 999.9 | 116,600 | 119,500 |

| Gold Phuc Loc Tai 999.9 | 116,600 | 119,500 |

| PNJ Gold - Phoenix | 116,600 | 119,500 |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 jewelry gold | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3. SJC - Updated: August 17, 2025 17:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 123,500 | 124,500 |

| SJC gold 5 chi | 123,500 | 124,520 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 123,500 | 124,530 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,600 | 119,200 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,600 | 119,100 |

| Jewelry 99.99% | 116,400 | 118,200 |

| Jewelry 99% | 112,529 | 117,029 |

| Jewelry 68% | 73,334 | 80,534 |

| Jewelry 41.7% | 42,244 | 49,444 |

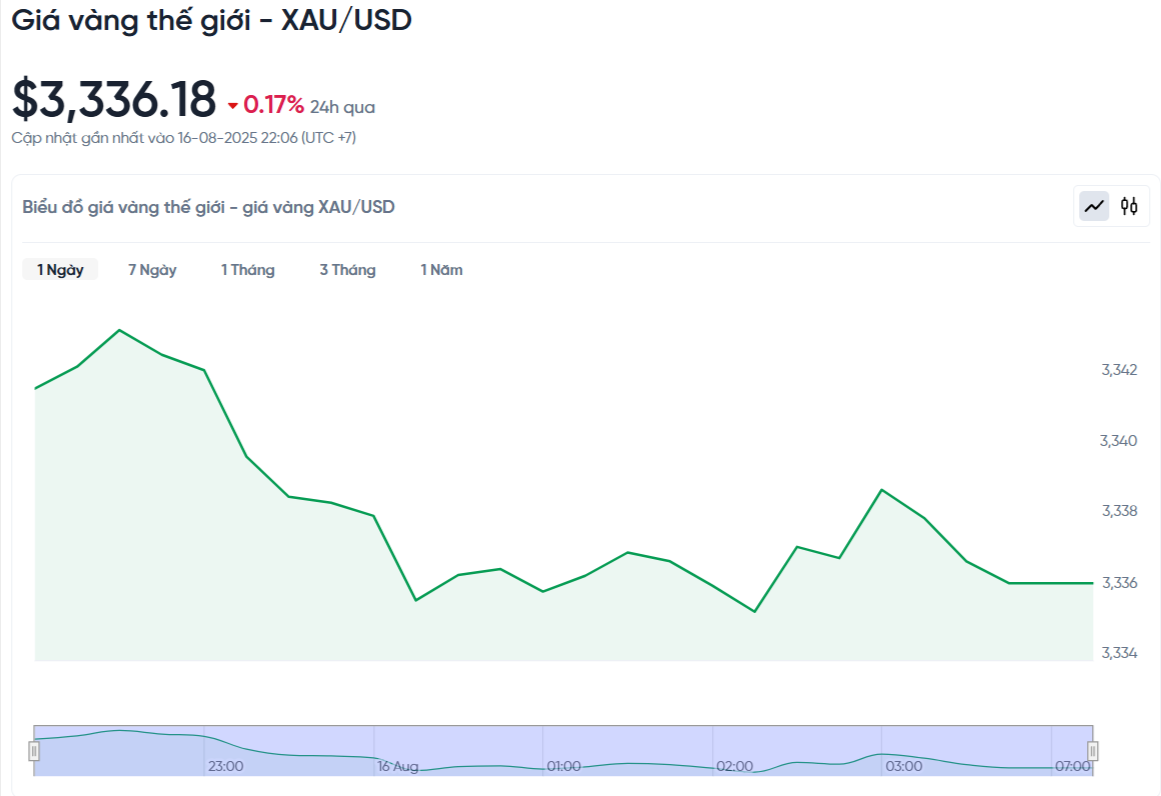

World gold price this afternoon August 17, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 p.m. on August 17, Vietnam time, was 3,336.18 USD/ounce. The gold price this afternoon decreased by 5.5 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,450 VND/USD), the world gold price is about 106.39 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.11 million VND/tael higher than the international gold price.

At Saigon Jewelry Company (SJC), the price of gold bars has increased to an all-time high, reaching VND124.5 million/tael for selling. The gap between buying and selling prices has narrowed to VND1 million/tael, lower than last week.

The price of SJC 4-9 gold rings has dropped sharply after a week. Although the domestic gold price has peaked, gold bar buyers still lost nearly 1 million VND/tael, while gold ring buyers lost up to 3.2 million VND because the difference between buying and selling prices remained at 2.5 million VND/tael.

Gold prices have struggled to regain some of their lost ground this week after last week’s tariff turmoil, but mixed consumer and inflation data have not been enough to entice investors to take fresh positions.

Spot gold started the week at $3,394.89 an ounce but quickly eased as the Swiss tariff saga continued to haunt the market. By Sunday evening US time, gold was down to $3,373 and on Monday morning it continued to fall below $3,350.

A brief recovery pushed gold back to $3,360 at the U.S. open, but the rally was short-lived. Shortly after the North American market closed, gold hit a short-term bottom around $3,340.

The following days saw gold prices fluctuate within a narrow range of around $30. The lowest was recorded at $3,335 on Tuesday morning, while the highest peak reached $3,367 after the CPI report was as expected on Wednesday morning.

Gold briefly crossed $3,370 on Wednesday evening but quickly fell back. When the July PPI report was released Thursday morning, gold was trading around $3,350.

A sharp rise in the producer price index has shaken expectations of a possible Fed rate cut in September, sending gold prices down to a weekly low of around $3,330 at midday on Thursday US time.

From that point until the end of the weekend trading session, gold prices fluctuated within a very narrow range of about $10. Retail sales reports and consumer confidence indexes had almost no significant impact on the gold market.

Gold Price Forecast

According to the latest survey from Kitco News, the majority of experts on Wall Street predict that gold prices will continue to move sideways in the near future. Meanwhile, the majority of individual investors remain optimistic that gold prices can increase.

Specifically, 10 experts participated in the Kitco News survey. The results showed that only 1 person expected gold prices to increase, 1 person predicted prices to decrease, and the remaining 8 people believed that gold would continue to fluctuate within a narrow range. From the perspective of retail investors, the results of the online survey with 183 votes showed that 63% (115 people) expected gold prices to increase, 18% (33 people) predicted a decrease, and 19% (35 people) thought prices would stabilize.

Adrian Day, chairman of Adrian Day Asset Management, said gold prices could fluctuate wildly depending on the outcome of the meeting between President Trump and Putin. However, if there are no surprises, gold is likely to rise slightly within its current range. He also said the market has already priced in the possibility of the Federal Reserve cutting interest rates in September, so more signals of flexible monetary policy are needed for gold prices to break out.

Colin Cieszynski, strategist at SIA Wealth Management, predicts gold prices will be little changed next week, unless there is an impact from the Jackson Hole conference, where central banks discuss monetary policy.

James Stanley, senior market strategist at Forex.com, said gold is in a support zone and could rise on expectations that the Fed will maintain a dovish monetary policy after the Jackson Hole conference. In the short term, the market will pay attention to July core inflation data and signals from the Jackson Hole conference from August 21-23.

Ole Hansen, head of commodity strategy at Saxo Bank, said the recent inflation data does not change the long-term bullish outlook for gold. He believes the Fed will have to strike a balance between controlling inflation and supporting economic growth.

Gold is currently trading in a $200 range around $3,350, but demand from ETFs remains strong, hitting a two-year high, suggesting the market still expects the Fed to ease policy and the risk of stagflation persists.

There will be little major economic data next week, so the market will focus on the Fed’s moves. Most notably, the minutes of the July FOMC meeting and Fed Chairman Jerome Powell’s speech at the Jackson Hole conference on Friday.

With a relatively light economic calendar next week, aside from preliminary PMIs and the Fed’s Jackson Hole conference, gold is likely to continue moving sideways. The surprise factor could come from geopolitical developments, although the Trump-Putin meeting is too late on Friday to have an immediate impact.

Source: https://baonghean.vn/gia-vang-chieu-nay-17-8-gia-vang-nhan-giam-manh-vang-mieng-lap-ky-luc-moi-10304610.html

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum and offer incense to commemorate Heroes and Martyrs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/17/ca4f4b61522f4945b3715b12ee1ac46c)

Comment (0)