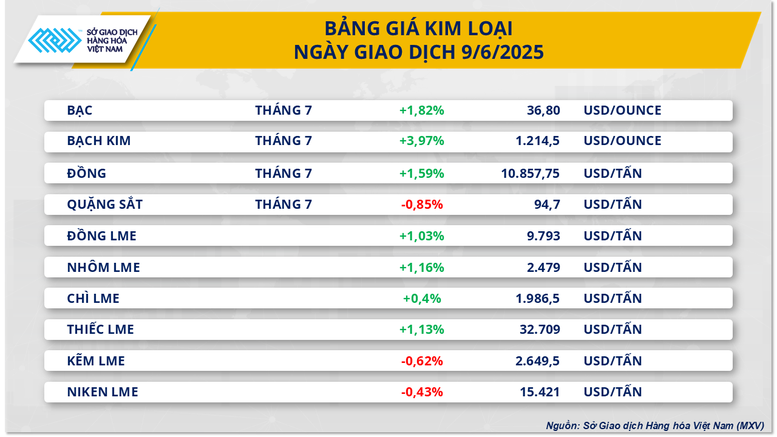

According to MXV, with 7/10 items closing in green, the metal group played a leading role in the upward trend of the entire market. The precious metal group stood out.

At the end of the trading session, silver prices set a more than 13-year high when they increased by 1.82% to $36.8/ounce. In addition, platinum prices also recorded their 6th consecutive increase, with 3.97% to $1,214.5/ounce, reaching the highest level since May 2021.

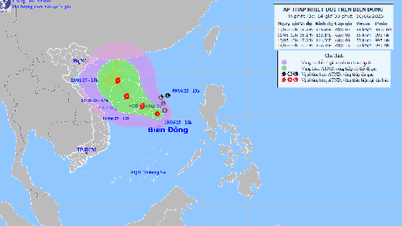

Senior US and Chinese officials began tariff talks in London on June 9. The two sides are seeking to restore the interim agreement reached in Geneva. However, Washington has accused Beijing of dragging its feet on commitments, particularly regarding rare earth exports.

Earlier in April, China suspended exports of many essential minerals, disrupting supply chains for the auto, aerospace, semiconductor and defense industries.

The talks in London come as both economies are under pressure. China’s exports to the US fell 34.5% in May from a year earlier, the sharpest decline since February 2020. In the US, consumer and business confidence have plummeted, with first-quarter GDP falling as imports surged as people rushed to buy before prices rose. The US labour market remains resilient, but experts predict the pressure will become more apparent in the summer.

The US and China are by far the leading consumer markets for silver and platinum - two metals widely used in industrial sectors, from clean energy to automobile manufacturing. The market expects that the resumption of negotiations between the two sides will open up opportunities to reach new trade agreements, contributing to promoting the recovery of industrial production and thereby strengthening the prospects for silver and platinum consumption in the coming time.

In the base metals group, contrary to the general trend of the group, iron ore prices continued to decrease by 0.85%, down to 94.7 USD/ton.

On the other hand, iron ore prices continue to be under pressure amid signs of slowing demand. According to the China Iron and Steel Association (CISA), during the period from May 21 to 31, the average daily crude steel output of large and medium-sized steel enterprises in China reached 2.1 million tons, down 4.9% compared to the period from May 11 to May 20.

In addition, China’s exports in May rose by just 4.8%, below expectations and down sharply from the previous month, reflecting the pressure from tariffs as well as weakening global demand. At the same time, the producer price index (PPI) fell 3.3% year-on-year, marking the steepest decline in 22 months. This development shows that increasing competitive pressure and weak demand are eroding factory profits, which could lead manufacturers to consider scaling back operations, further weakening demand for industrial metals.

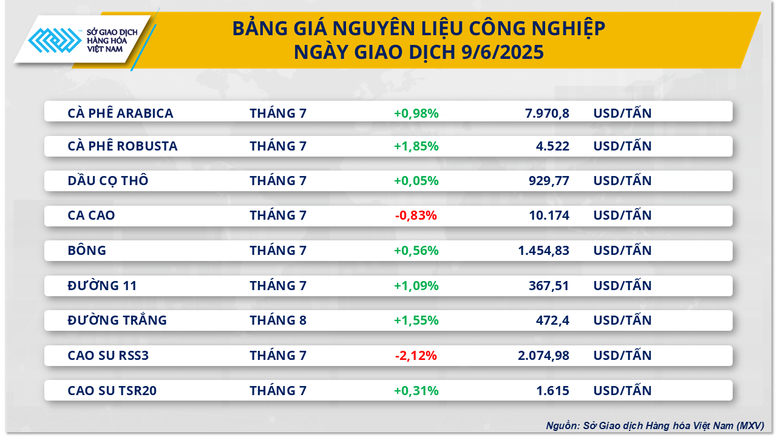

Robusta coffee prices recover strongly

At the close of yesterday’s trading session, the industrial raw material market recorded green spread across most key commodities. Of which, the price of Arabica coffee increased by 0.98% to 7,971 USD/ton while the price of Robusta coffee also increased by 1.85% to 4,522 USD/ton.

The rise in coffee prices was supported by the Brazilian real rising to an eight-month high against the dollar, which reduced the incentive for exporters to sell, thereby tightening supplies and supporting coffee prices.

In addition, statistics from the Brazilian Government show that coffee exports in May reached only 170,200 tons, down 30.5% compared to the same period last year; accumulated in the first 5 months of the year, down 13.1% compared to the same period. Limited domestic reserves have caused a significant decrease in export volume in the first months of this year.

Brazil’s 2025-26 coffee harvest has reached 28% of the planted area, but is still below the five-year average of 29%. Robusta harvest is estimated at 40%, down from 42% at the same time last year, while Arabica is at 21%, down slightly from 23% in the previous season.

Source: https://baochinhphu.vn/gia-kim-loai-quy-thiet-lap-dinh-moi-gia-ca-phe-dao-chieu-phuc-hoi-102250610085801723.htm

![[Photo] National Assembly Chairman Tran Thanh Man attends the State Audit Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/10/5813d32d61614c44a04f114ec3ecf35d)

Comment (0)