Update the latest coffee prices today June 25, 2025

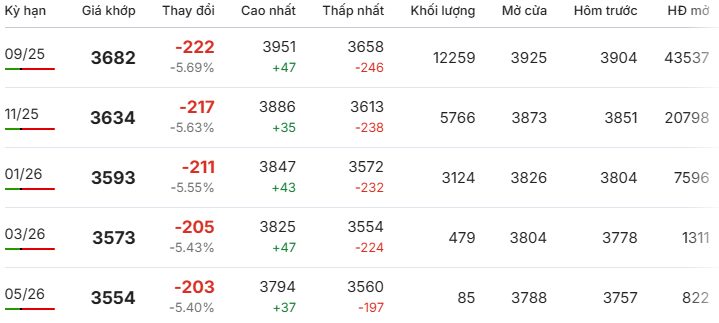

Robusta Coffee Price London June 25, 2025

According to the latest survey of Quang Nam Newspaper , today's coffee price in the trading session at 08:16 on June 25, 2025, robusta coffee price in the market continued to decrease, specifically:

September 2025 futures decreased by 222 USD/ton (-5.69%), down to 3,682 USD/ton.

November 2025 futures fell by USD 217/ton (-5.63%), to USD 3,634/ton.

January 2026 futures fell $211/ton (-5.55%), to $3,593/ton.

March 2026 futures fell $205/ton (-5.43%) to $3,573/ton.

May 2026 futures fell 203 USD/ton (-5.40%), to 3,554 USD/ton.

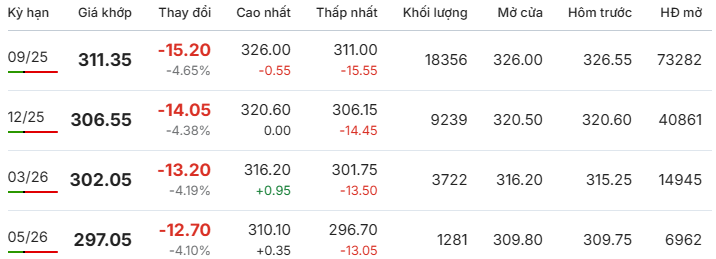

New York Arabica Coffee Price June 25, 2025

Similarly, at the New York Stock Exchange, Arabica coffee prices tended to decrease in the trading session at 08:17 on June 25, 2025, specifically:

September 2025 futures fell 15.20 cents/lb (-4.65%) to 311.35 cents/lb.

December 2025 futures fell 14.05 cents/lb (-4.38%) to 306.55 cents/lb.

March 2026 futures fell 13.20 cents/lb (-4.19%) to 302.05 cents/lb.

May 2026 futures fell 12.70 cents/lb (-4.10%) to 297.05 cents/lb.

The Arabica coffee market is also showing negative developments and needs to be closely monitored in the coming time.

Coffee prices are again in turmoil due to major fluctuations in the weather.

Coffee markets unexpectedly plunged after the latest weather forecasts eliminated the risk of frost in Brazil's key coffee growing regions such as São Paulo and Minas Gerais.

Meteorologists say the cold front moving into southeastern Brazil will not have a serious impact, even though the country supplies nearly 50% of the world's arabica and about 20% of its robusta.

Forecasts indicate that the cold snap will peak on Wednesday morning, but the risk to coffee crops is considered low. “We don’t see a significant threat to major growing regions,” said one European analyst.

Against this backdrop, Rabobank Netherlands has just released a report stating that global coffee demand could fall by 0.5% by 2025, mainly due to rising prices, forcing companies to pass on high inventory costs to buyers. Although green coffee prices have cooled from their peak, retail prices are still rising, causing demand in major markets such as Brazil and Germany to show signs of slowing.

Global coffee imports in the first quarter were down 7% from the previous quarter and 1.9% lower than the same period last year. In contrast, global coffee production is expected to reach 171.1 million bags in 2025–26, shifting from a deficit of 900,000 bags to a surplus of 1.4 million bags. Rabobank is also optimistic that supplies will improve further in 2026–27, thanks to the positive outlook from Brazil.

However, the decline in coffee prices has been somewhat tempered by the slower pace of the harvest in Brazil than last year. Cooxupé, Brazil’s largest coffee exporter, reported that as of June 20, only 24.3% of the crop had been harvested, compared to 34.2% a year earlier.

Additionally, robusta inventories tracked by ICE hit a five-week low of 5,126 lots on Tuesday (June 24), while arabica inventories also fell from a peak of 892,468 bags (May 27) to 865,898 bags as of the start of this week.

Source: https://baoquangnam.vn/ca-phe-gia-bat-ngo-roi-tu-do-boi-tin-tuc-ve-tinh-hinh-suong-gia-tai-brazil-khong-con-la-moi-lo-3157324.html

Comment (0)