According to a newly released report by Vietnam Investment Credit Rating JSC (VIS Rating) on the macro credit outlook for the second half of 2025, Vietnam's economy is expected to maintain stability thanks to three key factors: proactive fiscal policy, extensive administrative reform, and flexibility in responding to global risks.

VIS Rating assessed that the Government's continued push to increase infrastructure spending will create a significant boost for the business environment and strengthen investor confidence. At the same time, administrative reforms such as merging provincial administrative units (from August 15, 2025) and cutting 30% of administrative procedures at the central level will help remove bottlenecks, promote investment disbursement progress and resource allocation efficiency.

Important resolutions issued by the Politburo in May 2025, including Resolutions 57, 59, 66, and 68, are considered long-term strategic orientations, focusing on developing the private economy, green industry, high technology, and perfecting legal institutions. A series of policies such as tax incentives, capital support, and testing sandbox mechanisms for technological innovation are gradually coming into practice.

In the growth picture for the second half of 2025, VIS Rating believes that infrastructure, energy, technology and residential real estate sectors will become Vietnam's growth engines.

In particular, infrastructure construction and civil works benefit directly from public investment, especially in key transport and urbanization projects.

Residential real estate is recovering thanks to improved progress in legal reform, combined with real demand and credit policies targeting middle-income earners.

Energy is boosted by the green transition strategy, stable demand and newly approved power plans, while technology is the sector with high expectations as the Government increases support for innovative and high-tech startups.

On the contrary, export-dependent industries such as manufacturing, logistics, seaports and industrial parks are facing many risks.

According to VIS Rating, prolonged geopolitical tensions in the Middle East, the risk of rising oil prices, rising logistics costs, and especially the US's plan to re-apply reciprocal tariffs after July 9, 2025, will put considerable pressure on export competitiveness. However, this is also a driving force for Vietnamese enterprises to accelerate the process of self-sufficiency in production, market redirection, and enhancement of internal value chains.

Notably, the fact that export enterprises are actively shifting to the EU, ASEAN and non-US markets, along with measures to control origin fraud and reform trade regulations, is expected to help strengthen the resilience of the economy.

Overall, VIS Rating maintains a positive and stable view on the country's credit outlook in the second half of 2025. Although global challenges still exist, domestic reforms, flexible policy shifts and strategic shifts in economic structure will help Vietnam maintain sustainable growth and gradually improve the quality of its internal strength.

Source: https://doanhnghiepvn.vn/kinh-te/du-bao-4-nganh-dan-dat-tang-truong-kinh-te-nua-cuoi-2025/20250630052852165

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

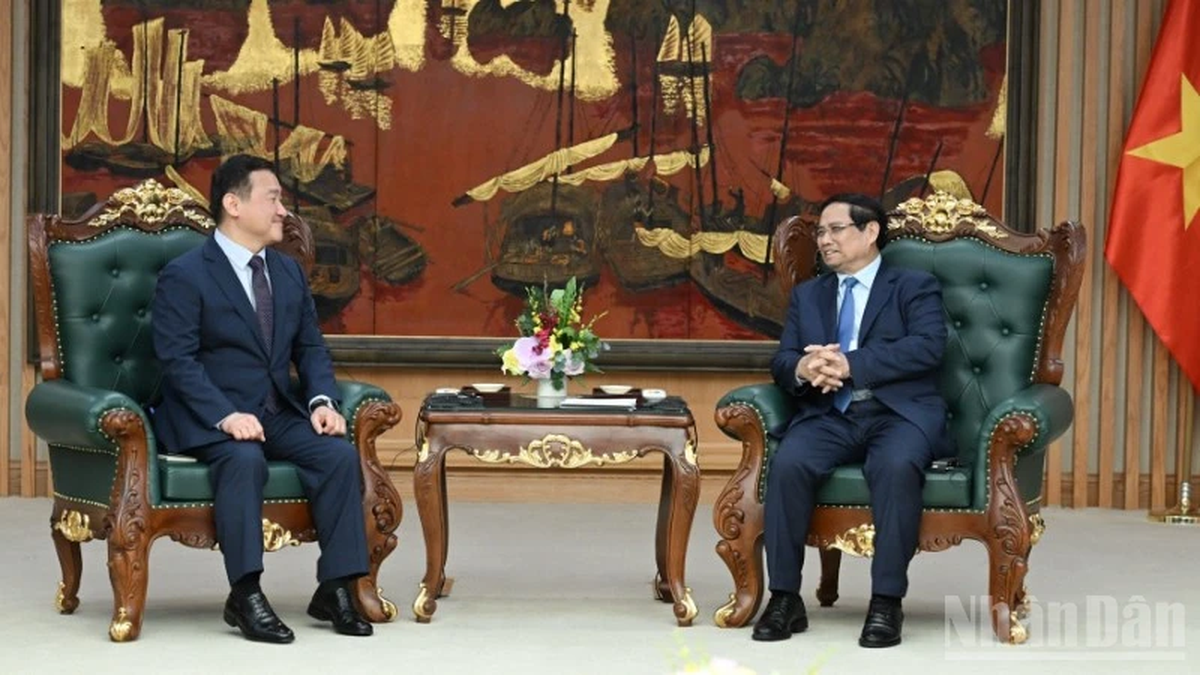

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)