Throughout 80 years of building and developing the country, the finance and banking sector has always played the role of a key capital channel, contributing to stabilizing the macro- economy , promoting production and business, and accompanying people and businesses to overcome many challenging periods.

From the early difficult days to the period of deep integration, banks have been the "blood vessels" that nourish the economy, creating momentum for sustainable growth.

|

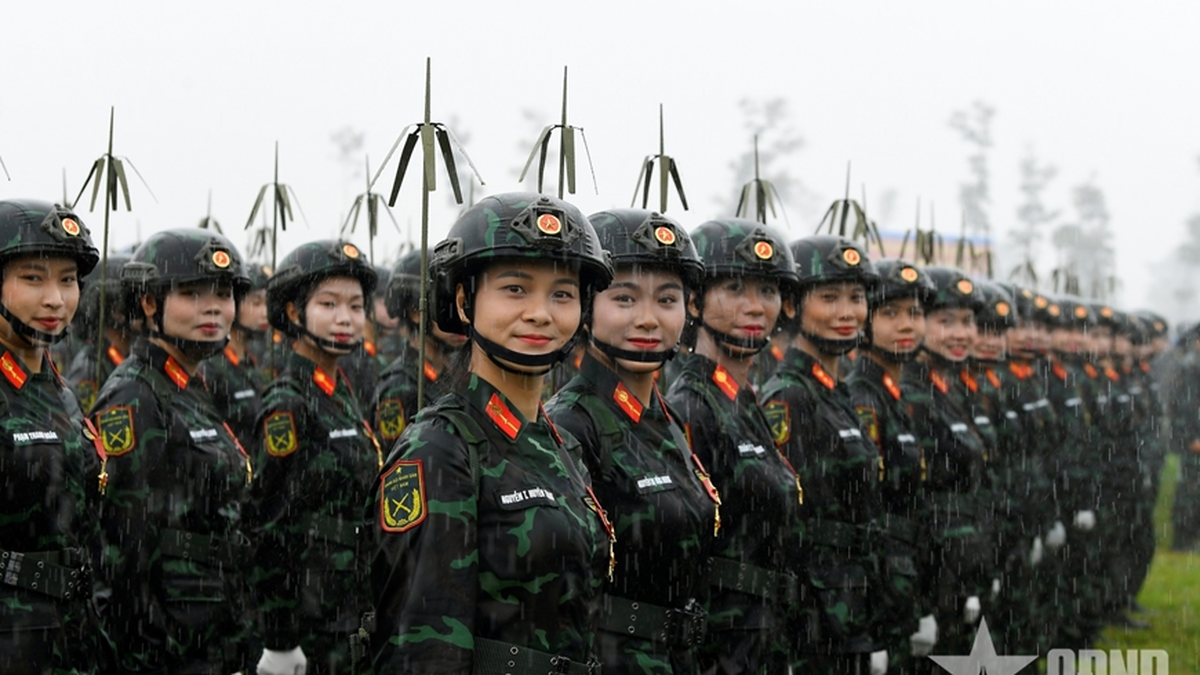

| Locally managed investment capital is the brightest spot, estimated at VND324.1 trillion, equal to 41.1% of the annual plan and a sharp increase of 29.4% over the same period last year. (Photo: Vietnam+) |

From this solid foundation, Vietnam is entering a new stage of development, with the goal of building an international financial center. Recent decisions by the Government and the Prime Minister show a strong determination to create a modern, transparent, attractive financial ecosystem that is deeply integrated with the world .

Aspiration to position Vietnam on the global financial map

Developing an international financial center is not only a resource mobilization strategy, but also an important step to position Vietnam in the global financial value chain.

With Resolution 222/2025/QH15 of the National Assembly on the International Financial Center in Vietnam and the Action Plan recently issued by the Government, Vietnam officially entered the stage of realizing the vision of building an International Financial Center in Ho Chi Minh City and Da Nang.

A National Steering Committee headed by Prime Minister Pham Minh Chinh has been established, aiming to form and put these centers into operation by the end of 2025.

According to Associate Professor Dr. Nguyen Thuong Lang, Senior Lecturer at the National Economics University, the emergence of the International Financial Center is a signal of the maturity of the Vietnamese financial system, reflecting the stability of the economy and the confidence of the banking system, as well as the forces involved in researching, operating and developing this system. More importantly, this is an opportunity to reduce capital pressure on the banking system, opening up a new channel of mobilization from the international market.

Associate Professor Dr. Pham Thi Hoang Anh, Deputy Director in charge of the Board of Directors of the Banking Academy, also emphasized that the International Finance Center will gather many large banks in the world, investment funds and leading financial companies. “With this scale, capital flows will circulate more flexibly between domestic regions and between Vietnam and the world, promoting trade, investment and sustainable development,” Ms. Hoang Anh commented.

In the International Financial Center ecosystem, the banking industry plays the role of both institutional architect and operating force.

According to Associate Professor Dr. Pham Thi Hoang Anh, when establishing the International Financial Center, the State Bank will be the pillar in establishing a stable legal framework for the operation of the International Financial Center, from regulations on currency, foreign exchange, payment to ensuring the safety of the banking system in the context of deep integration into the international capital market.

From another perspective, Associate Professor Dr. Nguyen Thuong Lang believes that banks must be the “pioneers”, leading the financial system to integrate internationally with depth and high efficiency; taking advantage of global financial technology advances, quickly applying them to new conditions, thereby building a modern financial system.

To effectively attract international financial institutions to the International Financial Center, Associate Professor Dr. Nguyen Thuong Lang said that the prerequisite is that Vietnam's legal system needs to be clear, coherent, attractive, consistent with international practices, and proactive.

In addition, high transparency, compliance with market principles and meeting international credit standards are required. In addition, quality human resources are needed, capable of operating and developing the market.

Capital pillar of the economy

|

| In July alone, total state budget revenue is estimated at 242.1 trillion VND. (Photo: Vietnam+) |

Looking back over the past 80 years, the banking industry currently meets 60-70% of the economy's capital needs, especially in priority areas such as agriculture and high technology, thereby both promoting growth and ensuring sustainable development.

Recently, credit growth across the system has been positive. The latest update from the State Bank shows that credit across the system as of the end of 7 months increased by about 10% compared to the end of 2024. The lending interest rate level continues to decrease, creating favorable conditions for production and business.

This result was achieved thanks to the efforts of both the State Bank and commercial banks, creating conditions for businesses and people to expand production and business.

Mr. Le Ngoc Lam, General Director of the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), said that in 7 months, BIDV has reduced its income by about 3,000 billion VND to lower lending interest rates, helping businesses and people reduce capital costs.

Similarly, at Tien Phong Commercial Joint Stock Bank (TPBank), Deputy General Director Nguyen Viet Anh shared that the bank has diversified its mobilized capital sources, increased the mobilization of non-term capital (CASA) and other mobilized capital investment sources, including foreign capital to thicken its capital base and thereby gradually lower the mobilized interest rate level. This is also an important condition to help reduce interest rates for businesses and people.

On the management side, Deputy Governor of the State Bank Pham Thanh Ha emphasized that in the coming time, monetary policy will continue to aim at macroeconomic stability, controlling inflation and improving credit efficiency. The State Bank requires credit institutions to seriously stabilize input interest rates, strive to reduce lending interest rates, contributing to economic recovery and development.

Vietnam's banking and finance sector has proven its mettle through the most difficult times, from the global financial crisis to pandemics and economic fluctuations.

With the determination of the Government, the support of the banking system and efforts to improve the business environment, the goal of building an international financial center in Vietnam is not only a long-term vision, but is gradually becoming a reality - opening a new, extensive and sustainable development phase for the Vietnamese economy.

According to VNA/Vietnam+

Source: https://baoquangtri.vn/kinh-te/202508/dinh-vi-viet-nam-trong-chuoi-gia-tri-tai-chinh-toan-cau-41961b9/

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum and offer incense to commemorate Heroes and Martyrs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/17/ca4f4b61522f4945b3715b12ee1ac46c)

Comment (0)