Proprietary trading is an activity in which a securities company uses its own money to buy and sell securities for the purpose of making a profit - Photo: QUANG DINH

After a period of strong adjustment due to the US tariff shock in the first quarter of 2025, the Vietnamese stock market has recovered strongly, with many companies in this field reporting large profits.

Securities industry records profits

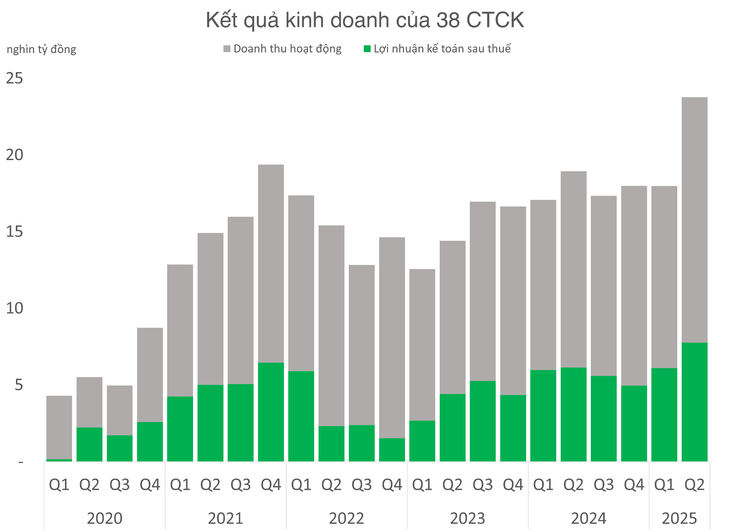

According to statistics from nearly 40 large and small securities companies , the total operating revenue in the second quarter of 2025 reached about 23,800 billion VND, of which the estimated after-tax profit was approximately 7,700 billion VND. These are all new record numbers for the securities industry.

Data: Financial statements

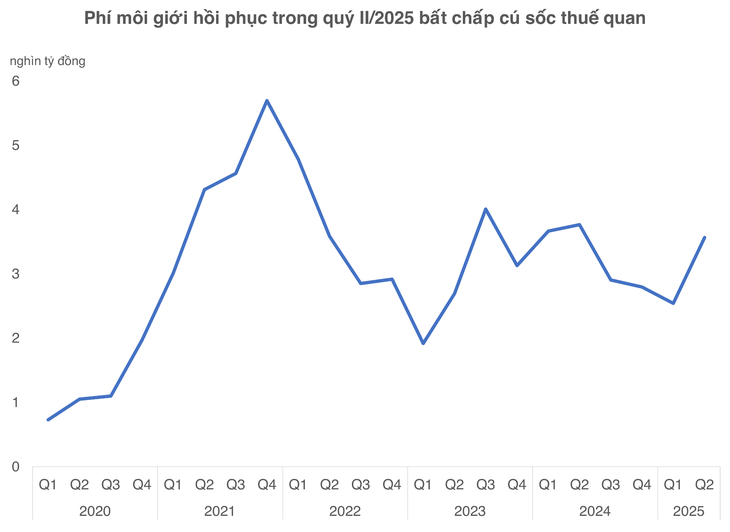

One notable point is that brokerage transaction fees have started to grow again after several consecutive quarters of decline.

Data: Financial statements

According to Mr. Nguyen The Minh - Director of individual customer analysis at Yuanta Vietnam Securities - brokerage fees have improved, but many companies are still making almost no profit and even suffering losses.

Meanwhile, margin lending rates have improved compared to previous quarters. The return of individual investors is the driving force behind margin lending rates.

In fact, the growth rate of interest on loans was better than the growth rate of outstanding loans in the last quarter. "Individual investors, not institutional deals, are the driving force of outstanding loan growth," Mr. Minh commented.

If margin deals are often associated with large organizations, "big guys" with the ability to bargain for low interest rates, then the decrease in this ratio can be inferred from the sharp increase in lending activities to individual investors. The advantage of lending to this group is that the profit margin will be better.

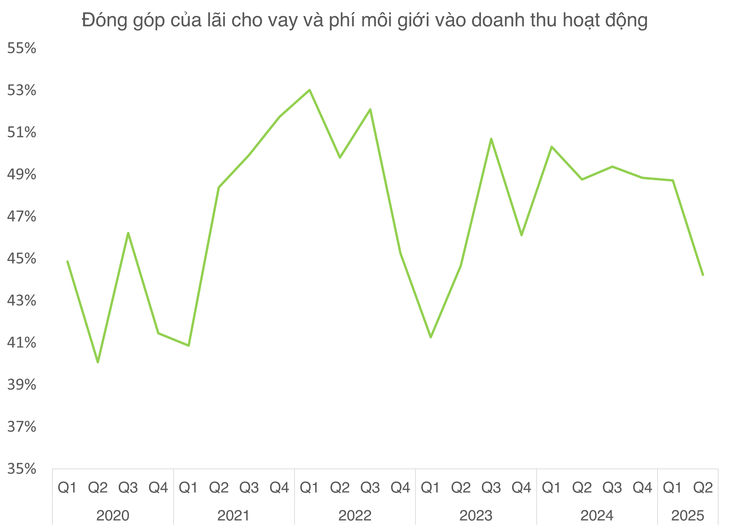

Brokerage fees and lending interest grew positively, but their contribution to operating revenue decreased sharply in Q2-2025.

Despite the recovery, the increasingly fierce competition between securities companies is still great. And many places are forced to find ways to preserve operational efficiency.

Self-employment becomes the spearhead of profit

In the second quarter of 2025, HSC Securities had an impressive "bottom-fishing" quarter when it disbursed thousands of billions of VND into codes such as TCB, MWG, HPG... right when the market was strongly adjusting and making a slight profit.

HSC's stock trading portfolio increased by about VND1,400 billion, bringing the total value to more than VND3,545 billion.

In the context of outstanding loans being limited to around VND20,000 billion due to the unfinished capital increase, the strategy of promoting self-trading helps HSC maintain business performance.

The most prominent stock in the portfolio is TCB, which HSC bought for nearly VND1,200 billion, bringing the total holding value to VND1,211 billion. FPT , a stock that was mostly sold in the first quarter, was also bought back for more than VND870 billion in the second quarter.

Other bluechips such as MWG, STB and HPG also increased their weight in the stock trading portfolio, with additional investment values of VND367 billion, VND358 billion and VND240 billion, respectively. Most of these trading positions are making a slight profit as of the end of the second quarter of 2025.

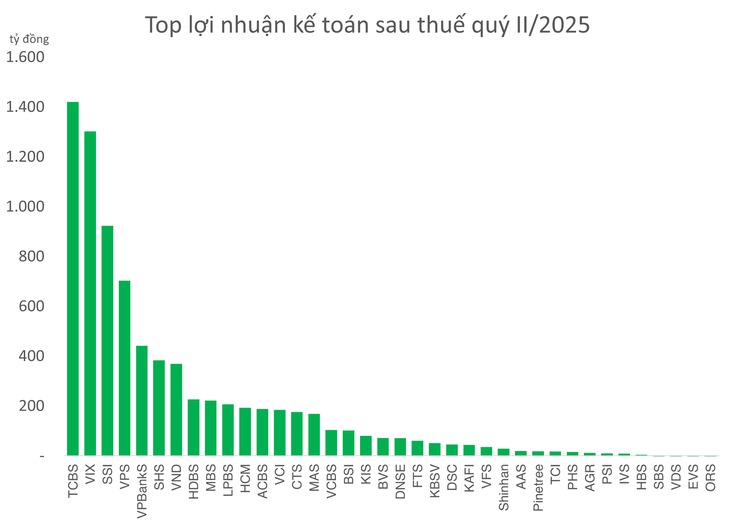

But when it comes to self-trading, VIX Securities is the most typical example. In the second quarter, this company recorded a profit after tax of more than 1,300 billion VND, an increase of 951% compared to the same period, and for the first time, a profit of 1,000 billion VND.

Of which, profit from proprietary trading activities (FVTPL) alone reached over VND 1,700 billion, accounting for over 80% of operating revenue, with an impressive gross profit margin of over VND 1,400 billion.

The surge in the proprietary portfolio helped VIX report profits approximately equal to TCBS Securities while surpassing SSI and VPS.

CTS Securities also increased its profit by more than 8 times thanks to the large contribution of proprietary trading activities from stocks such as VSC, EIB, VPB, VIX...

However, switching to self-trading is not a "magic wand". Long-term holding can force securities companies to record losses, as in the case of Dragon Viet Securities (VDSC) with nearly VND7 billion in the second quarter.

Back to topic

Learn Humility

Source: https://tuoitre.vn/cong-ty-chung-khoan-rot-ngan-ti-mua-co-phieu-lo-dien-loat-3-chu-cai-hut-dong-tien-2025072512380525.htm

![[Photo] Signing of cooperation between ministries, branches and localities of Vietnam and Senegal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/24/6147c654b0ae4f2793188e982e272651)

Comment (0)