BSI's P/E valuation is up to 29.54 times

When the stock market is excited, cash flow is widespread and liquidity remains high, the group of securities stocks is expected to benefit directly from the market liquidity explosion and margin debt increases to a record level.

Statistics at 30 major securities companies as of June 30, 2025, the total outstanding loans reached more than VND 284,000 billion (at the end of 2022 it was only VND 109,126 billion). This is a record number, an increase of about VND 20,000 billion compared to the end of the first quarter of 2025.

Thanks to the market boom, from June 23 to August 14, BIDV Securities Joint Stock Company (code BSI) shares jumped 25.5%, from VND40,250/share to VND50,500/share, liquidity increased by more than 50% compared to the previous period. With the rapid increase in a short time, as of August 14, BSI shares were trading at a P/E valuation of 29.54 times, higher than the industry average (19.33 times); P/B valuation was 2.23 times, higher than the industry average (1.64 times).

It should be added that in 2017, 2018 and 2021, BSI shares only traded at a P/E of less than 10 times. Normally, the average for the stock group is 10 - 15 times.

Thus, after the recent hot increase, BSI shares are trading at a valuation that is no longer cheap compared to the industry and market average, as well as compared to the stock itself in the past.

As of June 30, 2025, BIDV Securities Joint Stock Company owns total assets of approximately VND 14,847.3 billion. Of which, VND 6,606 billion is recorded as loans, accounting for 44.5% of total assets; VND 5,727.3 billion are financial assets recorded through profit/loss, accounting for 38.6% of total assets; VND 1,577.1 billion are investments held to maturity, accounting for 10.6% of total assets.

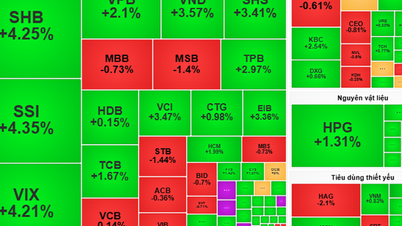

BIDV Securities Joint Stock Company said that, in addition to margin loans, the Company is promoting its proprietary trading activities, by investing VND 1,821.3 billion in unlisted bonds; VND 1,684.57 billion in listed bonds; VND 109.1 billion in Hoa Phat Group shares (code HPG); VND 79.2 billion in VPBank shares (code VPB); VND 67.96 billion in Vinh Hoan Joint Stock Company shares (code VHC); VND 58.1 billion in Phan Vu Investment Joint Stock Company shares...

In the first half of 2025, BIDV Securities' revenue structure recorded VND 434.07 billion from margin lending interest and brokerage activities, accounting for 51.5% of total revenue; VND 315.15 billion in interest from financial assets recorded through profit/loss, accounting for 37.4% of total revenue.

Thus, with the proprietary trading portfolio accounting for 38.6% of total assets, and margin lending for securities investment accounting for 44.5% of total assets, BIDV Securities has maintained and continues to maintain the majority of assets directly related to market developments. In addition, in the first 7 months of the year, when the stock market was favorable, BIDV Securities' business performance also showed positive results, contributing to further support expectations of boosting stock prices to maintain a strong upward momentum.

“Measure” the level of attractiveness

Securities stocks are cyclical, rising rapidly with the market, but when the market turns around, they may be the first group to be affected. Because when the market reverses, the trend of using margin for investment will decrease, thereby affecting the interest from lending activities.

For BIDV Securities, in 2022, the Company recorded a decrease in revenue of 18.3%, to VND 1,089 billion; profit after tax decreased by 68.5%, to VND 112.37 billion. Of which, brokerage revenue decreased by 32.5%, to VND 348.76 billion; profit from financial assets recorded through profit/loss decreased by 23.5%, to VND 297.16 billion.

Mr. Lam Van Van, representative of ECI Capital Investment Fund, commented: “Securities companies have the characteristic of ‘following’ the stock market cycle, so when the market increases, they will benefit; on the contrary, when the market decreases, business performance may decline, due to loss of brokerage fees, reduced margin interest and having to set aside additional provisions for proprietary trading activities.”

Returning to BIDV Securities' business performance in the first half of 2025, although the stock price increased and traded at a valuation that was no longer cheap, the company's profits still declined. At the end of the first half of 2025, BIDV Securities recorded a 9.8% increase in revenue, reaching VND 843.61 billion, but net profit decreased by 27.4%, reaching only VND 183.01 billion.

Thus, although the stock market is still anchored at a high price range and the valuation of the securities group is still "expensive", this valuation level is no longer attractive to investors, especially when BSI shares are trading at a valuation of up to 29.54 times.

Source: https://baodautu.vn/co-phieu-bsi-tang-nong-cung-con-sot-chung-khoan-d362338.html

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

Comment (0)