After a sharp drop of more than 64 points to 1,493 points on July 29, the VN-Index quickly recovered, closing the trading session on July 30 at 1,507 points, up more than 14 points. This development, according to analysts, is not beyond expectations in the context of the market having had a long streak of increases.

Stock investment opportunities exceed 1,500 points

Speaking at the talk show "Stock market continuously hits new peaks: Opportunities and risks?", organized by Nguoi Lao Dong Newspaper on the same day, Mr. Le Huu Thoai, Director of Online Customer Department of Rong Viet Securities Company (VDSC), said that the market has had an impressive growth streak after the adjustment due to the tariff factor.

"The VN-Index bottomed out around 1,075 points, then recovered strongly and has now increased by about 45%, a very impressive figure. This development is supported by positive factors such as positive trade negotiations, credit promotion policies and especially the business results in the second quarter of 2025 of listed enterprises are gradually improving," said Mr. Thoai.

Not only in the index, market liquidity also recorded an explosion. Trading sessions with a value of 2-3 billion USD continuously appeared. On July 29, the total matched value of the entire market reached more than 76,000 billion VND - a record number in the history of Vietnam's stock market. For experienced investors, this is a signal that the market is strongly attracting cash flow and opening up great opportunities in the long term.

However, that does not mean that investors can be subjective. Mr. Vo Diep Thanh Thoai, Head of Senior Client Department at DNSE Securities Company, said that correction sessions are inevitable in an upward trend. "Investors need to prepare a strong mentality to "stay" with the market.

We have witnessed many explosive trading sessions with stocks hitting ceiling prices in series, like the session on April 10. But instead of following market forecasts of increase or decrease, let's focus on the stock portfolio and specific investment strategy" - Mr. Thanh Thoai expressed his opinion.

According to this expert, these corrections are the golden time to restructure the portfolio and optimize profits in the medium and long term. Keeping good stocks through the corrections will help investors take advantage of the big waves in the near future.

From a macro perspective, Mr. Truong Dac Nguyen, Investment Director of Blue Horizon Financial, assessed that one of the important factors driving strong cash flow into the market is the prospect of upgrading Vietnamese stocks from frontier to emerging.

"This is a factor that can create great attraction for foreign capital, which is known for being quick and always ahead of the trend. If the upgrade is successful, Vietnam will have more opportunities to attract foreign capital, while affirming its position on the global financial map," Mr. Nguyen commented.

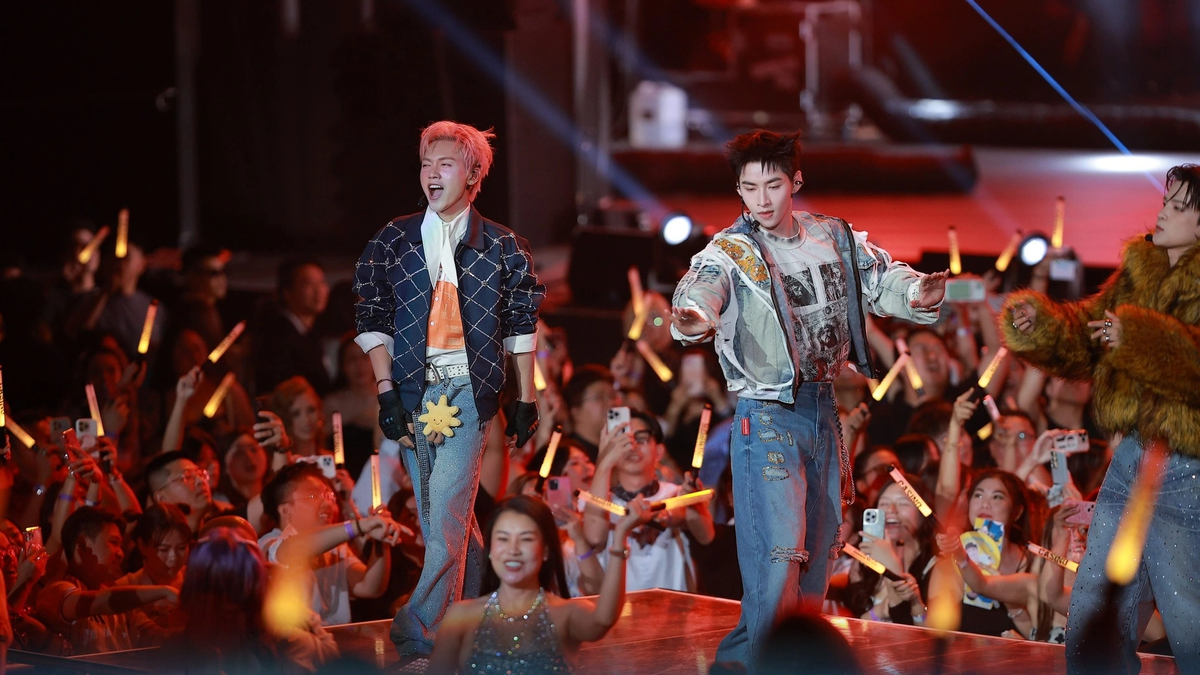

Speakers and guests participating in the talk show of Nguoi Lao Dong Newspaper on July 30. Photo: Tan Thanh

Lessons from foreign investors

Regarding the recent continuous net buying and net selling by foreign investors, which has caused the market to increase rapidly and then decrease sharply, Mr. Le Huu Thoai said that investors should not rely too much on the movements of foreign investors when making investment decisions.

"Many investors consider foreign investors as a leading indicator, but we need to have an objective view. In the first 6 months of the year, they net sold about VND40,000 billion, but by early July they were net buyers of VND11,000 billion. So, overall, foreign investors are still net sellers, but the VN-Index is still increasing strongly, continuously reaching new peaks. That shows that they are just a group of investors in the market and their actions are more for reference than a guideline," Mr. Thoai analyzed.

Regarding the prospect of upgrading the market, Mr. Thoai said that this is a factor that can change the game in the medium and long term. "Vietnam is facing many positive signals to be upgraded to an emerging market. At that time, foreign institutional capital will be forced to reconsider their strategies and review their investment portfolios. The question is where will they put their money? And which listed companies have the quality to attract them?" - he asked.

In that context, domestic investors can proactively learn from the behavior of foreign investors, instead of being swept away by them. "Ask the question: If they are upgraded, what stocks will they buy? And are those stocks already in your portfolio?" - this expert emphasized.

This view was agreed upon by Mr. Vo Diep Thanh Thoai. He said that foreign money is not called "smart money" for no reason. When the VN-Index was still in the 1,280 - 1,300 point range, foreign investors started buying strongly. When the market reached 1,400 points, they continued to net buy another 11,000 billion VND in just 2 weeks, showing a very high intensity and determination. "At that time, some people even thought that foreign investors were "buying at the top". But what is the reality? Now the VN-Index has surpassed the 1,500 point mark and that proves that foreign money is still very sensitive and strategic" - Mr. Thanh Thoai said.

Therefore, according to him, the problem is not only what foreign investors are doing but also how domestic investors react. He believes that instead of focusing too much on milestones like 1,400 or 1,500 points, which can easily create a feeling of "high or low", investors should return to the "bigger picture".

What is the market potential from now until the end of the year? Is the macro policy favorable? Is credit flow, tax management, and GDP growth enough to support the market? "There is no shortage of opportunities in the stock market, the important thing is whether investors have a clear strategy to manage profits and control risks" - Mr. Thanh Thoai emphasized.

Forecasting the market in August, when the second quarter business results reporting season has ended; while August 1 is the time when the US tariff policy with other countries will take effect, Mr. Vo Diep Thanh Thoai said that the "painful memory" in April related to tariffs could cause investors to temporarily stop trading to wait and see. "Sensitive macro stories, caution is necessary but still need a long-term perspective" - Mr. Thoai said.

Another risk pointed out by Mr. Truong Dac Nguyen is that the business results of the second quarter of the company are not as good as expected. "Equally important is that the USD/VND exchange rate has increased by about 3.5% since the beginning of the year. If from now until the end of the year, the exchange rate cools down, it could cause foreign investors to stop net selling, attracting more FDI capital" - Mr. Nguyen said.

Promote upgrading solutions

At the seminar "Upgrading the stock market to expand capital mobilization channels for the economy" organized by the State Securities Commission in coordination with Lao Dong Newspaper on the same day, Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, said that the Ministry of Finance and the commission are urgently reviewing and proposing amendments to many legal documents to remove bottlenecks, meet the criteria of international organizations, and aim to upgrade Vietnam's stock market from frontier to emerging by 2025.

Currently, Vietnam's stock market has more than 10 million investors, with liquidity among the highest in the region, surpassing many markets that have been developed for decades. According to Ms. Pham Thi Thuy Linh, Head of the Stock Market Development Department (State Securities Commission), the Ministry of Finance has met all 9 criteria set by the rating organization FTSE Russell. However, to be upgraded, Vietnam needs more positive feedback from foreign investors. Therefore, the State Securities Commission is promoting solutions to create favorable conditions for institutional investors to access and participate in the market.

In addition, the operation of the KRX trading system is expected to help deploy modern mechanisms such as central clearing partner (CCP), intraday trading, new derivative products and pending securities trading, important factors helping the Vietnamese stock market approach international standards.

Despite his optimism, Mr. Pham Luu Hung, Chief Economist and Director of the Center for Analysis and Investment Consulting - SSI Securities Company, noted that the upgrade also comes with many challenges. He cited some countries such as Pakistan, UAE or Greece that did not meet expectations after the upgrade. Therefore, Vietnam needs to continue to reform the capital market both before and after the upgrade. Mr. Hung proposed to study the loosening of listing conditions to create opportunities for startups and technology enterprises to enter the market, thereby promoting the depth and quality of the stock market.

M.Chien

Source: https://nld.com.vn/chung-khoan-vuot-1500-diem-tinh-tao-nam-bat-co-hoi-196250730212651663.htm

Comment (0)