Closing session on July 30, VN-Index closed at 1,507 points

After a strong shake-up on July 29, the Vietnamese stock market recorded a positive signal right at the opening of the session on July 30 with the VN-Index increasing by nearly 9 points. Although there was a time when it was struggling around the reference level, the bottom-fishing demand and the leadership of banking stocks quickly brought the market back to green. In addition to banking, cash flow also poured into sectors such as securities and some prominent stocks such as GEX and VSC. However, selling pressure increased in the last 30 minutes of the morning session, along with the red from VIC and VHM, causing the VN-Index to reverse and decrease slightly.

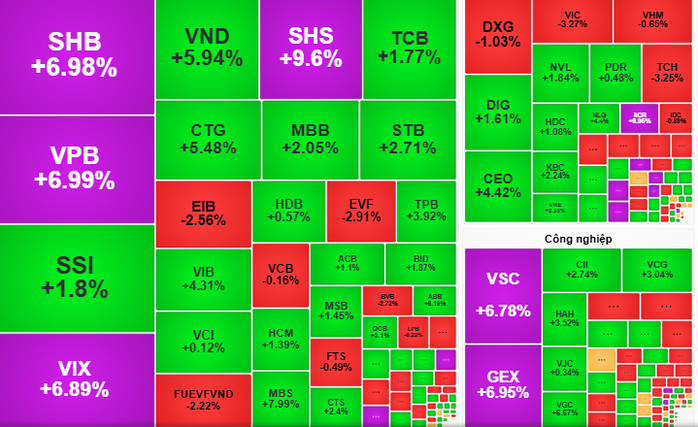

Entering the afternoon session, the market continued to fluctuate around the reference level before bouncing back. The banking group continued to play a pivotal role with SHB , VPB hitting the ceiling price (7%), CTG increasing by 5.48%. Mid-cap stocks were equally exciting as DPM increased by 4.8%, HSG increased by 5%, while VIX, HHS, VGC, VSC all wore purple (increased to the ceiling price). Statistics showed that the market had 223 stocks increasing and 111 stocks decreasing, reflecting strong cash flow. Notably, foreign investors switched to net buying with a value of VND 872.8 billion, focusing on FUEVFVND, SHB and VIX.

At the end of the session, VN-Index closed at 1,507 points, up 14 points (+0.95%).

According to Vietcombank Securities Company (VCBS), VN-Index may need more time to test the momentum at the 1,500-point mark, so a tug-of-war in the session on July 31 is inevitable.

VCBS emphasized that the banking group, which accounts for a large proportion in the VN-Index basket, was the main driving force behind the recovery session on July 30. Bottom-fishing cash flow also spread to many other sectors, creating opportunities for investors. However, in the context of the market still having potential fluctuations, investors should select stocks showing signs of recovery from the support zone to disburse in parts, in order to optimize opportunities and minimize risks.

Some other securities companies believe that the momentum from the banking group may still be strong. Therefore, the VN-Index is likely to maintain green, but profit-taking pressure in the 1,500-1,510 point range will cause the market to continue to fluctuate. Investors need to closely monitor leading stocks such as SHB, VPB, CTG and some prominent mid-cap stocks to make appropriate trading decisions.

Source: https://nld.com.vn/chung-khoan-ngay-mai-31-7-co-phieu-ngan-hang-co-tiep-tuc-dan-song-196250730184608498.htm

Comment (0)