Experts predict VN-Index will head towards the resistance zone of 1,398 - 1,418 points this new week - Photo: AI drawing

Stocks fluctuate with a lot of information

• Mr. Truong Hien Phuong - Senior Director of KIS Vietnam Securities:

- In the short term, the following three factors are considered to have the greatest impact on market sentiment and trends. First, July 9 is the deadline for the US to decide on tariff issues for countries that have not reached a trade agreement.

For Vietnam, many forecasts indicate that the expected tax rate will be below 46%, possibly around 20-25%. If at this level, although still high, it will still help reassure investors.

Second, after a lull, investors are closely watching developments in the conflict between Israel and Iran. An escalation could send oil prices soaring and lead to cost-push inflation. However, the latest news suggests that the geopolitical situation is showing signs of improvement. Third, global markets are awaiting the Fed’s decision on whether to cut, hold or raise interest rates.

Domestically, the second quarter business results are the awaited factor. If positive, combined with favorable international information, market sentiment will be excited and liquidity will improve. On the contrary, if international factors develop negatively, positive business results will not be enough to create a big impact.

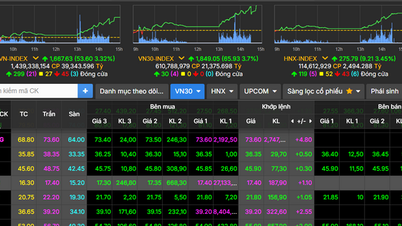

In addition, the VN-Index has continuously set new peaks this year and may reach 1,400 points this week. Although the index has increased, this does not fully reflect market developments.

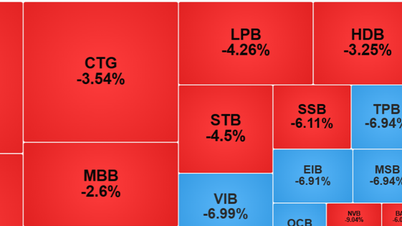

Most of the increase came from large-cap stocks in the VN-Index basket, while many other stocks have not returned to their old peaks, causing many investors to still suffer losses.

Technically, the psychological threshold of 1,400 points is often a strong resistance level, which can create a correction. However, with a positive domestic and international macro context, combined with expectations of market upgrade, the possibility of VN-Index surpassing this threshold is considered higher than in previous cycles.

Abundant liquidity stimulates cash flow

* Mr. Bui Van Huy - Director of Investment Research FIDT:

- The recent strong increase mainly comes from positive cash flow and investors' FOMO psychology. It is worth noting that the market's recent breakthrough has had significant contributions from large stocks such as Vingroup (VIC, VHM, VRE) and GEX...

The increase in these pillar stocks has created a ripple effect, leading to positive sentiment for the entire market. In addition, the fact that US stock indexes such as the S&P 500, Dow Jones, and Nasdaq continuously surpassed historical peaks has created a positive atmosphere globally.

In the short term, the market is still likely to continue its upward trend, especially as second quarter business results are gradually being revealed and many businesses may have positive reports.

However, the market growth relying heavily on a few large stock groups also has potential risks. If these groups face correction pressure, the overall market may also be affected.

At the 3-year peak, I think profit-taking pressure will increase. The market may witness some fluctuations or slight corrections to retest support levels. This is a completely normal and necessary development for the market to absorb supply pressure, creating momentum for more sustainable growth.

If the State Bank maintains low interest rates and ensures abundant liquidity for the economy , this will be the strongest "stimulating" factor. Low capital costs not only promote production and business activities but also increase the attractiveness of financial investment channels in general and securities in particular.

Noteworthy stocks

* Ms. Nguyen Phuong Nga - analyst at Vietcombank Securities (VCBS):

The market moved sideways in the 1,360-1,370 range during the week with differentiated movements among industry groups.

We recommend that investors prioritize short-term investment strategies during this time, continuing to hold stocks that are in good growth momentum in their portfolios.

At the same time, consider exploratory disbursement in stocks in industry groups that attract cash flow movements or have information support with convincing signals of consolidating support zones or successfully overcoming resistance.

Some notable groups include retail, real estate - industrial parks, securities, public investment - construction and import-export.

Source: https://tuoitre.vn/chung-khoan-lap-dinh-tien-ve-1-400-diem-loat-thong-tin-nha-dau-tu-can-chu-y-2025063010241129.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Many people eagerly await the preliminary review despite heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/4dc782c65c1244b196890448bafa9b69)

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/27/a79fc06e4aa744c9a4b7fa7dfef8a266)

Comment (0)