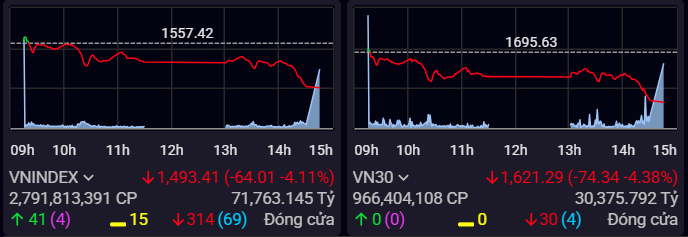

Immediately after the record session at 1,557.42 points on the occasion of the 25th anniversary (July 28), the Vietnamese stock market suddenly plummeted when the VN-Index lost 64 points (-4.11%), closing at 1,493.41 points today (July 29). In other words, all the "efforts" in the previous week of the largest index of the Vietnamese stock market "disappeared".

At the Hanoi Stock Exchange, the two indices HNX-Index and UPCoM-Index also decreased slightly, down to 255.36 points (-3.2%) and 106.07 points (-0.81%), respectively.

The notable point in today's session comes from the record high liquidity of the Vietnamese stock market, reaching 71,760 billion VND (far exceeding the old record set yesterday at 46,700 billion VND) due to the "dumping" action of investors.

The "red hot" state quickly spread throughout the market. On the HOSE floor alone, all 11 industry groups decreased with 314 stocks decreasing (of which, 69 stocks "hit the floor"), 41 stocks increasing (of which, 4 stocks "hit the ceiling") and 15 stocks remaining unchanged.

"Profit-taking" pressure appeared from the morning session, increasing strongly after 2:00 p.m. (Screenshot: SSI iBoard)

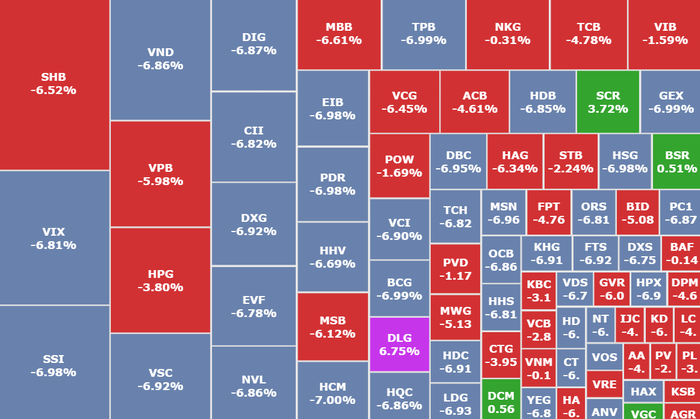

Regarding the industry group , the securities group has "heated up" recently, becoming the focus of "sell-off" when it decreased by 6.06% with liquidity of more than 16,000 billion VND, large stocks such as VIX (VIX Securities, HOSE), VND (VNDirect Securities, HOSE), SSI (SSI Securities, HOSE), VCI (Vietcap Securities, HOSE),... all hit the floor.

Next are the banking and real estate groups, down 4.73% and 3.5% respectively, with large-cap stocks hitting the floor: TPB (TPBank, HOSE), EIB (Eximbank, HOSE), OCB (OCB, HOSE), HDB ( HDBank , HOSE), NVL (Novaland, HOSE), DXG (Dat Xanh, HOSE),... In addition, other stocks all lost 2 - 5%, such as: VIC (Vingroup, HOSE), VHM (Vinhomes, HOSE), TCB (Techcombank, HOSE),...

The "VN30 basket" also fell simultaneously with 4 codes hitting the floor: HDB (HDBank, HOSE), SSI (SSI Securities, HOSE), MSN (Masan, HOSE) and TPB (TPBank, HOSE). The remaining group recorded a sharp decrease of 5-6%: LPB (LPBank, HOSE), BID ( BIDV , HOSE), VJC (VietJet, HOSE), VPB (VPBank, HOSE), MWG (Mobile World, HOSE),...

Foreign investors net sold 882 billion VND, focusing on FPT (FPT, HOSE) reaching 614 billion VND, VIX (VIX Securities, HOSE) reaching 247 billion VND, MWG (Mobile World, HOSE) reaching 243 billion VND. On the other hand, VCG (VINACONEX, HOSE) and VNM (Vinamilk, HOSE) were bought heavily with 285 billion VND and 243 billion VND.

Before today's trading session, many experts have made recommendations about the risk of the market facing a correction after surpassing its historical peak.

The market approaching the historical peak always comes with "pressure" to take profits, leading to a correction.

According to Mr. Tran Quoc Toan, Director of Branch 2 - Headquarters, Mirae Asset Securities , today's trading session comes with "profit-taking" pressure after the recent hot growth period.

First of all, there is a great pressure to "take profit" when many investors want to realize the profit of the market increasing sharply in a short period of time, especially in the group of large-cap stocks, which causes the index to fall sharply. Besides the pressure from domestic investors, the net selling pressure over the past time from foreign investors has also increased investors' fear.

In addition, the Domino effect when the index fell sharply and liquidity increased near the end of the afternoon session, created a sell-off and panic mentality for the entire market.

However, in general, the market approaching the historical peak is often accompanied by a large number of investors taking profits because the accumulated profits are quite large, leading to a correction.

So, even though the market is down sharply, this is a good opportunity to buy, especially for investors who missed the previous rally .

As for the group of investors holding stocks , the strategy that needs to be focused on now is risk management, especially when using leverage, it is necessary to consider reducing positions to prevent the case of the market getting worse.

Regarding industry groups, Mr. Tran Quoc Toan commented that leading stocks , especially banks and companies with good semi-annual business results, will tend to recover and increase again soon.

Source: https://phunuvietnam.vn/chung-khoan-chiu-ap-luc-ban-thao-manh-chua-tung-co-20250729174100559.htm

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)