Vietcombank increases capital funding for large projects

Right from the beginning of 2025, closely following the direction of the Government and the State Bank on organizing the implementation of the tasks of the banking industry in 2025, thoroughly grasping the motto of action: "Innovation, Efficiency, Sustainability", the guiding viewpoint of "Responsibility - Discipline - Connection - Creativity", Vietcombank strives to achieve the highest results in the goals and targets set out in Vietcombank's Development Strategy to 2025 and the Restructuring Plan associated with bad debt settlement of Vietcombank in the period of 2021-2025.

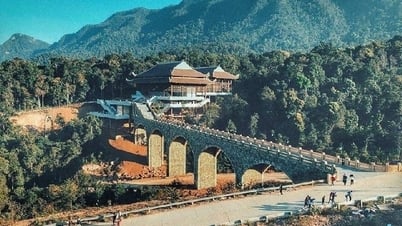

With its brand reputation, financial potential and outstanding service quality, Vietcombank has gained the trust of customers to participate in financing large projects worth tens of billions of VND along with many other small and medium projects. On April 15, 2025, Vietcombank signed a comprehensive cooperation agreement with Xuan Cau Holdings Joint Stock Company (Xuan Cau Holdings). Immediately after signing the comprehensive cooperation agreement, Vietcombank and Xuan Cau Holdings signed a credit contract of VND 22,000 billion for the Alluvia City project in Van Giang district, Hung Yen province.

|

Mr. Le Quang Vinh - Member of the Board of Directors, General Director of Vietcombank (right) and Mr. To Dung - Chairman of the Board of Directors of Xuan Cau Holdings representing the two units completed the signing ceremony of a comprehensive cooperation agreement on April 15, 2025. Photo: Le Hong Quang |

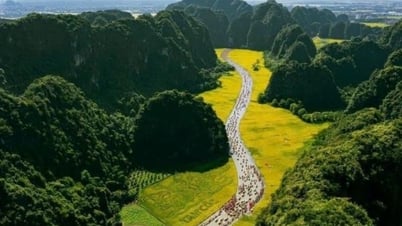

Previously, on March 10, 2025, Vietcombank and Vietnam Electricity Group (EVN) also signed a credit contract worth VND 5,472 billion for the Lao Cai - Vinh Yen 500kV transmission line project. This is a national important project, a key project in the energy sector, which has been approved by the Prime Minister in principle for investment and approved by the investor. The double-circuit 500kV transmission line project has a total length of about 229.5km with a total of 468 pole foundation locations, expected to be completed and put into operation before September 2, 2025. The total investment of the project is more than VND 7,410 billion; of which 80% is arranged from Vietcombank's loan capital and EVN's counterpart capital is 20%. The credit loan is worth VND 5,472 billion, will be disbursed within 2 years, the loan term is 15 years with competitive interest rates. Once put into operation, the line will be able to transmit about 2,000-3,000MW from hydropower plants in the Northwest region and neighboring provinces to the national grid. At the same time, the project will create strong links between regions in the power system, increase the ability to operate safely and stably for the national power system; reduce power loss in the transmission grid, increase the efficiency of EVN's electricity production and business, contribute to strengthening the country's energy security, financial and monetary security, and contribute to the sustainable development of the country's socio-economy...

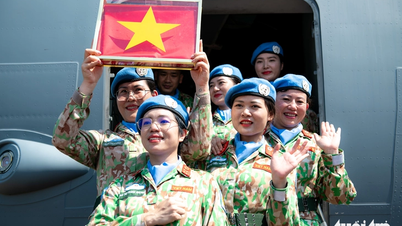

At the end of April, on April 23, 2025, in Hanoi, Vietcombank and Vietnam Airlines officially signed a Memorandum of Understanding (MOU) on cooperation in arranging capital for the investment project of 50 narrow-body aircraft. The event demonstrates the key role of two leading state-owned enterprises in accompanying the implementation of key national projects, serving the strategy of developing Vietnam's transport infrastructure and economy. According to the MOU, Vietcombank will participate in arranging capital for Vietnam Airlines' investment project of 50 narrow-body aircraft, including prepayments and long-term loans from 2026 to 2032. With experience as a credit focal bank for many key transport projects, Vietcombank will closely coordinate with Vietnam Airlines to build an optimal financial structure, ensuring long-term efficiency for this large-scale investment project.

|

The leaders of Vietnam Airlines and Vietcombank took a souvenir photo at the Memorandum of Understanding signing ceremony on April 23, 2025. Photo: Nguyen Duy Thanh |

Along with signing agreements with companies and financing large projects, Vietcombank also signed comprehensive cooperation agreements with small and medium-sized companies operating in many fields nationwide. In particular, promoting the role of a leading and key bank, Vietcombank is the focal point for arranging capital for a series of key and national key projects such as: arranging credit for the Block B Gas Project Chain between PVN and EVN; providing credit (syndicated capital) worth 1.8 billion USD for Component Project 3 - Essential works in the airport under the "Long Thanh International Airport Construction Investment Project - Phase 1"; financing the Ho Chi Minh City - Long Thanh Section Expansion Project under the Ho Chi Minh City - Long Thanh - Dau Giay Expressway Project...

Highest charter capital in the banking industry

On November 30, 2024, at the 8th session of the 15th National Assembly, the National Assembly unanimously approved the policy of additional state capital investment at Vietcombank from retained earnings. The value of additional state capital investment is VND 20,695 billion, thereby increasing the total charter capital to VND 27,666 billion. This is a particularly important milestone for Vietcombank in particular and the banking industry in general with the highest value of additional state capital investment ever. In April 2025, after completing the capital increase, Vietcombank became the bank with the highest charter capital in the system (VND 83,557 billion), worthy of its role as the main force, leading in terms of scale, market share, and market regulation capacity of State-owned commercial banks.

|

Vietcombank Annual General Meeting of Shareholders 2025. Photo: Nguyen Duy Thanh |

On April 26, 2025, Vietcombank (Code: VCB) successfully held the 2025 Annual General Meeting of Shareholders. One of the key contents at the General Meeting of Shareholders was to approve the plan to issue individual shares to increase charter capital. Accordingly, Vietcombank plans to offer up to 6.5% of outstanding shares, equivalent to a maximum of 543.1 million shares to no more than 55 investors, including strategic investors and professional securities investors. The total offering value at par value is estimated at VND 5,431 billion.

The issuance plan can be flexibly implemented in one or more phases in the period of 2025-2026, based on market developments and actual demand from investors. According to regulations, privately issued shares will be restricted from transfer for at least 3 years for strategic investors and 1 year for professional securities investors. After completing this plan, Vietcombank's charter capital will increase from nearly VND 83,557 billion to nearly VND 88,988 billion, continuing to maintain its position as the bank with the largest charter capital in Vietnam. This creates a solid foundation for Vietcombank to increase its competitiveness, expand its operations and invest in depth in strategic projects.

The increased charter capital is the basis for Vietcombank to expand credit activities, especially to support the development of priority sectors, growth drivers, and important national projects; maintain and promote the key role in implementing the policies of the Party, State and Government to support the economy; ensure the capital safety ratio CAR according to regulations; create resources to support weak banks; contribute to implementing the Strategy of the banking industry to 2030.

To date, Vietcombank has total assets of over 2 million billion VND; the largest charter capital and equity among banks in Vietnam; capitalization of over 20 billion USD - the largest on the Vietnamese stock market and in the Top 100 largest listed banks globally; has the best efficiency and quality of operations in the banking system. With a network of 130 branches, nearly 600 transaction offices nationwide, 9 domestic and foreign subsidiaries and nearly 1,200 correspondent banks worldwide, Vietcombank is currently providing a variety of services to more than 500 thousand institutional customers and more than 24 million individual customers.

Source: https://thoibaonganhang.vn/vietcombank-gop-phan-thuc-hien-muc-tieu-phat-trie-n-kinh-te-cu-a-da-ng-va-chinh-phu-167842.html

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)