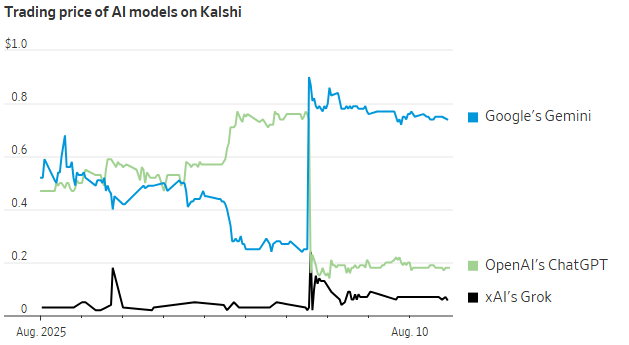

According to the WSJ , on Kalshi, Polymarket and other sites that allow “prediction” bets on real-world events, there are thousands of people willing to put several million dollars a month into picks for the top AI models.

The AI race is in full swing. On social media, websites that rank AI models are sought after by millions of tech enthusiasts. The constant buzz makes the topic attractive for betting, although not all the information is meaningful.

Earn thousands of dollars in just a few hours

Foster McCoy made $10,000 in just a few hours in early August by betting that OpenAI's GPT-5 release would fail.

Responding to the WSJ , the 27-year-old trader noticed that an online ranking site seemed to be inflating the model, so McCoy placed $4,500 on Google rival Gemini, which would be named “AI of the Month.”

As a result, just days after its launch, social media was flooded with complaints about GPT-5’s basic errors that were repeated from previous versions, such as mislabeling maps of the United States. Some experts even said that the model lost its inherent “personality” and performed worse than its competitors in benchmark tests.

After much promise, GPT-5 was seen as a minor improvement rather than a quantum leap forward. Thomas Wolf, co-founder of Hugging Face, commented that users were expecting something completely new, but it didn't happen.

|

The odds on Google's Gemini winning "AI model of the month" suddenly skyrocketed as more players bought into McCoy's assessment. Photo: Kalshi. |

It was just a normal day for McCoy, who has traded a total of $3.2 million on Kalshi since the start of 2025, earning $170,000 .

Remarkably, he is just one member of a team that specializes in betting and making hundreds of trades a week on AI markets.

Questions around technology topics like “What’s the best AI by the end of 2025?”, “Will AI regulations become federal law this year?”, or “Will Sam Altman get a stake in OpenAI this year?” are all offered as betting topics.

In August alone, trading volume on AI prediction markets grew to about $20 million , according to the WSJ . A Kalshi spokesperson said the platform is seeing a 10-fold increase in trading volume on AI events compared to the beginning of the year.

Hunting for news to bet

Each bet, or “contract,” is priced in dollars to reflect the odds. McCoy bought thousands of contracts that Gemini would win the AI performance race in August, at around $0.40 , meaning he had a 40% chance of winning.

If Gemini wins, McCoy's $0.40 will become $1 . If he loses, the expert will lose everything.

However, most of the action happens before the final outcome. As more and more people pour money into Gemini, the price of the contract increases. McCoy immediately sells when the contract rises to around $0.87 . The mechanism works like betting on a sports match, but with a bit less risk, as the player can choose to cash out when the odds increase.

“You're just betting against what other people know,” says McCoy, who attributes his success to spending a lot of time online.

Beyond the race for AI performance, social media debates can be a goldmine. After GPT-5 launched, a series of posts by Elon Musk proclaiming the superiority of the xAI chatbot Grok caused the “Grok wins” option to surge more than 500% in just a few hours. Soon after, the contract fell back to almost its original position.

To predict big moves, Harvard undergraduate Rishab Jain regularly scans the X accounts of little-known researchers. Since starting this work in June, Jain has won more than $3,500 .

|

Harvard student Rishab Jain, who won more than $3,500 from the AI trading market, scans every bit of information he can glean from the social media of lesser-known experts. Photo: Rishab Jain. |

A day before GPT-5 was released, OpenAI CEO Sam Altman posted an image of the Death Star from the Star Wars series. In the comments, a researcher from Google DeepMind responded with an image of the killer sphere under attack.

This is a sign of confidence from the Gemini creators, Jain said, adding that the student also scanned source files from Google apps and tracked public GitHub repositories associated with its products.

Jain suggests looking for backend changes that could signal an upcoming Gemini model. “I’m almost obsessed with what’s going on in this world . Google has a lot of products that need to integrate a new model before it’s officially released, and you can see those changes happening on the backend if you know where to look,” the Harvard student said.

As the volume of transactions for AI-related contracts continues to grow, the incentive for good information will only increase, which will also be a big advantage for less knowledgeable players, said Robin Hanson, an economics professor at George Mason University.

“When you have better information in this type of market, you can make better decisions. If you know a little more, you can make more money,” Hanson commented.

Source: https://znews.vn/ai-thanh-tro-do-den-moi-post1578090.html

![[Photo] President Luong Cuong's wife and Queen of Bhutan visit Tran Quoc Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/62696af3852a44c8823ec52b03c3beb0)

![[Photo] General Secretary To Lam attends the inauguration and groundbreaking ceremony of 250 projects to celebrate National Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/3aa7478438a8470e9c63f4951a16248b)

![[Photo] General Secretary To Lam and President Luong Cuong attend the handover ceremony of the Presidential Office Headquarters](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/a37cfcbd301e491990dec9b99eda1c99)

![[Photo] General Secretary and Prime Minister visit the National Exhibition and Fair Center](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/f4503ad032d24a90beb39eb71c2a583f)

![[Photo] Close-up of the first International Financial Center building in Ho Chi Minh City](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/3f06082e1b534742a13b7029b76c69b6)

Comment (0)